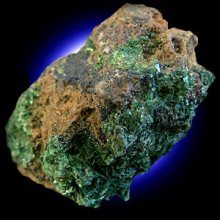

Having successfully fought off carbon emissions free nuclear power last century, environmentalists have now discovered that their latest raison d’etre is…eliminating carbon emissions. The trouble is, that’s going to require a heck of a lot of extremely environmentally destructive mining to achieve without turning back to nuclear power.

Energy News: Latest Developments in the Global Power Sector

There are a significant number of listed energy stocks in Australia. They range from multi-billion-dollar companies like Woodside Petroleum Ltd [ASX:WPL], all the way down to tiny explorers with a part interest in one exploration permit. Energy stocks also include coal miners, as thermal coal is a major source of electricity generation. Uranium stocks are also included in the sector. You can break the companies in the sector down into three parts. They can be producers, developers, or explorers. The larger producers cover the whole spectrum. They usually have a portfolio of producing assets, as well as assets in the development stage and exploration targets.

Uranium: A Second Look Coming

It feels so wrong to step against the herd. The human brain is from the Stone Age. It wants safety more than anything else. Now’s your chance to overcome your brain, and think of your future self (and family). You don’t think of today. You think of 2024 or 2025 — or even further out. Here’s a forward-looking trend for you…

Net Zero Myths Are Unravelling Ever Faster

It’s been a disastrous month for Net Zero. So many of the myths which the emissions target relies on are unravelling at the same time that it has us all in quite a tangle.

Tamboran [ASX:TBN] Shares Surge after Significant Gas Increase

Gas fracker Tamboran sees its shares jump after increasing its 2C contingent gas resource to 2 trillion cubic feet at its Beetaloo Basin projects in the Northern Territory.

Small Caps: Hidden Clues in the Carnage

The small-cap sector has now underperformed the Top 100 stocks for 22 months! That’s longer than the two previous drawdowns over the last 25 years or so. The macro noise is loud right now. But there is always opportunity in the market, even when so much seems to be working against us…

Why Are Australia’s Petrol Prices So High?

Retail prices are soaring. But why? The answer lies in Australia’s dwindling refining capacity. It turns out we are at the whim of global markets. What does this mean in the long-term? Read on to find out…