Tamboran Resources [ASX:TBN] has seen its shares jump 11.54% to trade at 14.5 cents after an increase in its unrisked 2C contingent gas resource, which now stands at a staggering 2 trillion cubic feet (TCF) within the Beetaloo Basin, nestled in the heart of Australia’s Northern Territory.

The company has had a busy quarter, with a series of key commercial deals and progress across its assets within the Basin. In June, the company signed two Memorandum of Understandings (MOU) with BP and Shell to supply LNG from Tamboran’s proposed LNG plant at Middle Arm NT.

Tamboran is one of five companies in the NT that the government has provided commitments for land use in the proposed Northern Territory LNG (NTLNG) project at Middle Arm in Darwin.

While development momentum has been strong in recent months, it’s been a hard year for Tamboran, which has seen its share price slide 27.50% after it faced a year of legal challenges to its fracking operations due to concerns about groundwater contamination from locals and environmental groups.

For a full breakdown of the underlying results and the outlook for Tamboran, read on.

Source: TradingView

Tamboran’s latest results

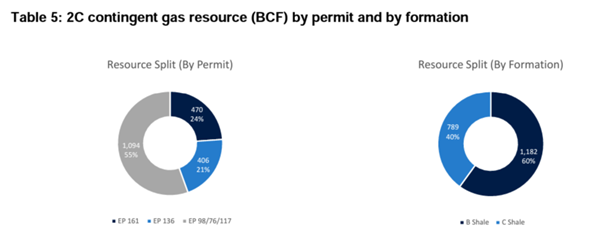

The expansion of Tamboran’s gas reserves had a cascading effect on several permits within the Greater McArthur Basin. In particular, the EP 136 permit witnessed a substantial increase in unrisked 1C contingent gas resources, soaring to 116 billion cubic feet (BCF).

Simultaneously, the unrisked 2C contingent gas resources for EP 136 surged to an impressive 406 BCF.

Source: Tamboran 27/09/23

Equally noteworthy is the development in the adjacent EP 161 permit. Here, unrisked 1C contingent gas resources experienced a commendable rise to 91 BCF, while the unrisked 2C contingent gas resources now stand at 470 BCF.

Tamboran stands as the dominant player in the Beetaloo Sub-Basin, with approximately 1.9 million net prospective acres held through two joint ventures—one joint venture with oil and gas giant Santos and the other with US investor Bryan Sheffield.

This vast acreage promises to supply much-needed energy to both the Northern Territory and the east coast markets, addressing their growing energy demands.

Tamboran’s Managing Director and CEO, Joel Riddle, emphasised the company’s strategic focus on the western region of the Basin today, saying:

‘Tamboran continues to demonstrate the continuous nature of Mid Velkerri B and C Shale across our 4.7 million (gross) acreage position in the Beetaloo Basin.’

‘This strategic positioning is expected to support a potential accelerate production to supply natural gas to the Northern Territory market. This is particularly critical given recent production declines from the offshore Blacktip gas field, which is expected to impact the region’s gas supply.’

‘With gas-fired-power driving the majority of the Northern Territory’s electricity supply, Tamboran is committed to delivering a secure source of natural gas to the benefit of Territorian families and businesses.’

Tamboran’s immediate focus centres on the development of the proposed EP 98/117 Pilot Development, with the goal of initiating production by the end of 2025.

Simultaneously, the company is actively pursuing the proposed Northern Territory LNG (NTLNG) development in Darwin, targeting first production by the end of 2030.

The NTLNG project has received $1.5 billion from the Federal government in an effort to promote ‘sustainable development’, focusing on renewable energy and manufacturing.

Outlook for Tamboran

Tamboran Resources’ remarkable expansion of gas reserves in the Beetaloo Basin positions them as a pivotal player in shaping the future of Australia’s energy landscape.

However, the increase in resources doesn’t simply mean Tamboran have landed the paydirt.

Fracking is a complex art, and many companies have reached this point without landing paydirt.

Firstly, there are some positives to acknowledge in the current development.

The drilling was completed by the most powerful rig in Australia, a behemoth capable of drilling more than 3000-metre horizontal sections in the main shell plate.

This is significant because the longer the horizontal wells that can be drilled, the more that can be recovered per well. This helps significantly bring down the costs and will be a real driver of the economics behind the project.

However, the Maverick 1v well was the third such well on the same pad, with previous drills seeing issues in flow rates.

Non-company explorers have speculated that it was due to issues that may have to be resolved with pumping to get the wells going, something that is not unheard of but will add to the costs for the company.

Thankfully, Tamboran has a strong brain trust of US fracking veterans that will likely resolve these issues.

Overall, the future for Tamboran should be positive, with their production timelines matching a market that desperately needs their gas.

Future demand for LNG

Liquefied Natural Gas is a rapidly growing source of energy across the world.

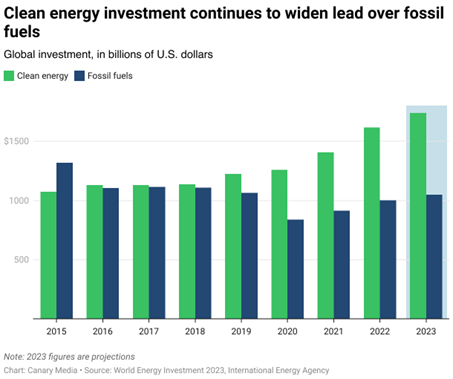

Demand for LNG is expected to increase by 50% globally by 2030 as many countries attempt to shift away from heavier fossil fuels.

But can everyone get a slice of the pie when investment into exportation or new projects is falling each year?

Source: IEA

Our Editorial Director Greg Canavan has been looking into the cost and implications of Australia’s energy transition to renewables from a wide-eyed economic perspective.

He thinks he’s found a gap in the market where Australians can follow hedge fund investors and billionaires like Warren Buffett into smart investments before the market realises.

Buffett’s Berkshire Hathaway has seen the writing on the wall and is spending big, including:

- Buying 2.1 million shares of a Houston-based oil producer, one of the largest in the world.

- Increased its stake in Occidental Petroleum to 25%, worth over $13.5 billion.

- Spending $3.3 billion to boost its stake in a LNG export terminal in Maryland.

Warren Buffett is no fool, when the ‘Oracle of Omaha’ makes a move, it’s recommended you listen.

If you want to learn more about how you can position yourself in the coming Net Zero energy environment, and the potential U-turn governments will have to make, then

Regards,

Charles Ormond

For Fat Tail Commodities