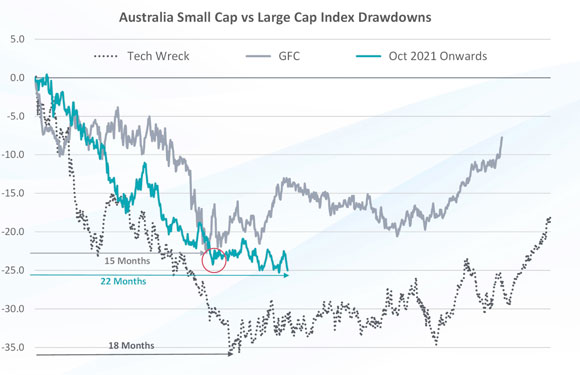

I’m sitting in an office tower in the Melbourne CBD when David Wanis of Longwave Capital Partners shares the following chart:

|

|

| Source: LongWave Capital Partners |

This again!

It’s not the first time I’ve seen it. David has been updating it for a while, and God bless him for doing so.

The chart shows that the small-cap sector has now underperformed the Top 100 stocks for 22 months!

That’s longer than the two previous drawdowns over the last 25 years or so.

When will this dud period end?

I saw the same chart when it was 18 months…15 months…you get the idea.

It gives you an idea of how tough the market has been since late 2021.

It’s also a clue to see where a big opportunity lies.

Markets move in cycles. Periods of underperformance are often followed by outperformance.

Yes — past performance is no guarantee of future performance. However, the market, like life, is a matter of playing the odds.

I’d expect an equivalent period of small-cap strength relative to the Top 100 when they start firing.

David also made an important point that day. It’s that individual stock picking can buck this malaise.

The macro noise is loud right now.

But there’s another way we can use this drawdown.

That’s to see which stocks are NOT going down with the general trend of the small-cap sector.

One of those stocks is part of my latest report available here. It’s called Maas Group Holdings [ASX:MGH].

It’s up about 30% in 2023. That might look modest in the context of what small caps can do at time.

However, it’s a very tidy return for any part of the market. It’s been a tough year.

The good news is that I think this makes for an excellent hold for the foreseeable future.

Maas has a strong foothold in the construction and infrastructure space.

One way to ‘read’ the market is to look for confirmation elsewhere.

Seven Group Holdings [ASX:SVW] — a much bigger stock — is also heavily exposed to construction and infrastructure.

Look how it keeps grinding up, despite all the negativity at play in the markets right now…

|

|

| Source: Yahoo! Finance |

Clearly, investors don’t give a damn about China, bond yields and a potential US recession when it comes to these two.

They’re happy to hold come what may — at least for now.

The point is that there is always opportunity in the market, even when so much seems to be working against us.

Another of my small-cap recommendations is up 60% since March too.

Why? It’s growing its business! I’m excited for this one. It’s possible that by 2025 or 2026 this stock is up 200–300%.

I can’t guarantee it, of course! But, again, I like the odds.

But you have to be prepared to buy and hold for all that time. It can be an oddly difficult thing to do.

Human nature wants to snatch any gain that appears. We get spooked. We get bored. We need the money for a holiday.

Sometimes you just have to leave well enough alone.

This is the opportunity in front of you now. Small-cap stocks, as a sector, are on the floor.

Every investing book you can ever read would suggest buying low now — and potentially selling high in two, three, five years.

That’s pure logic.

But I can tell you that people respond emotionally to the stock market.

And people right now aren’t feeling bullish, and they see the market having a tough time now and put it all in the too hard basket.

I urge you not to make the same mistake (as I see it). Go here for the full run down on why now could be the time to go shopping!

Human psychology is a fascinating thing

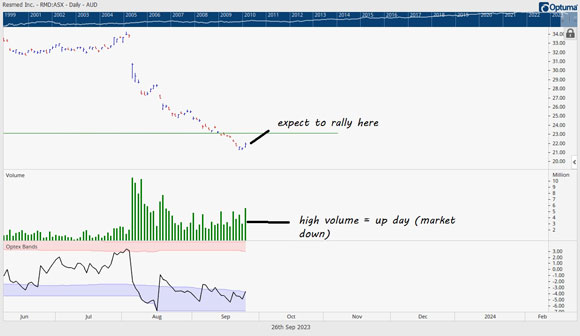

We can see it playing out in healthcare stock ResMed [ASX:RMD] right now too. There might be a short-term opportunity here.

ResMed is one of the most highly regarded firms on the ASX. Earlier in the year it was trading on a 38 P/E ratio.

Lately it’s been smashed around 35%.

ResMed’s business model (treating sleep apnoea) is coming under a perceived threat from new weight loss drugs taking the market by storm.

I don’t know enough about either to say whether this is true, or to what extent. ResMed is not a small cap — my area of expertise.

However, I’m always interested in opportunity.

I’m aware some big fund managers have come out in support of the stock.

I also know that we’ve seen some big sell offs in various stocks lately — and these proved overdone in hindsight. It’s a twitchy market.

The huge volume profile over the last two months suggests some big funds are buying this dip.

It’s possible the stock is now bottoming out.

Take that with a huge dose of caution. Calling a ‘bottom’ in any stock is a dangerous game.

But ResMed was up yesterday on big volume. I noted that I expected a rally before I went to bed last night.

See the chart here…

|

|

| Source: Optuma |

It’s playing out so far…

ResMed was up in US trading overnight, even as the Dow and S&P500 fell.

Another thing to watch for here is the role of short sellers.

I know these guys were taking their positions back in August, and maybe earlier. At some point they will roll off — and buy back the stock to get out.

Let’s see what happens from here.

The way I read it is that ResMed should not break below the $21 level now set as the current low.

If it does, forget the idea. It will be a dud.

However, right now ResMed should stabilise and potentially recover some lost ground.

Another example of potential opportunity in the current carnage.

Best wishes,

|

Callum Newman,

Editor, Money Morning