A few weeks ago, I finished interviewing eight experts on Net Zero and the energy transition. I asked each of them the same question: which commodities do you see as the key shortages which will undermine Net Zero? They all came back with the same response…

Copper Stocks on ASX: Investing in the Australian Copper Market

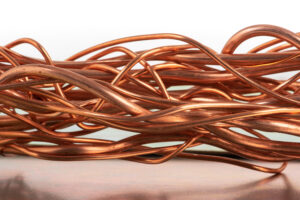

Copper is a vital material in the global economy, whose importance has remained strong for decades.

However, with the global decarbonisation campaign and transition to cleaner technology, copper’s importance is only set to grow.

Will Technology Curb Demand for Copper?

In today’s Fat Tail Commodities…James Cooper draws on his past experiences in the field as a geologist and explains why technological breakthroughs won’t bring on the increased supply that some analysts expect. Read on to find out why…

True North Copper [ASX:TNC] Shares Up 25% After Great First Drill Results

True North Copper has released the results of its inaugural drilling program at its newly purchased Mt Oxide Project in QLD. Its first drill hole saw impressive results of 66.5m at 4.95% Cu.

Sneak Peek: An Emerging Food Crisis and How to Play It

Today I reveal an investment opportunity I shared with Diggers and Drillers readers in our latest monthly report. While the specific stock recommendation will be withheld for subscribers only, I think the idea behind it is prudent to share it with you today. Enjoy this peak behind the curtain…

The Commodities Boom That Isn’t…YET

Are you wondering why the purported resources boom doesn’t really feel like one? You’d be forgiven for being puzzled by the recent price movements. It’s not just the stock prices of individual mining companies. The commodities have been trending weakly as well. The only exception is in lithium and rare-earth element (REE) companies. If there’s so much talk about a forthcoming energy revolution, why hasn’t the market priced that in? Read on to find out…

What Determines Commodity Prices?

The term ‘commodities’ relate to some of the most tangible physical assets out there — ore, mines, equipment, plants, and labour. But they’re also entangled with abstractions — inflation, aggregate demand, bond yields, and wider macroeconomic trends. Given that, how are we to determine what truly affects their prices? Well, there are many moving parts, and I’ve broken them down for you below…

![[ASX:TNC] ticker](https://daily.fattail.com.au/wp-content/uploads/2023/08/ASX-TNC-FEATURE-TICKER-300x300.png)