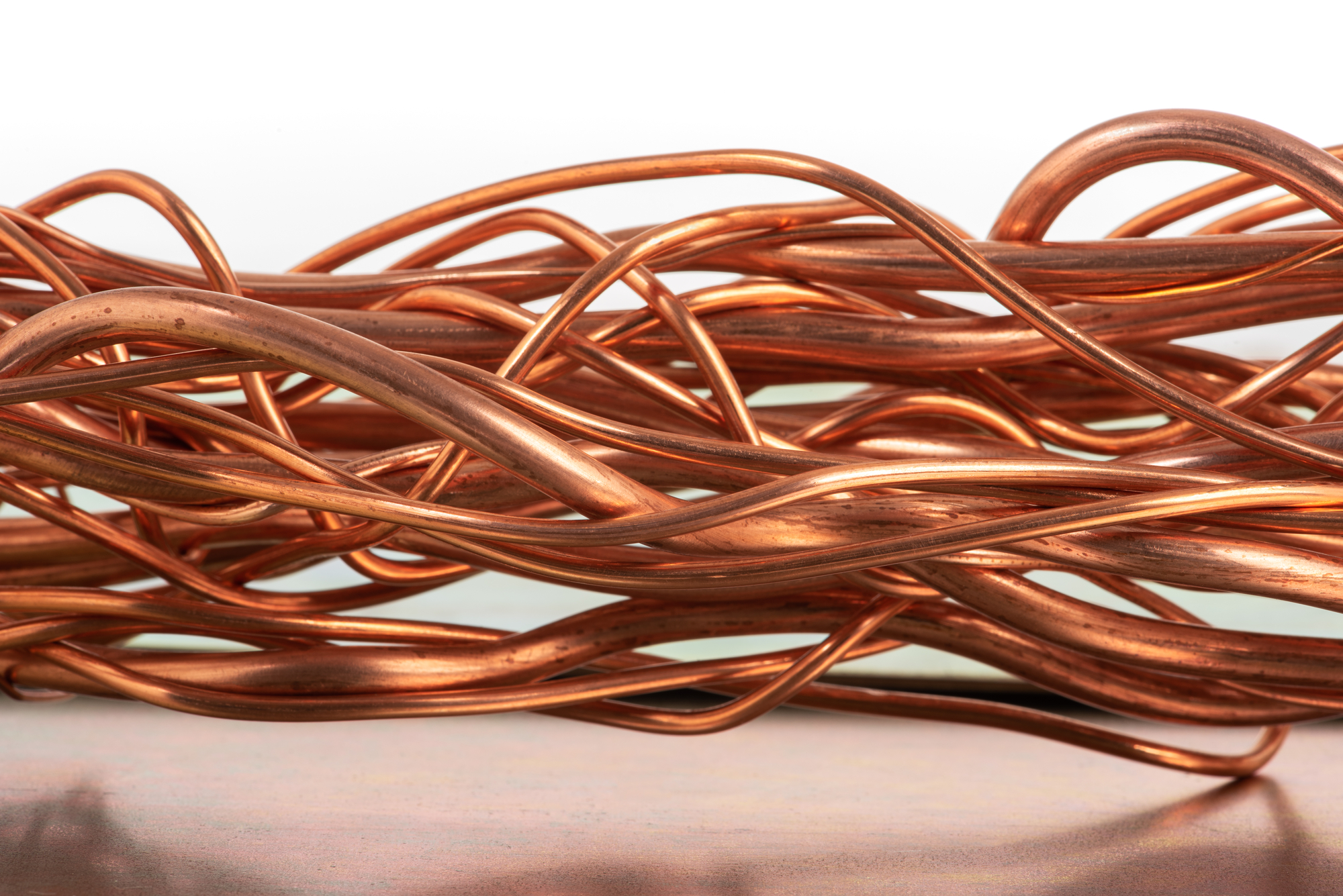

I’ve written extensively about the emerging opportunities for copper.

Geopolitics, riots, water shortages, declining output, and lack of new discovery are all reasons you should be planning for higher prices in the years ahead.

With its supreme qualities as an electrical conductor, the red metal is the one commodity that can’t be replaced in a future electrified economy.

It’s why copper is set to become the ‘new crude’.

There are many reasons to be optimistic about this metal — but are there any risks?

Right now, we have high interest rates in the West and deflation in the East…neither bodes well for a commodity tied exclusively to growth.

Yet copper continues to buck the doom and gloom sentiment. Futures are consolidating well above their April lows.

Perhaps more importantly, though, is the number of large-cap copper producers breaking into all-time new highs…

That includes the two major (pure) copper producers, Ivanhoe Mines [TSX:IVN] and Southern Copper [NYSE:SCCO], both of which have doubled in price over the last 12 months.

I’m sure the market bears will be scratching their heads.

But are these bullish moves a factor of limited supply rather than rising demand?

It’s widely accepted by the mining industry that underinvestment in new discovery will bring on shortages.

According to Benchmark Intelligence, these shortfalls are destined to hit the market by the late 2020s.

But let’s play devil’s advocate for a moment…

Could technology solve the looming supply problem?

According to the high-profile New York-based fund manager Goehring & Rozencwajg (G&R), there’s plenty of room for innovation in the ‘archaic field’ of mineral exploration, meaning the idea of supply shortages could be overblown (emphasis added):

‘Additional supply could come from introducing a new exploration tool from Ivanhoe Electric known as the “Typhoon” geophysical survey system.

‘As opposed to the oil and gas industry, which has made considerable advancements in exploration technology over the past seventy years, the mining industry largely relies on technologies used for hundreds of years.

‘Geologists walk along the surface with a pick hammer and a sampling “grab bag,” looking for rock outcrops and soil alterations.

‘A geologist from the eighteenth century would feel right at home today. Given the relatively primitive techniques, it stands to reason that most significant deposits are still located reasonably near the surface.

‘The oil and gas industry has developed exploration tools to look deep into the earth’s crust. A lack of technology restricted the mining industry to what could be found visually near surface.’

As a former geologist who’s worked in all phases of exploration across many different types of commodities, including copper, I disagree with G&R.

Yes, geoscientists conduct fieldwork. It’s part of a process called ‘ground-truthing,’ ensuring the data in the office matches what’s seen on the ground.

But more than that, exploration geologists have been using advanced software to identify chemical anomalies in the soil and computer programs to measure the probable geometries of ore bodies sitting ‘unseen’ below the surface for years.

Computer science is an important skill for the profession…software is ingrained with fieldwork.

The reality on the ground couldn’t be more different from G&R’s observations…mineral exploration has been ‘technified’ for decades.

But could companies like Ivanhoe Electric be the game changer?

I’d argue the Typhoon system described by G&R is just a reworking of current systems.

Just like the oil and gas industry, mineral exploration has been using deep-penetrating geophysical surveys for decades.

A technology known as Induced Polarisation (or ‘IP’ for short) has helped geologists find copper ore bodies lying hundreds of metres below the surface.

That puts a dent in the idea that ‘the most significant deposits are still located reasonably near the surface.’

IP has been uncovering these for decades.

As a former copper hunter, we used IP technology with Equinox Minerals in Zambia…a company I worked for back in 2010.

The technology assisted with two major copper discoveries.

But that wasn’t led by the IP geophysics…but rather the expertise from its operator, Alex Copeland.

He was a pioneer in this technology.

Alex held decades of experience in geophysics and mineral discovery…it was his time in the field refining and tweaking he’s technology that became the catalyst for the major discoveries.

And that’s the key point…

It’s not so much the technology, rather the skill of the operator to interpret the noise from the data that matters in mineral exploration.

As Alex explained to me, being able to adapt the technology to the different conditions was crucial.

What worked in Australia didn’t necessarily work in Zambia.

Each deposit was different…IP surveys offer clues in one location…but those same clues are useless in other areas.

Simply put, nature is not a standardised playing field that can plugged into an algorithm.

For decades, new technologies have been touted as the game changer…but rather than lead discovery, they are simply tools assisting operators in narrowing down their search.

It’s a dwindling game of chasing deeper, lower grade and more marginal deposits.

But once again, a new ‘innovation’ is arriving in the form of Artificial Intelligence (AI).

KoBold Metals, a company that uses AI and machine learning to hunt for raw materials, has been peddled as the new generation in mineral discovery.

A company determined to prove computer scientists based in California can replace geologists and boots on the ground.

Yet despite receiving large capital injections from prominent billionaires Jeff Bezos and Bill Gates, KoBald is yet to make its first discovery.

In fact, rather than lead discovery, KoBold is using its deep pockets to buy up deposits previously discovered by ‘primitive’ geologists.

There’s going to be a lot of hype in the years ahead about AI and its ability to change the landscape in the field of exploration, but history proves there’s nothing new under the sun…

More supply won’t come from some technological breakthrough. It can only arise from higher prices.

Regards,

|

James Cooper,

Editor, Diggers and Drillers

PS: Another commodity that has its own rocketing demand path ahead is gold. While it’s not my area of expertise, Fat Tail’s resident gold bug Brian Chu is saying some of the most powerful and fast-growing countries on the planet are moving to ‘lock up’ as much of the world’s gold as they can by whatever means necessary. And this could have huge implications for you and your money. You’ll hear more from Brian about this very topic next week. Stay tuned…