No doubt you’re familiar with international agencies, governments, corporations and public figures touting the coming energy revolution and how it’ll change the way we live. With that, the demand for critical metals and resources will be nothing like we’ve seen before.

But the prices don’t appear to reflect this, not least if you look at the different market measures.

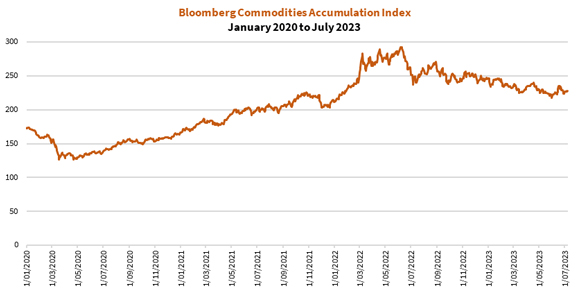

Let’s start with the Bloomberg Commodities Accumulation Index [BCOMTR]:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

As you can see, the index rallied hard at the start of the Russia-Ukraine conflict in February last year before declining as the price of crude oil peaked in June 2022. This isn’t a setup showing a bull market.

Perhaps this index is too broad a measure.

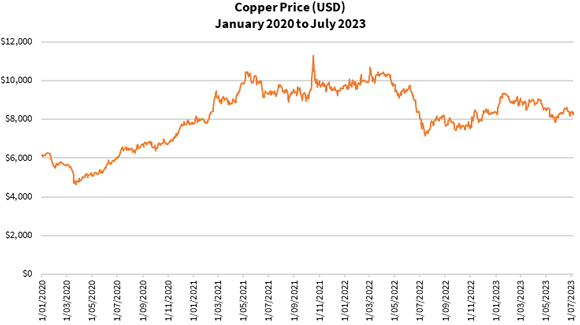

Sure, crude oil is down, but critical metals such as copper, nickel and silver should be in high demand due to the need for battery technology, electric vehicles and advanced infrastructure, right?

Let’s have a look at the price of copper:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

Hmm…that doesn’t look too bullish a setup either!

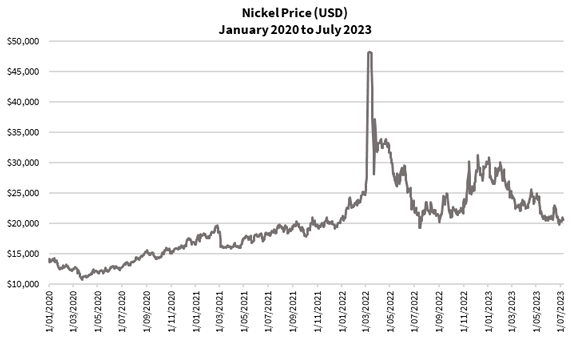

What about nickel?

|

|

| Source: Thomson Reuters Refinitiv Datastream |

That doesn’t look too bullish to me. It looked like something was brewing earlier this year, but it’s since fizzled out.

Moving onto silver…

|

|

| Source: Thomson Reuters Refinitiv Datastream |

That looks like a tight formation, but no real signs of breaking out…whether upwards or downwards!

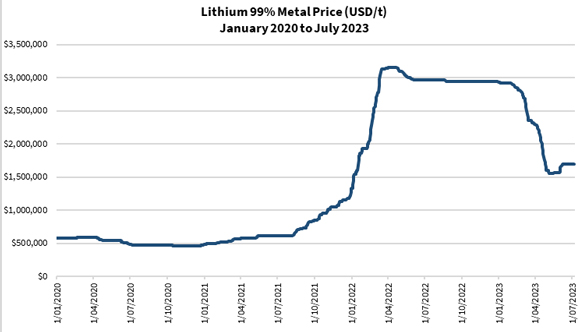

Finally, let me show you also how lithium performed:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

For all the hype over lithium in the past year, the metal has taken a clobbering and is trading at 50% of its highs last March. One thing I’m noticing recently is a sudden resurgence of mining companies producing or merely exploring lithium.

So, I’ll give you that…lithium is looking bullish. The other metals, however…

To me, everything points to more talk about a resources boom but little to show for it. These movements are consistent with ‘buy the rumour, sell the fact’. The claim that there’s a surge in demand for these resources doesn’t line up with their prices.

A challenging environment for miners

Even looking at the activity on the ground within mining companies won’t help solve the mystery.

There’s nothing there to show that the lack of a price boom is due to an oversupply of these metals.

In fact, most producers have been operating in a challenging environment due to a combination of border restrictions, health mandates, unexpected weather events and company-specific mishaps.

It’s noticeable in company quarterly reports. Even the largest producers have reported lower production and higher operating costs in successive quarters.

For example, Evolution Mining [ASX:EVN] experienced a setback at its Ernest Henry gold and copper mine in Central QLD, which suspended operations for six weeks in March 2023 due to flooding, leading to an almost 20% cut to its annual production. A year ago, the company’s share price tumbled by 20% in a day when it released a revised 2023–24 production guidance that cut its forecasts by 10–15%.

This flooding event affected Aeris Resources [ASX:AIS], which updated the market on its June quarter production last Friday, showing that overall production was below management’s annual guidance. A key cause of the underperformance is the Mt Colin base metals mine that treats its ore at the processing plant at Ernest Henry.

Investors dumped Aeris Resources shares after the company released this report, causing the share price to fall by 16% on the day.

The same has been happening in WA.

Gold Road Resources [ASX:GOR] downgraded its annual production in late June due to operational delays at the Gruyere mine.

St Barbara [ASX:SBM] faced rising costs in the last three years at its flagship Gwalia operations, resulting in it selling it to Genesis Minerals [ASX:GMD] late last month.

I could find more examples for you, but you get the idea!

Now, I know that this article doesn’t really offer much comfort to commodities investors.

At least from what I’ve presented so far!

But I want to call it as it is, lest you hold unrealistic expectations and be frustrated by the lack of results with your resources stocks.

But there’s a missing piece to the puzzle that I haven’t yet covered…

The missing piece of the commodities ‘boom-not-boom’ puzzle

It’s to do with monetary policy and inflation.

The last 15 months have seen some of the sharpest rate rises in the last half-century. It caused a meteoric rise in the US dollar relative to other currencies, as you can see below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

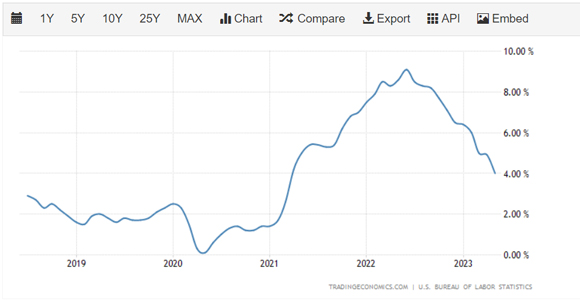

While interest rates rose, spending and trading activities slowed down, which helped slow inflation. Here’s the headline inflation rates in the US:

|

|

| Source: Trading Economics |

Now, commodity prices are closely correlated to inflation, being the key inputs to production.

That’s why people invest in commodities. It offers some protection against inflation.

Markets are expecting inflation will slow down further in the coming months. That’s what the US Federal Reserve Chair Jerome Powell indicated in an announcement after the meeting in June. This is echoed by other central bankers who have continued to raise interest rates — for example, in the UK, Sweden and Australia.

As such, I foresee a little more short-term pain on the commodities front.

However…

I think the central banks may’ve built up an avalanche.

The bankers are saying that they’re going to keep rates higher for longer, but remain deaf to the whistle of the deflation avalanche gathering pace.

I’m leaning on them doing an about-turn to cut rates even as early as the end of this year.

Watch for the US CPI readings for June that’s due for release in the middle of this week.

It was 4% for May, and it’s likely to be around 3% for last month. So this points to inflation slowing down further (at least for the purposes of how the markets behave).

The snowflakes are gathering and tumbling down the hill.

When they cut rates, not a matter of if, they’ll potentially unleash the biggest boom in almost everything. Commodities could ride this one like a champion.

Right now, you’ve got the choice pickings while investors are chasing the momentum stocks in AI and technology.

Find out more with Diggers and Drillers if you want to build a portfolio of critical metals stocks.

Or, if investing in precious metal and mining stocks is your thing, join me at The Australian Gold Report.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities