Commodities are interesting.

They relate to some of the most tangible physical assets out there — ore, mines, equipment, plants, and labour.

But commodities are also entangled with abstractions — inflation, aggregate demand, bond yields, and wider macroeconomic trends …

Consider the age-old commodity, gold.

As our gold expert Brian Chu recently noted to subscribers of The Australian Gold Report, the metal is under pressure from the aforementioned macroeconomic forces:

‘As much as I hope the index will turn around, I believe we might see the ASX Gold Index fall below 6,500 first.

‘At the top of the list is the US Federal Reserve, which met last Wednesday and announced a pause on raising rates. However, Federal Reserve Chair Jerome Powell predicted one or two more rate rises in the future as he believes inflation is still too high.

‘On top of that, the Bureau of Labour Statistics released the Consumer Price Index (CPI) figures for May. The CPI rose just 4% year-on-year, which was a sharp drop from 4.9% for April.

‘So on one end, the interest rate could rise and on the other inflation is slowing down. Both act to push the price of gold down.

‘Another force that’s placing pressure on the price of gold comes from headline jobs and earnings figures released a fortnight ago.

‘The market interpreted these figures to suggest the US economy was steady, which didn’t favour gold.

‘Now we understand that these headline figures are often adjusted downwards, but the market doesn’t care about that.

‘This begs the question of whether the US economic recovery is really happening and if so, is it sustainable?

‘The short answer is no.’

While the gold price is under pressure, Brian thinks gold stocks are becoming more attractive as they start to trade below fair value according to his rigorous valuation framework.

He writes extensively about the framework to readers of The Australian Gold Report. If you’re interested, you can read more here.

James Cooper — our other commodities expert extraordinaire — echoed Brian’s sentiment about value emerging in the sector.

Last week, he wrote that the pessimistic mood is an opportunity:

‘Right now, explorers across every commodity have been heavily discounted.

‘Most resource investors are feeling extremely pessimistic right now. But this is exactly the time they should be buying.’

Factors affecting coxmmodity prices

Commodities like oil and copper are key inputs for production by manufacturing industries. So, demand for these commodities is closely related to global industrial economic activity.

That’s not exactly rocket science.

If global economic activity wanes — seemingly the case now — demand for key input commodities will subside.

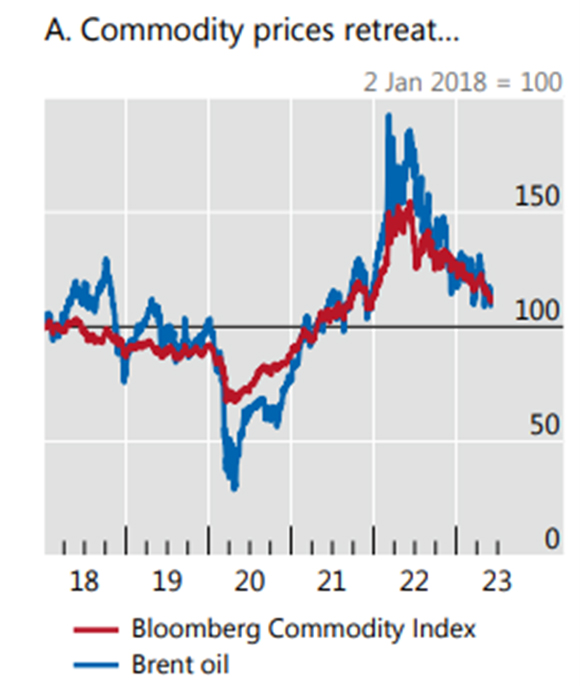

We can see that with the Bloomberg Commodity Index below.

|

|

| Source: Bank for International Settlements |

A side note here.

A chart like the one above does not automatically entail waning demand.

Concluding that commodity prices must be down because of falling demand is what economist Scott Sumner dubbed ‘reasoning from a price change’.

And he thinks we should never reason like that:

‘My suggestion is that people should never reason from a price change, but always start one step earlier — what caused the price to change. If oil prices fall because Saudi Arabia increases production, then that is bullish news. If oil prices fall because of falling AD [aggregate demand] in Europe, that might be expansionary for the US. But if oil prices are falling because the euro crisis is increasing the demand for dollars and lowering AD worldwide; confirmed by falls in commodity prices, US equity prices, and TIPS spreads, then that is bearish news.’

The key is to remember prices can drop for two reasons — falling aggregate demand (bad news) or a positive supply shock (more production, good news).

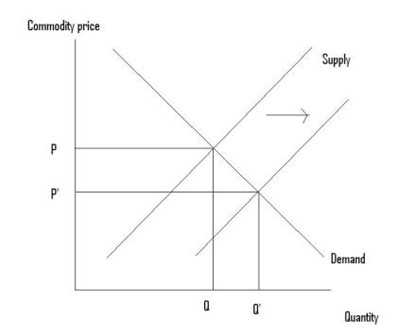

Commodity prices could be falling if there’s more supply on the market. This would lead to something like this:

|

|

| Source: Market Monetarist |

In the illustration, the commodity price p drops to p’ as the supply curve shifts rightward. More quantities are now consumed at a lower price, with overall demand unchanged.

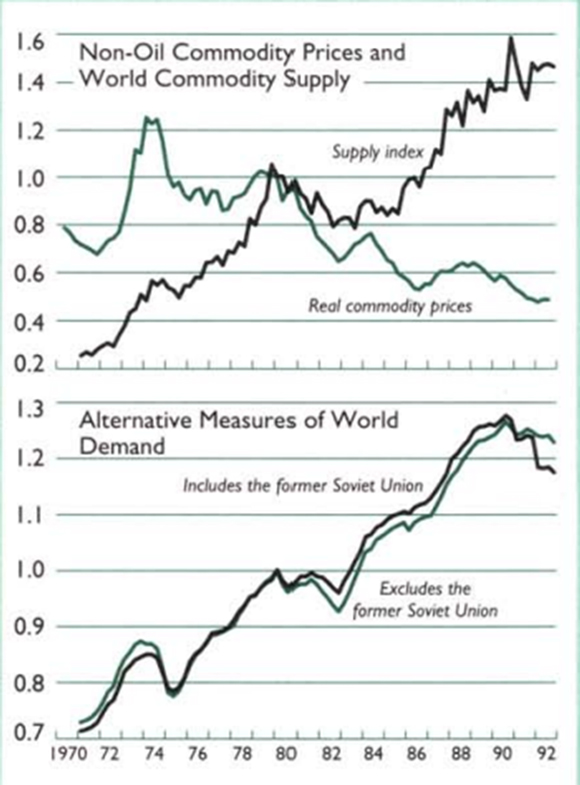

A good illustration of this was the two decades between 1970 and 1990.

During the period, real commodity prices fell…because supply rose. And despite demand also rising, the shift in the supply curve more than accounted for it, lowering prices.

|

|

| Source: IMF |

So, the key is figuring out what’s behind the fall in commodity prices.

In February, BHP Group [ASX:BHP] released its latest commodities outlook report. In it, the mining giant was circumspect about the demand-supply balance for calendar 2023:

‘We gauge that the constellation of prices observed in late January over-states how tight physical commodity markets are likely to be over the full year, especially in non-ferrous metals where roughly half of global demand emanates from outside China.

‘In our central view small surpluses in non-ferrous metals and broadly balanced markets in steel-making raw materials are in prospect for the full calendar year: not the imminent return to deficit conditions that financial markets seemed to be envisaging in January.’

Commodities and recessions

Commodity investors have been hit on the head with warnings of a global recession.

The US has been on the verge of a recession for what feels like over a year. Its yield curve has certainly been inverted for that long.

But should recessions spell doom for commodity prices?

Not necessarily.

I mentioned him before, but macroeconomist Scott Sumner thinks we care too much about recessions these days.

In fact, he went further and called out recession-mongers as purveyors of the following logical fallacy:

‘We all know that recessions are traditionally associated with really bad labour markets (true). Thus past recessions have been important events (true). Recessions are almost always correlated with two negative quarters (true). Thus future cases of two negative quarters will be important events (false).

‘Here I’m dodging the question of whether two negative quarters are “actually a recession”, which is about as uninteresting a question as one could imagine. Who cares?

‘I’ll tell you who cares about recessions — dumb people who believe that words have magical powers. “If only I could convince you that this is a recession!” Yawn.

‘It’s not that I think you are wrong; it’s that I don’t care. Japan had a bunch of recessions in the 2010s. Do I care? No, none of them showed up in the labour market.

‘It’s incredibly uninteresting to see a slow growth economy alternate between slightly positive quarters and slightly negative quarters.

‘This is why the “Will there be a recession?” debate is so dumb. I don’t care whether the US experiences a recession; I’m simply not interested. The interesting question is whether the US will experience the sort of recession that we experienced in the past, where the unemployment rate always rose by at least two percentage points.’

Currently, the US unemployment rate is at historic lows.

So, too, is Australia’s.

What should we glean from that?

The onset of a recession is not in itself the danger for commodities. It’s the type of recession that matters.

And given the current strength in the labour market — both here and in other major economies — a recession here could warrant nothing but a yawn from someone like Sumner.

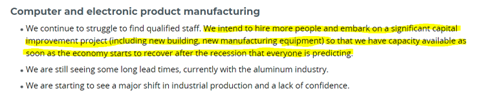

Anecdotally, Bloomberg’s Joe Weisenthal pointed out some comments from the latest Dallas Fed Manufacturing Survey this week, showing that US firms are ‘so scared of getting short capacity, they’re already preparing for the next economic recovery.’

|

|

| Source: Joe Weisenthal |

In Joe’s words:

‘Remember, the big story this period is that companies found themselves experiencing shortages of everything: shortage of labour, shortage of components, shortage of warehouse space etc. This was exactly the opposite story from the post-Great Financial Crisis period, when the story was persistent excess and fear of a demand downturn. Here the fear is not having available capacity, and there’s an assumption that any downturn will be short-lived.’

Copper on the mind

I’ll leave you with a brief word on copper.

Despite softening commodity prices, The Australian Financial Review ran a frazzled story yesterday about looming copper shortages.

Quoting billionaire prospector Robert Friedland, the story ran:

‘Copper is poised to follow other commodities upended by recent price surges as the mining industry struggles to expand ahead of accelerating demand, warns the man behind some of the world’s biggest mines.

‘Demand for critical raw materials is set to jump as nations mandate clean energy and transport while clambering to develop their own supply chains. But a combination of factors suggests supply will not keep pace, according to billionaire Robert Friedland.’

Hm. That sounds familiar.

Friedland’s thesis echoes what James has been saying for months.

Copper is set for a massive demand surge that supply cannot accommodate without steep price rises.

Just last week, James reiterated his thesis to subscribers of Diggers and Drillers:

‘When I look at sentiment for copper investment, I see one that pivots from short-term weakness to long-term strength…

‘The weakness is based on inflation fears in the US and growth anxiety stemming from China.

‘On the other hand, the long-term outlook is built on a lack of new discoveries, constricting supply, and enormous projected demand from the energy transition.

‘The long-term drivers will push investors back into the developers and explorers.’

Commodities are often priced according to their homogeneity — a gold nugget is a gold nugget everywhere.

But not all commodities have homogenous fortunes.

For James and others like Friedland, copper offers unique promise, sheltered from the wider issues that may plague commodities like oil or iron ore.

Regards,

|

Kiryll Prakapenka,

Editor, Fat Tail Commodities