Unusual trading of Liontown shares has sparked rumours of a potential bidding war…why we may be seeing a renewed scramble to lock up lithium assets once more…how India could play a role in this volatile market…and why you should consider lithium for your own portfolio…

Lithium

The Lithium Story Isn’t Over Yet

When it comes to Australian lithium miners, we’ve seen plenty of activity recently. Albemarle has made another bid for Liontown, but it’s not the only company looking to snap up Australian lithium assets. There could be more to come…

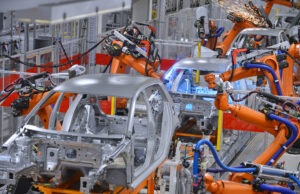

This Battery Race is Up for Grabs

Lithium-ion batteries play a crucial role in the energy transition. But while lithium-ion batteries continue to be the battery of choice, this is a decades-old technology. There’s plenty of innovation happening in the industry, and this is a space ripe for disruption.

The Race of the Decade

More automakers and battery makers are building gigafactories to secure their supply chains and cut down costs…and these are going to need plenty of critical minerals.

Lithium Takes a Dive…Is it Time to Bail Out?

Over the last month, the lithium sector has been thumped. Last year’s hot stocks have been declining this year with losses worse for explorers and developers. However, there’s a little more to this story than just a falling commodity price. Why? Well today, I will attempt to unpackage this. Read on to learn more…

Liontown’s [ASX:LTR] Kathleen Valley Lithium Project on Track for 2024 Production

Liontown Resources announced today that significant progress had been made in the construction of its Kathleen Valley Lithium Project and that it’s on track for mid-2024 production. Shares were down by 0.90%, trading at $2.76 per share.