There’s been a lot happening when it comes to Australian lithium miners.

On Monday, lithium giant Albemarle Corporation made another takeover offer for Liontown Resources [ASX:LTR].

Liontown has the Kathleen Valley Lithium project, which the company expects will be one of the largest lithium mines in the world once it starts production next year. They also have lithium supply deals with Ford, Tesla and LG Chem.

As you may remember, Albemarle has already tried to buy Liontown many times. In late March, they made a $5.5 billion takeover cash bid — or $2.50 a share — to which Liontown’s board said thanks, but no thanks.

This was up from the $2.35 a share offered in early March and the $2.20 in October last year, all of which were rejected.

Now Albemarle has offered $6.6 billion, or $3 a share, adding that this was their ‘best and final’.

This time, it looks like they could be closing the deal. Liontown’s board agreed to let Albemarle look at the books, saying that they intend to recommend shareholders to accept the offer.

Once the offer came out, shares for Liontown spiked to $2.9 a share — although they’ve been trading slightly lower since.

|

|

| Source: Google Finance |

But this isn’t the only move we’ve seen in this sector. In fact, there’s been plenty of interest for Australian lithium assets recently.

Last month, Azure Minerals [ASX:AZS] rejected a $901 million takeover bid from Chilean company, SQM.

It’s also come to light that Mineral Resources [ASX:MIN] is looking to buy Bald Hill mine.

Located in the Eastern Goldfields, the Bald Hill Lithium project was owned by Alita Resources, but the company went into administration after lithium prices fell in 2019.

What’s interesting about Bald Hill is that it it’s a lithium mine already in production — which is why it’s been catching a lot of attention — with bids reportedly coming in from the likes of Austroid Corporation and Glencore.

So, while things may be looking slow out there, there’s been plenty of activity in this corner of the market.

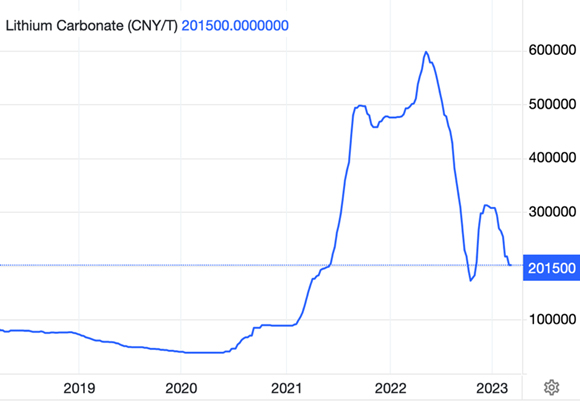

Lithium prices may have fallen, but they are still high

Lithium prices may have dropped off the cliff this year, as you can see in the chart below, but lithium prices remain high when compared to previous years.

|

|

| Source: Tradingeconomics |

This is all great for lithium producers.

Take Albemarle, for instance.

In the second quarter of 2023, Albemarle made US$2.4 billion in net sales, or a 60% increase from the previous year. This was mainly because of higher prices and sales.

As they wrote:

‘The company is updating its full-year 2023 outlook to reflect recent lithium market prices. Net sales are expected to increase 40–55% over the prior year, primarily driven by the continued global shift to electric vehicles. The year-over-year increase in Adjusted EBITDA is expected to be in the range of 10–25%, primarily due to higher Energy Storage pricing.

‘Energy Storage net sales for the full year are estimated to range between $7.9 billion and $8.8 billion, above previous outlook primarily due to higher lithium market index pricing.’

Even with the recent lithium drop in prices, Albemarle expects that for the year the price they sell lithium will be 20–30% higher than the previous year.

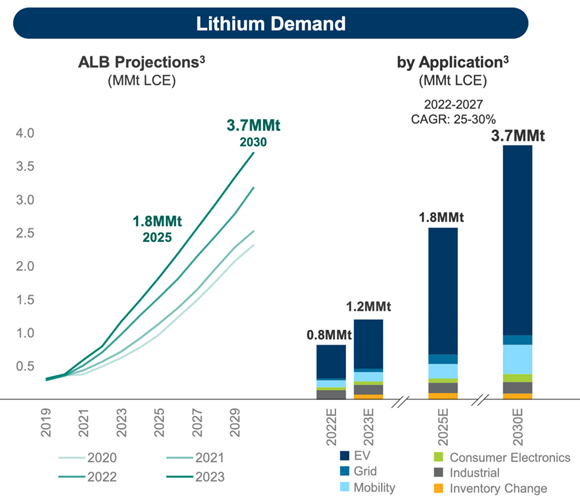

What’s more, Albemarle has continued to revise its lithium demand projections.

|

|

| Source: Albermarle |

They now expect it to be over 15% higher than previously thought because of the Inflation Reduction Act in the US and continued demand for electric vehicles (EVs).

So, we continue to see companies taking steps to secure lithium supply.

Lithium is a crucial component

The fact remains that lithium is still a key material for lithium-ion batteries.

And EV sales continue to grow.

According to InsideEVs, in the first six months of the year, there were 5.8 million plug-in electric cars registered globally. That number is up by 40% year on year, making up around 15% share of total sales.

Then again, as I mentioned recently, more automakers and battery makers are looking at building gigafactories to keep building EVs, secure their supply chains and drive down costs.

All these gigafactories in the pipeline are going to need to source raw materials from somewhere.

So this is all adding up to a big win for lithium…

Best,

|

Selva Freigedo,

Editor, Fat Tail Commodities

Comments