It’s been almost 10 years since Tesla announced it was building its first Gigafactory.

These massive factories produce lithium-ion batteries, and Tesla wanted to start manufacturing its own batteries to put them in their electric vehicles (EVs).

You see, when it comes to EVs, the battery is the most crucial part…and the most expensive.

So, the idea was that by bringing manufacturing in-house and using economies of scale, Tesla would be able to cut costs, hence reducing the price of their Teslas.

The company constructed its first Gigafactory in Nevada and has continued to build.

It now has factories in California, Texas, New York, Berlin, and Shanghai, and it is looking to build a seventh in Mexico.

The plan is to continue to expand to hit their EV manufacturing goals.

As Elon Musk said in a meeting last year:

‘Ultimately, we will end up building, I don’t know, probably at least 10 or 12 Gigafactories.’

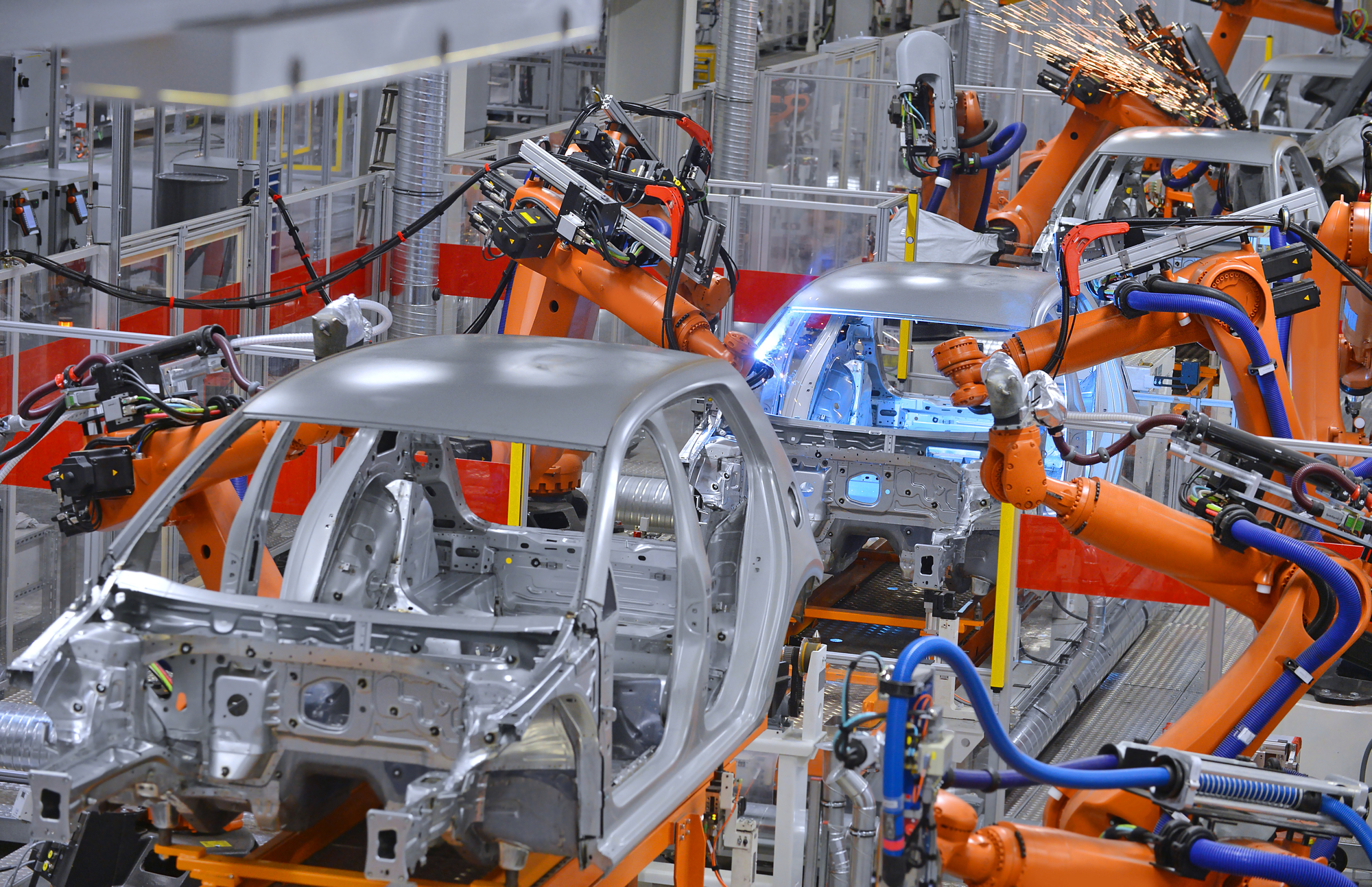

Tesla may have been the first, but more and more are now following its steps…

We’ve been hearing a lot lately about Gigafactories…

As EV sales grow, more automakers and battery makers are looking at building gigafactories to secure their supply chains and drive down costs.

To give you an idea, just three years ago, there were 115 Gigafactories in the pipeline scheduled to be in operation by 2030. That number has now ballooned to over 400, according to Benchmark Minerals.

China is the leader when it comes to building gigafactories. After all, China is the largest battery and EV manufacturer in the world.

But both the US and Europe are racing to catch up.

As Bill Russo, former chief of Chrysler in China said:

‘China’s problem with internal combustion engines was they were forever playing the game of catch-up. Now, the US has to play the game of catch-up with EVs.’

And we’re seeing a lot of investment flowing into creating these EV supply chains.

For instance, last year the US launched the Inflation Reduction Act. One of the main objectives was to bring in more cleantech manufacturing into the US and expedite EV uptake by offering tax credits to consumers.

But for electric vehicles to qualify for these credits, there are some caveats.

The EV maker needs to finish assembling these vehicles in the US. A percentage of the battery materials must be extracted or processed in the US…or a country the US has a free trade agreement with, like Australia.

So, you can see how the Act could be a major catalyst for accelerating investment into the US EV supply chain and battery manufacturing.

In fact, it’s already bearing fruit.

Since the launch of the Inflation Reduction Act, the US has added 436-gigawatt hours (GWh) of battery capacity to its pipeline, or a 57.9% increase.

As Evan Hartley from Benchmark Minerals put it:

‘Since the inception of the IRA last year, the US battery cell production capacity pipeline has experienced a growth rate significantly higher than Europe, and even China, highlighting the attraction the country now has for cell producers.’

Here’s the thing though…

While these Gigafactories are massive in size, they can be built relatively quickly.

For example, Tesla built its Gigafactory in Texas in less than two years, and Shanghai’s Gigafactory in only a year.

But building the critical minerals needed to supply these gigafactories is more complicated. These factories are going to need plenty of critical minerals…

And on average, it takes around 16 years to progress a mining project into production.

In short, as EVs continue to take off and more gigafactories come into play, critical mineral supply may take longer to ramp up to catch up with demand.

What’s more, this is intensified by geopolitics — countries looking to cut their reliance on China and build their own supply chains.

For example, S&P Global estimates that the IRA will increase lithium demand by 15% in 2035 when compared to the projected demand before the IRA. It will also increase demand for nickel by 14%, demand for cobalt by 13% and 12% for copper.

So, while things may be looking somewhat grim now, over the long term, the future continues to look bright when it comes to critical minerals as demand continues to ramp up.

Best,

|

Selva Freigedo,

Editor, Fat Tail Commodities