Have you had a chance to look at Brian Chu’s Australian Gold Report service?

I think you should.

Brian and I both agree on gold’s ability to preserve wealth against currency depreciation and a turbulent financial system.

But there’s another reason you should be paying attention.

Earlier this week, Brian showed me how gold is matching with the biggest hitter in Australian asset growth…Sydney house prices.

Step back to 1994 and the median house in Sydney was around $200,000.

Fast forward to today’s prices and the median is a dizzy $1.3 million.

That’s a staggering 550% increase that’s catapulted virtually every other class in Australia.

Except this…

Back in 1994, gold sat at AU$500 an ounce…it’s now just under 3,000 an ounce.

A gain of 500%!

It places gold in the realms of Sydney price growth over the last two decades.

Not bad for a safety asset!

It certainly trumps safe havens like cash or bonds.

It’s a key reason you should consider allocating at least some of your wealth toward precious metals.

You can find out more about Brian’s service by clicking here.

Now, let’s shift gears to another commodity…lithium.

Over the last month, this sector has been thumped.

Last year’s ASX darlings, Mineral Resources [ASX:MIN] and IGO [ASX:IGO], have been hammered with solid 30% declines this year…for the explorers and developers, losses have been worse still.

So, why are investors rushing for the exits on last year’s hottest stocks?

Well, there’s a little more to this story than just a falling commodity price…that’s what I’m attempting to unpackage today.

I believe the root cause of the negativity stems from wholesale buyers in China…the world’s most important market for lithium.

Physical traders act as intermediaries between the miners that supply the market and Li-ion battery makers who consume inventories.

Wholesalers want lower prices.

If they expect the commodity to fall, they’ll destock and clear out warehouses.

That creates a short-term glut in the market and the appearance of oversupply.

Volatility here has a direct impact on the miners…it’s a key reason why lithium stocks have sold off.

As you can see below, the Sprott Lithium Miners ETF [NASDAQ:LITP], made up of the world’s largest miners including Pilbara Minerals [ASX:PLS], Albemarle Corporation [NYSE:ALB], IGO, and Livent Corporation [NYSE:LTHM] has fallen more than 20% since mid-July.

The ETF is now approaching the major low made back in March 2023.

|

|

| Source: ProRealTime |

But from a technical standpoint, this could be setting up for a major bottom.

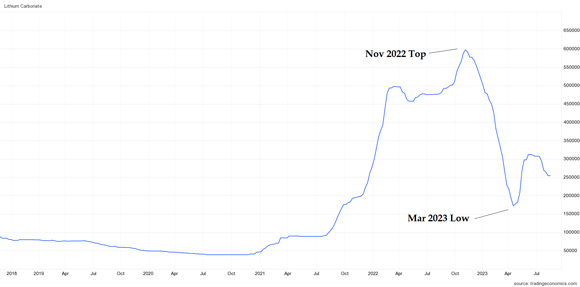

To show you what I mean, let’s look at the price for the underlying commodity…lithium carbonate.

Given equities have been under considerable pressure, you’d be excused in thinking the same thing was happening for the underlying commodity.

Except lithium carbonate remains well above its March 2023 lows.

Rather than collapse, the world’s lightest metal is showing signs of consolidating.

A ‘higher low’ from here would certainly strengthen the technical outlook and offer investors a reason to turn more upbeat on lithium stocks.

It’s why I’ll be keeping a close look at the futures chart as we pinpoint the direction of this sector for the remainder of 2023.

|

|

| Source: Trading Economics |

But turning our attention to the fundamental side offers solid evidence that the fortunes of lithium miners could be about to turn.

Nearly 300,000 new electric vehicles (EVs) were sold across the US in Q2 2023, a record for any quarter.

It represents a staggering 48% increase from Q2 2022.

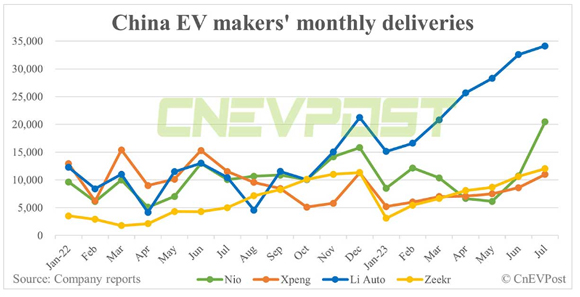

But perhaps more importantly, sales are booming in China according to the latest analysis from Deutsche Bank.

See for yourself below.

|

|

| Source: CnEVPost Company Reports |

According to one of China’s largest EV firms, Li Auto, 2023 is defying expectations.

In its latest sales update, the company announced (emphasis added):

‘Delivery of 32,575 vehicles in June 2023, surpassing the 30,000 monthly delivery mark for the first time and representing an increase of 150.1% year over year.

‘This brought the company’s second-quarter deliveries to 86,533, up 201.6% year over year.

‘The company has already surpassed its total vehicle deliveries for the entire year of 2022 with its deliveries in the first half of 2023.’

There’s nothing here to suggest demand will drop for lithium…Li Auto’s sales growth (blue line above) is rocketing this year.

EV sales growth matters for lithium miners

As you might recall, I’ve described lithium as a ‘one-hit wonder commodity.’

That’s because demand is exclusively tied to one thing…EV sales.

With purchases booming in the world’s two largest economies, the demand for lithium will surge.

Yet some analysts suggest supply will dent the outlook this year. This suggests that higher output will start to flood the market before the end of 2023.

However, that doesn’t align with the realities on the ground.

The mining industry is facing a perfect storm of rising construction, finance costs and extreme staffing shortages.

Emerging producers will continue to experience delays and technical hurdles in building out their downstream capacity.

That’s why I don’t buy into the oversupply threat (just yet).

As an investor looking to enter this market, your best bet is to focus on established producers.

Those companies are already holding the infrastructure and downstream capacity…

That’s a major competitive advantage and possibly the best way to play any future recovery.

I’ll leave it there for today.

Regards,

|

James Cooper,

Editor, Fat Tail Commodities