James Hardie Industries [ASX:JHX],the world’s largest fibre cement maker, is having a roaring day on the ASX.

The stock is the morning’s biggest gainer on the ASX 200 by 13.4% and trading at $46.77 per share. The double-digit move comes after record second-quarter earnings and a solid financial position.

The company’s strong performance in the face of a challenging housing market pleased investors, as it positions itself for brighter times ahead.

Much of the pain was avoided by the company as it brought its prices up across its divisions. In Australia, the price of materials sold increased 15%.

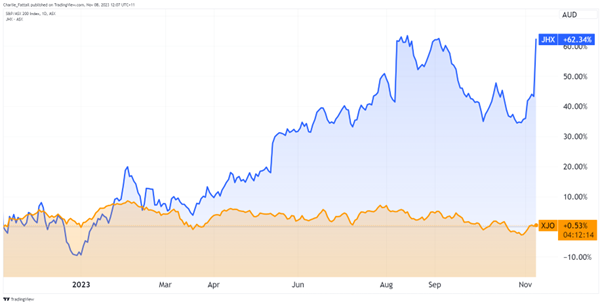

The share price is up by 62% in the past 12 months as the company celebrates the execution of its strategy of reducing costs and building out its margins.

Source: Trading View

Sales down profits up

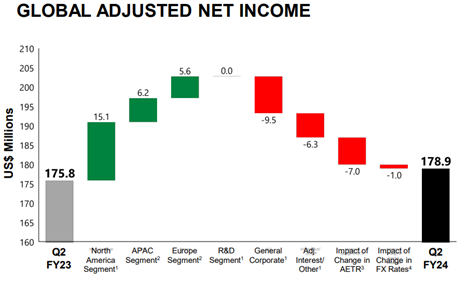

The Dublin-based company reported adjusted net income of US$178.9 million for the three months ending September 30. That landed in the middle of their expected range and was US$3.1 million more than a year earlier.

While earnings and income reached record numbers for James Hardie, global sales were flat at US$1 billion.

Profits were driven by a marked increase in average sales prices (ASP) for all its international divisions, especially Europe, which saw a 20% increase in ASP.

While margins grew — thanks to ASP — sales volumes were down across the group. Volumes fell between 2−7% across its American, Asian, and European divisions.

James Hardie CEO Aaron Erter was chipper at the results, saying:

‘Our team’s focus remains simple: working safely, partnering with our customers, managing decisively, and controlling what we can control. This focus has enabled us to deliver a strong first half, and a record quarterly result for Adjusted Net Income.’

‘I believe our last three quarterly results are proof points that we are accelerating through this cycle and taking share. We have a superior value proposition that helps our customers grow profitably and be successful. Our team is focused on maintaining momentum to deliver strong financial results again in the third quarter as highlighted by our guidance range provided today.’

The guidance given today suggests a more cautious tone, noting that the global housing market ‘continues to remain uncertain’.

This was reflected in an estimate that the American total addressable market (TAM) is expected to decrease 7−14% in CY23 compared to last year.

These declines put guidance of adjusted net income in the range of US$165–185 million.

The company also announced a share buy-back of US$250 million over the next year, replacing dividends until October 2024.

‘Control what you can control’

Mr Erter’s comments ring true with today’s results. The building company has successfully maintained a strong position within an uncertain macroeconomic environment.

Through solid cost controls, the company has successfully brought its margins back to a group total of 24%. This was especially true in North America, where EBIT margins hit a record 31.7%.

Source: James Hardie Q2FY24 Report

The company hit further records with 1H24 operating cash flow of US$459 million, up 74%.

Despite robust earnings, the highly cyclical building industry faces tough times. Driven by high-interest rates, you can see the impact on sales volumes across the group.

For the next strategy phase, the company is spending more to set up for longer-term growth rather than fuss about short-term dips in volumes.

The company downplayed this, saying it always was a ‘growth company’ but it’s more than usual.

By the end of FY24, James Hardie projects US$550 million in capital costs as it builds out its capacity.

The company sits in a healthy financial position, so it makes sense that they want to remain agile and have the capacity to ramp up production if the market cycle turns up.

When that will come is still up for debate.

Timing housing market cycles is often tricky in an environment of high-interest rates. Housing remains at the mercy of Central Banks, who have maintained a hawkish ‘higher for longer’ mantra.

Another market that will likely be a big winner when interest rates come down is the mining sector.

How to catch the next Aussie mining boom

Junior miners have had it rough in the past year. Facing depressed commodity prices, many players can’t seem to catch a break.

But with trouble comes opportunity. Today, in the market, massive resource holders are worth cents.

Mining juniors holding some of the largest reserves in the world in a range of minerals can be picked up at discounts unseen in 50 years.

While uncertainty remains high, gold miners are having a field day.

As cautious investors hedge in gold, ASX miners stand out as great picks to consider to balance a portfolio and diversify your holdings.

Want to know which critical minerals to look for in the next boom or what Aussie miners are holding the keys to our tech future?

Click here to learn more about how to capitalise on the next mining boom.

Regards,

Charlie Ormond

For Fat Tail Daily