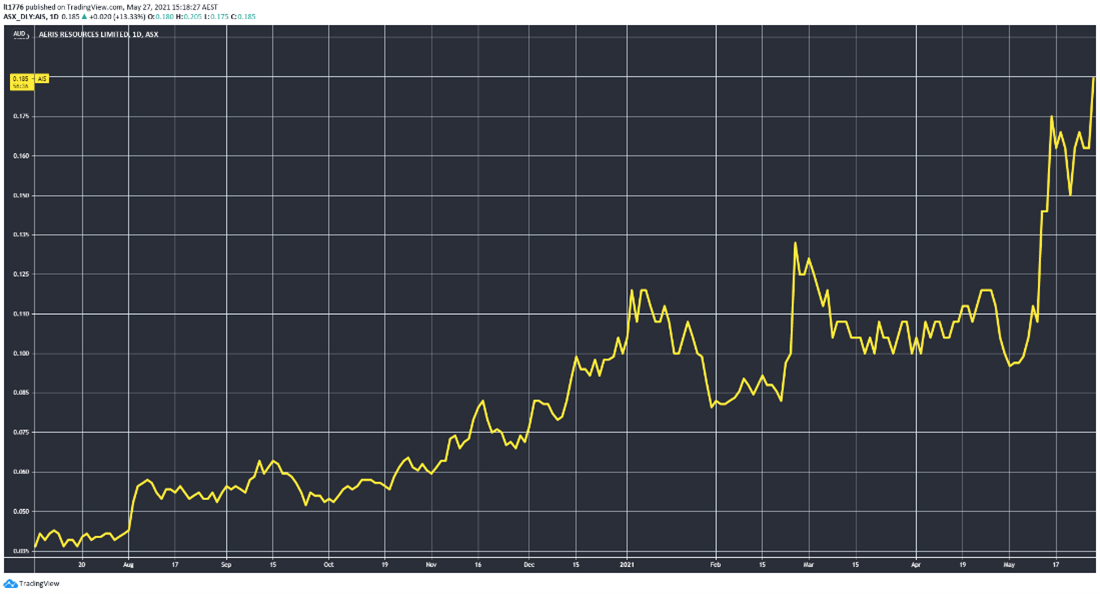

At the time of writing, the Aeris Resources Ltd [ASX:AIS] share price is up more than 12%, to trade at 18.5 cents.

Today’s announcement is a continuation of a strong run for AIS shares, as you can see below:

Source: Tradingview.com

We take a look at today’s announcement and the outlook for the AIS.

Highlights from today’s announcement from AIS

Here they are:

‘– TAKD019 intersects a 60m thick sulphide interval (ranging from disseminated to massive) from 140m down hole (assays pending)

‘– The Reverse Circulation (RC) drill program has defined a significant shallow oxide/supergene enriched copper footprint from 5m below surface (assays pending)

‘– Diamond drilling continues to expand the down plunge and along strike extents of the mineralised system associated with the larger/deeper Moving Loop EM (MLTEM) plate:

– TAKD011 – 1.75m @ 8.54% Cu, 5.62g/t Au, 21.9g/t Ag (from 346.85m1) o Five new diamond holes (TAKD015 – TAKD019) have all intersected the sulphide horizon (assays pending)

– Downhole electromagnetic (DHEM) surveying has defined a second EM conductor at depth, beneath the known mineralised system

‘– Application made for further 40 RC drill holes to further define potential near surface mineralisation

‘– Mineralisation now traced 850m down plunge and remains open down plunge and along strike’

For context, those are all killer grades at a shallow depth, they are going after more hits aggressively and it would appear at first glance that the resource could go quite deep.

All good news for Aeris then.

Outlook for Aeris Resources — is the slumbering gold bull awake yet?

Aeris bills itself as an ‘established Australian copper-gold producer and explorer’.

Which makes sense given their operations.

Copper is increasingly harder to mine these days as well, so shallow grades like that are impressive.

Despite a huge run-up it would be understandable to wonder if Aeris has more room to run.

Currently copper is taking the limelight as industrial metals move with inflation fears, increased demand, and supply chain issues.

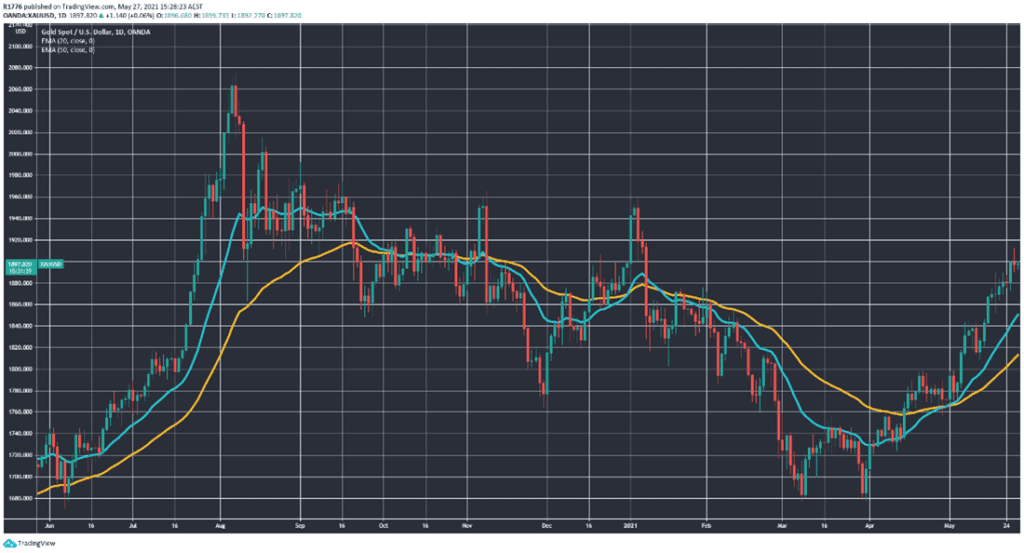

Meanwhile gold appears to be moving finally as well:

Source: tradingview.com

The crossover of the 20- and 50-day moving averages in early May was followed by a strong move up.

Meaning that AIS could be well placed to benefit either from a boom in industrial metals prices, a boom in the gold price, or both.

I’m leaning towards both based on what I’m seeing in the market.

Finally, if gold stocks like AIS are suddenly on your radar, I’d encourage you to check out our free report which covers the easiest way to invest in gold in Australia.

Regards,

Lachlann Tierney,

For The Daily Reckoning Australia

PS: Discover what is probably the easiest way to start investing in gold in Australia. In fact, it’s as easy as buying a book on Amazon! Click here to read the FREE report.