The US economy is teetering from high inflation. Iran goes into revolution and oil prices skyrocket.

The price of crude more than doubles to $39.50 per barrel.

Long lines appear at gas stations all over the US.

A new Fed Chairman called Paul Volcker is installed to solve the national crisis.

His remedy?

Shock therapy.

By 1980, the prime rate — the price of money for the most creditworthy borrowers — hits 21.5%.

The US unemployment rate reaches 11%.

In 1982, a young man called Ray Dalio predicts a coming depression.

Ray sees that US banks have lent too much money to emerging Latin American countries.

And in August 1982, Mexico defaults on its debt. Other countries soon follow.

US banks are heavily exposed. It indicates a nasty credit contraction ahead.

Congress invited Dalio to testify at a hearing they were holding on the crisis.

He goes on a national and widely watched business TV show called Wall $treet Week with Louis Rukeyser and confidently explains why a long depression is coming.

Dalio gets it hopelessly wrong.

‘I thought the economy and the stock market would go down a lot,’he recalled years later. However, ‘The economy and stock market went up a lot!’

The Mexican debt default in August 1982 marks the low for the Dow Jones Industrial index.

It never trades below this level again.

‘I lost money for me. I lost money for my clients,’ Ray said. ‘I was so broke that I had to borrow $US4,000 from my dad. This was very, very embarrassing.’

Today Ray Dalio is one of the richest men in the world.

But he fell into the trap many have done — making grave predictions at real estate cycle midpoints.

What happened instead?

Interest rates fell. Tax rules changed. The US government ran huge deficits — and land values ran into an even bigger peak in 1989!

That brings us to today…

Westpac analysts currently forecast for the federal deficit to be $90 billion this financial year, and $160 billion for the next.

The record ‘stimulus’ promised by the government is to ensure enough taxpayers continue to pay their debts to the finance, insurance, and real estate (FIRE) sector.

Consider that the Victorian state Government has pledged $500 million to ‘help tenants cover the rent and keep a roof over their head.’

It’s an indirect subsidy to the banks, as it allows any leveraged landlord to keep paying their mortgage.

And the six-month mortgage ‘holidays’?

They have the potential to gift the banks thousands of dollars in interest repayments over the life of the loans.

That’s because the interest payments forgone now, capitalise into even bigger debts.

And what’s on the other side of this pandemic lockdown?

——————–OUT NOW——————–

Catherine Cashmore’s New Real Estate eBook Drops Wednesday, 6 May…

Read The Mid-Cycle Almanac: Your Investing Playbook for 2020-2026, and discover:

- How far house prices are likely to drop in this mid-cycle slowdown…

- Whether you should still try to push on and sell if your house, unit or apartment is on the market — or if you should stay put for a while…

- Why you may soon have a buying opportunity like no other in your lifetime (prime property…world-class stocks…if Catherine is right, it’s likely everything will be marked down and on sale)…

———————————————————————————

In the words of Victorian Premier Daniel Andrews:

‘When we get to the other side of this, the biggest construction boom in our state’s history, will need to be even bigger.’

That’s a sentiment shared by PM, Scott Morrison, who said:

‘“The best way to keep people off jobkeeper and jobseeker” is to “keep the pace up” on projects, with the federal government working with states to “put the pedal down on future projects”.’

And Australia has the financial muscle to do this.

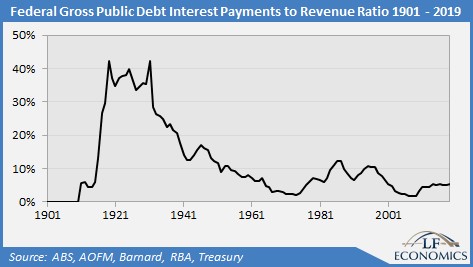

Currently, the percentage of revenue devoted to servicing the federal debt is around an all-time low.

See for yourself…

|

|

|

Source: Phillip Soos |

That gives the federal government huge scope to offset the downturn with deficit spending.

It also lays the foundation for a land and stock market boom that could dwarf anything we’ve seen thus far.

This is not a guess — it’s simply the real estate cycle in action.

And specifically, the mid-cycle slowdown.

Every property cycle has one.

We have centuries of real estate history to prove it.

The Forgotten Depression

We do have a very good example to compare the current market to.

If we go back 100 years, it takes us to the mid-point of the real estate cycle at the time.

By 1920, the Spanish Flu had killed a reported 100 million people — more so than the First and Second World Wars combined.

Whole economies shut down on a scale similar to what we’re seeing today.

The pandemic hit mostly the working age population (between 20–40 years). Newspapers from the era carry stories of people contracting the flu in the morning and dying by evening.

It was truly the mother of all pandemics.

On the back of it came a depression (1920–21). Few have heard of it — it’s rarely mentioned.

For that reason, it’s often referred to as ‘the forgotten’ (or lost) depression.

In some respects, it was worse than the Great Depression. The difference was there was no real estate crash in 1920.

The Forgotten Depression was characterised by extreme deflation.

Wholesale prices fell 36.8%, the most severe drop since the American Revolutionary War — and worse than any year during the Great Depression.

There were sharp declines in industrial production.

From May 1920 to July 1921, automobile production declined by 60%, and total industrial production by 30%.

GDP plummeted by a whopping 24%. Unemployment soared to over 11%.

The climate was terrible for businesses. And those that avoided bankruptcy saw a 75% decline in profits.

It took until 24 August 1921 for the stock market to bottom (at 63.9). A decline of 47%.

Keep that date in mind, as it’s close to the forecast we have for the bottoming of the current stock market downturn.

The recovery however was rapid — just as you would expect at the mid-cycle point, without a real estate crash.

The recession of 1920–21 had the most severe decline and most robust recovery of any recession between 1899 and the Great Depression.

Some economists have used it as a textbook example for why governments shouldn’t stimulate the economy in a recession.

There was nothing on the scale of what we are seeing today to help those struggling.

However, notable is the technological revolution that followed.

It fuelled the ‘Roaring Twenties’.

Televisions were invented. Homes were connected to the electrical grid and indoor plumbing. The first cross-Atlantic flight was successfully navigated. Cars and electrical manufacturing took hold.

Jukeboxes were invented. As was the cheeseburger!

The transformation led to a sharp rise in productivity.

It changed forever the size and living arrangements of households and workplaces.

There was huge expansion in credit, and construction.

And with technology being the only option to connect with people in the current pandemic, it won’t be surprising to see a similar trend emerge in 2021.

Why this doesn’t look like a property crash to me

Historically, a major real estate crash is always preceded by lax lending policies.

Think of zero deposit loans and ‘low doc’ borrowers.

The resulting speculation that comes from this causes central banks to increase interest rates to cool down the inflation that the boom induces.

That, in turn, stresses over-leveraged households that suddenly find that they can no longer service the debt.

A flood of foreclosures hits the market at this point.

That’s not the scenario we see today…

In Australia, the banks are in a much better position than they were 10 years ago (hence the ability to offer lengthy mortgage holidays).

The royal commission in 2018 curtailed a lot of real estate speculation because banks remain strict with their lending criteria.

Don’t forget, Australian regulators moved to cool the housing boom even earlier when they restricted the number of interest-only loans in 2017.

Investors have not had a large percentage of the buying market since 2017. Mortgage rates are around record lows.

However, that doesn’t mean mid-cycle slowdowns cannot produce severe recessions.

But it does mean that the recovery tends to be faster if real estate doesn’t crash…and I’m not expecting it to this year.

Why real estate probably won’t crash until 2026

Perhaps the best piece of evidence that we remain on track for a property boom into 2026 is this…

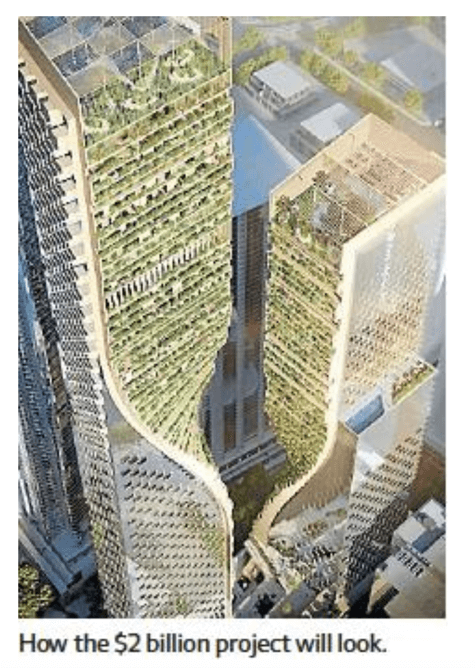

Approval has just been given for the country’s new ‘tallest’ tower.

Tall or ‘record’ buildings are the most reliable indicator of a cycle peak since 1837.

The tower will be constructed in Melbourne, with work also approved for three other large projects.

The Malaysian-backed developer will create 789 apartments, a 322-key hotel, 27,000sqm of office space, and 32,000sqm of retail space.

The proposed height of the tower is 368.1 metres.

|

|

|

Source: Australian Financial Review |

Measured from sea level, that puts it above the air traffic control limits.

This would unlikely have been approved prior to the pandemic.

Demolition is already under way. Construction of the first building in the two-tower development will begin mid-year. And the completion date is right at the end of the current cycle — 2026.

That’s when you can expect a major real estate crash, not now.

Before then, expect house prices to cool in the short term…

And then boom — stronger than ever — into the eventual cycle peak.

Sincerely,

|

| Catherine Cashmore, For The Daily Reckoning Australia |

PS: Want to discover more about my new property market eBook and the18-year cycle? Click here find out more!