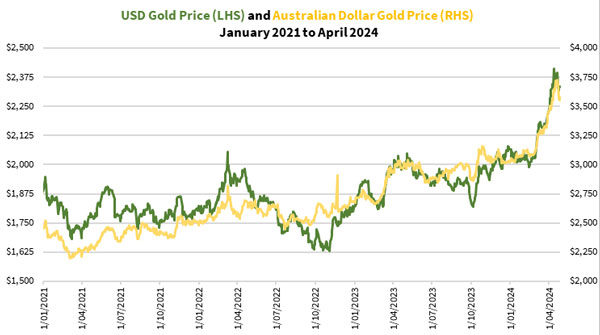

Gold started going parabolic after the US Federal Reserve’s March meeting. Before that, gold has been trending up since making a cyclical low in November 2022 as you can see below:

|

|

|

Source: Refinitiv Eikon |

Looking at how gold has rallied over 25% in the last three years, you might think the rally is long in the tooth.

Add to that the media hype on gold now, you might think it’s time to sell gold and move to another commodity, like copper.

Gold stock investors lived through three testing years. False rallies lured them to add to their portfolios, only to destroy their wealth as individual companies slumped as they operated in a hostile environment.

This month is especially poignant, at least for me.

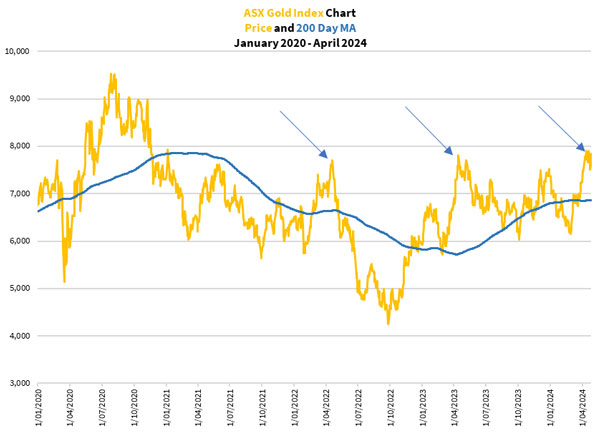

Let me show you why with this figure of the performance of the ASX Gold Index [ASX:XGD]:

|

|

|

Source: Refinitiv Eikon |

Gold stocks made their high for the year in April in both 2022 and 2023. It’s done the same this year.

However, in the past two years, gold stocks ground down for several months, dashing the hopes of many investors.

If you look at the past as a guide to help you invest, you’re inclined to sell into this recent surge in gold.

The signs are pointing to it.

In another period, I’d lean on making a quiet exit.

But this time, the corporate insiders and something else are telling me to do the opposite.

Let me talk about this today.

What not to do if you want to

invest successfully

In our times, years of events can happen within weeks.

Earlier this month the narrative changed from focusing on inflation accelerating in the US and in many countries around the world to fears of a world war erupting over Israel and Iran trading fire.

Things came to a head the weekend before this one when Israel fired missiles at Iran, threatening the Iranian nuclear facilities.

That was last week.

Now the attention has turned back to the state of the global economy as the US GDP reading for the first quarter disappointed market expectations. Add to that the dire outlook on our economy as inflation picked up pace and rental vacancies are falling while costs are rising.

If you’re trading based on the latest news, you’ll become a mental wreck. You’d be bullish one day and bearish the next.

Not to mention trying to work out which trades to jump on and to close.

Some of you may already have stopped reading or watching the news.

You might be doing the right thing.

Besides the media driving an agenda nowadays rather than reporting the facts and events as they happen, they’re unlikely to help you beat the crowd.

Think about how they cover financial and investment news, especially on gold.

Most of you have noticed that gold made new highs in Australian dollar terms as early as March 2023 when it breached AU$3,000 an ounce for the first time.

For several months, it held that level.

Did you hear much about that from the financial pundits on different channels?

I doubt it!

But things changed this month.

By now, gold has smashed through US$2,100, a crucial level I pointed out last December as the key resistance level which would give the gold bull market further momentum.

Finally, the media cranks up the press to churn out stories about how major investment banks predict gold will trade over US$2,500 and as high as US$3,000 by the end of the year.

Well what a surprise, I wrote about that last December too!

My point is that investing with the media pundits to guide your decisions will mean you’re late to the party.

Three signs to show this rally is

gathering steam

So let me get back to the main takeaway for this article which is why I’m not selling into the gold rally now.

Firstly, corporate activity is heating up in this space.

Last year was one of the biggest years for mergers and acquisitions in the gold space. Some US$30 billion worth of transactions, in fact. The biggest of course was Newmont Corporation [NYSE:NEM] buying our own gold mining giant Newcrest Mining to create the world’s biggest gold producer.

There were several others, some of which I recommended to my paid readers.

This year hasn’t seen it let up. Rather it’s accelerated!

Just last week, Equinox Gold [NYSE:EQX] arranged to buy the remaining 40% stake of Greenstone Gold Mines from its joint venture partner, Orion Resource Finance, for AU$1 billion.

This is yet another consolidation happening, adding to the list of mergers between gold producers and mine asset purchases.

Another sign is several companies managed to raise an excess amount of capital from investors in the recent round of offerings.

In the last three years, the trend has been that companies raising capital ended up with less funds than it intended because investors weren’t interested. Therefore, these companies would rely on a financial institution to buy these shares to close the funding gap.

This is no longer the case.

In extreme cases, the company closed its offer early as investors clamoured to buy cheap shares and dilute the capital. I’ve experienced it myself, having been shut out of an offer because I didn’t move fast enough.

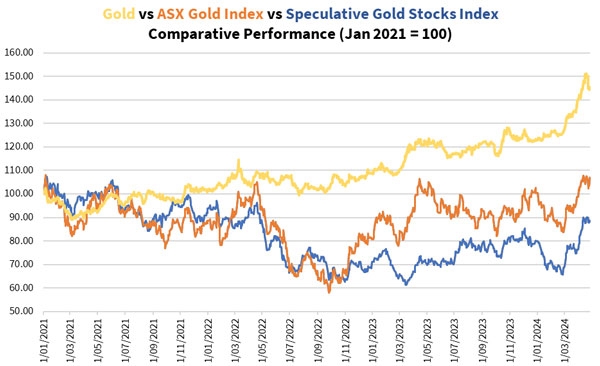

Thirdly, the figure below made me think twice about leaving this party early:

|

|

|

Source: Internal Research |

The figure showed the comparative performance of gold (yellow line), established gold producers (orange line) and gold explorers (blue line) since 2021.

Notice the significant gap between the performance of gold and gold stocks?

It’s clear gold has powered ahead in this gold price cycle while gold stocks lagged.

Two things might be happening right now: Either gold is overvalued or gold stocks are undervalued.

I’m leaning on the latter.

The reason for me believing that gold stocks are undervalued lies in the lack of a parabolic run in gold stocks in this gold price cycle.

The key reasons are the crippled supply chain and the aggressive rate rise cycle that pushed mining costs higher while labour availability suffered.

These companies just released their financial activity reports for the 2024 March quarter.

This time, the results look more positive, barring those in parts of Western Australia that faced unseasonably heavy rainfall.

Companies that were ramping up their operations are finding their cruising altitude. Meanwhile, production costs seemed to have peaked and are on the decline.

So we might be about to see a setup for the next leg of the rally as the numbers support this.

Follow the corporate insiders and reap the potential benefits

In closing, I hope that you can see why this year’s setup for gold stocks could be more promising than the last two.

Gold has moved higher but the backdrop of economic weakness supports this rise.

Gold stocks, on the other hand, are far from being overvalued. The recent conditions might help it overcome the curse of its recent past, taking it to new heights.

If you’re reluctant about taking this journey alone, then let me make an offer to you.

Check out this video where I showcase what my precious metals investment newsletter, The Australian Gold Report, has to offer. This is your one-stop shop for building a comprehensive precious metals portfolio from physical bullion to gold stocks.

Besides the established gold producers, I have two early-stage gold explorer/developer recommendations for you to consider.

Since February this year, one of them has almost doubled! While there are no guarantees this stock, nor any stock, will continue to perform like this, as gold stocks remain risky and volatile, the company’s potential could take it higher even at this level.

So you don’t want to hesitate any longer. Jump on board before the mainstream investors rush into this space.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report