From your humble drink can to the airframe of an F-16 fighter jet, aluminium’s role in the global economy is diverse and critical.

Like copper, aluminium is used in established industries, such as manufacturing and housing construction. Yet, it is also leveraged to growth sectors.

With superior corrosion resistance, aluminium is widely used in solar installations.

Here, it’s used in frames, wires, and support structures.

According to some sources, the ability to withstand the elements gives aluminium a service life exceeding 70 years.

Corrosion resistance also makes it ideal for offshore wind farms…tower platforms, transformer stations, and turbines are all made from aluminium.

For these reasons, the United States and the European Union have classified the metal as a critical mineral.

Yet, one of the biggest growth drivers could come from the mass build-out of the global power grid.

Few have considered the LIMITATIONS of the existing energy grid in the relentless move toward renewables.

However, this is the critical link connecting power generation to the end consumer, and aluminium is set to play a crucial role.

Power grid upgrade…it’s not all about copper

You might be surprised to learn that aluminium is already widely used in power grid installations as an alternative to copper.

This is not a new phenomenon.

The decision to find an alternative to copper dates back more than 80 years, taking shape in the early days of WW2.

At the time, the copper supply was being funnelled into manufacturing shells, bullets, and other war munitions. Recycling wasn’t an option—copper was being blown out of the circular economy!

In desperation, the US began minting steel coins to divert more copper to the war effort.

With the stakes high, engineers were tasked with testing an alternative metal—a metal with similar conductive properties…aluminium offered a viable alternative.

After passing initial trials, aluminium was incorporated into power utilities and other electrical wiring, including homes and factories.

Although up to 40% less efficient than copper, aluminium can conduct electricity long distances. Since then, aluminium has continued to play an important role in energy transfer.

That leads us to an important question…could mass global electrification drive strong demand for aluminium?

Electrification and the aluminium opportunity

Aluminium doesn’t receive as much attention as its high-profile base metal cousin, copper. Yet, it does share similarities.

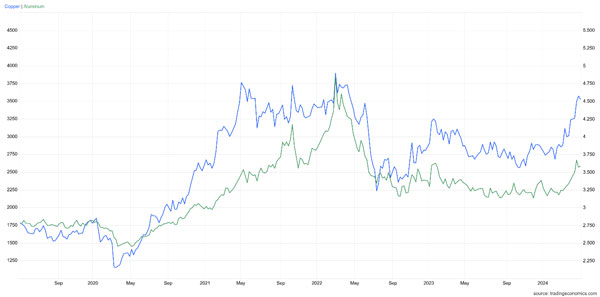

Note the strong correlation between aluminium and copper prices, below:

|

|

|

Source: Tradingeconomics.com |

While copper has fared better since coming off the resource-wide peak in 2022, both metals appear to be marching to the beat of a similar drum, gaining strong momentum in 2024.

Like copper, interest is picking up for this base metal.

According to the International Aluminium Institute, demand has been forecasted to grow by 33.3 million tonnes over the next decade. Rising from 86.2 million tonnes in 2020 to 119.5 million tonnes in 2030.

Around 37% of this growth is expected to stem from China, through manufacturing, construction, and the country’s ambitious power grid upgrade to accommodate electrification.

And like copper, SUPPLY will play a critical role in this investment opportunity.

Understanding the supply dynamic

Aluminium ore, known as bauxite, is not typically rare.

The formation is similar to laterite nickel deposits, where high volumes of rainfall remove ‘mobile’ elements from the soil, leaving behind a natural concentration of the less mobile elements.

That includes nickel, iron and aluminium.

Copper deposits, on the other hand, form via the mineralisation of primary ore deposits deep below the surface, making them harder to find and more expensive to extract.

That’s why, pound-for-pound, the per-unit value of copper will always exceed that of aluminium.

While bauxite deposits are relatively common, supply problems emerge at the processing level.

You see, aluminium production is energy intensive. About 17,000 kWh of electricity is required to produce just 1 tonne of refined metal.

Rising energy costs can impact supply, that’s what we witnessed across Europe in 2022.

As war broke out in Ukraine and Putin restricted gas supplies, energy prices spiked. In response, aluminium smelters slowed operations and curtailed output.

So, where’s the investment angle?

Given that bauxite is relatively common, the upside for miners may be limited.

Similarly, unless refiners have access to a cheap energy source, companies will be hostage to higher operating costs.

Investing in a dedicated aluminium ETF could be the most strategic option for gaining upside here.

Usually, I levitate toward stocks, but given the added risks, ETFs could offer the best opportunity. That’s not to say there aren’t company-specific opportunities though.

My Diggers and Drillers service recently uncovered a stock in the specialised high-purity alumina (HPA) market. HPA is a purified form of aluminium with specialised applications.

If you’re interested in finding out more about the emerging HPA opportunity, you can do so here.

Regards,

|

James Cooper,

Editor, Mining: Phase One and Diggers and Drillers