Over the weekend, I got caught up in a bit of doom-scrolling on Twitter (now X.com).

This was the chart that had everyone in a panic:

| |

| Source: Bloomberg |

The Japanese Yen is depreciating very fast against the US dollar right now.

Some people are concerned this could be a ‘canary in the coal mine’ moment.

A signal that the proverbial is about to hit the fan.

This comment summed up the general vibe:

‘This is it. We’re moving to a new stage of the Endgame. Japanese Yen ripping through barriers like paper, passing each level where the BoJ intervened before.

‘The slow-motion meltdown has finally begun to accelerate, and authorities are powerless to stop the decline, unless they want to dump their Treasuries.

‘Yellen probably on the phone with them tonight, warning dire consequences if they put their finger on the button to defend their currency. Japanese PM Kishida met with Biden this month, smiling on the surface, but pain underneath.

‘He knows, as Kuroda does, the terrible truth: They are TRAPPED.’

While this kind of cataclysmic mood can be found on Twitter most weeks, some of the more serious professionals are worried too.

Former Pimco CEO and ‘bond king’ Mohamed El-Arian noted there was severe pressure on Japanese authorities to act quick on this.

But he also added:

‘The risk for Japan is that such intervention could prove ineffective without accelerating the normalization of monetary policy.

‘Here the authorities worry that such acceleration could undermine the ongoing economic resurgence. Plus they think this is more a US driven process than internal.

‘Bottom line: It’s complicated.’

It’s the same message as the first poster, albeit delivered a bit more calmly.

What are they both getting at?

Rock and a (very) hard place

Basically, a falling Yen is likely to lead to higher inflation in Japan. This would normally mean higher interest rates to combat it.

Like our central bank in Australia is doing right now.

But here’s the thing…

Japan has an eye-watering debt-to-GDP ratio of 263%.

That’s the number one position in the world (with Venezuela coming in second)!

Increasing interest rates would likely cause debt to balloon even further (as interest payments ramp up) while simultaneously dragging on economic growth.

A double-whammy.

Alternatively, they could sell their US dollar holdings (Treasury Bills) to try to defend their currency.

As you can see here, they’re a big holder of US government debt:

| |

| Source: Statista |

The problem here is that any fire sale of US bonds will likely drive the price of those same bonds down.

Meaning, they’ll devalue their own holdings in the process.

And as the first poster alluded to, the US also doesn’t want Japan dumping their bonds right now.

They’ve got their own economic headaches.

Last week, the US had a massive 50% downside miss on GDP (economic growth).

At the same time, inflation came in red hot.

This raises the dreaded spectre of stagflation, which occurs when an economy slows down while inflation remains high.

Like Japan, this situation has hamstrung the Fed when it comes to interest rates, which are now expected to remain high.

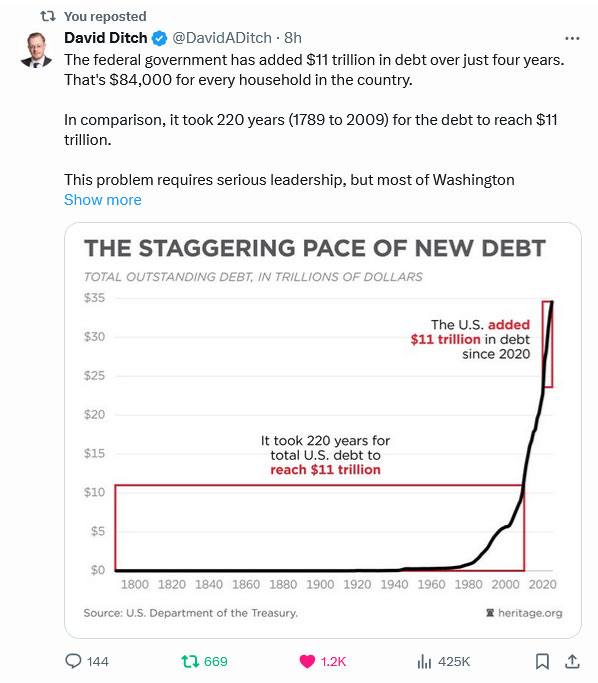

Bear in mind, the debt situation in the US right now looks like this, too:

| |

| Source: X.com |

So, where does all this leave you and me as investors then?

Lessons from the 1970s

Look, I’m not going to pretend I know what will happen next.

As I said at the start, markets always have all sorts of doomsayers, and most of the time, they are wrong.

The economy muddles through all sorts of issues more often than not and 99% of the time, the worry isn’t worth the angst.

It could all be a storm in a teacup.

That said, it’s clear to anyone who has studied history that the global monetary system is about to face a reckoning in the coming years.

That’s just how economic cycles go.

As an investor, thinking about how to hedge yourself against these possibilities is never a bad idea.

In the 1970s, real estate, energy, commodities, and gold/silver proved to be good investments in a stagflation-prone environment.

Stocks and bonds, not so much — though you could make an argument for defensive and value stocks at the right time too.

In today’s world, I’d also include Bitcoin — a new form of digital gold — as a useful hedge against a monetary system that’s clearly out of control.

But there’s a caveat…

If you own Bitcoin, you need to do so in a way where you have full control over your holdings.

Only ‘self-custodied’ Bitcoin is safe from the more extreme possibilities of government intervention.

Bitcoin ETFs — though easy to use and a good driver of overall demand — don’t offer this protection.

They’re ‘paper’ Bitcoin.

Of course, like any asset, you need to consider the risks and rewards on offer before you invest — and only then can you make a proper portfolio allocation decision.

But you need to think fast.

Because if things do get as bad as the doomsayers think, they’re likely to try and close the exits — including your access to buying Bitcoin.

Leaving you stuck in a world with soaring inflation and falling asset values all at once.

Many will be stuck in a pot like a slowly boiling frog, unaware of what’s about to happen.

Prepare accordingly.

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments