The cryptocurrency ‘whales’ — the wealthiest end of the market — are now buying coins en masse again.

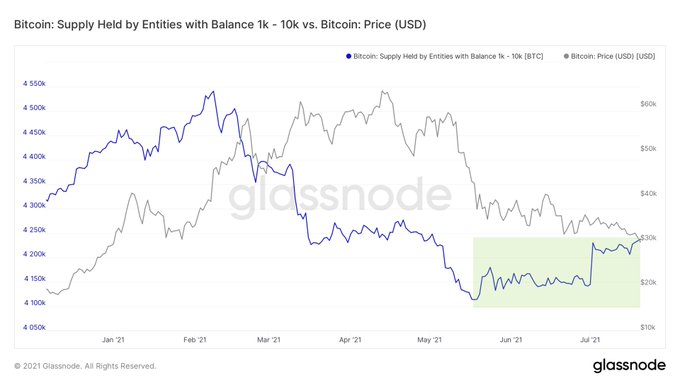

As Coinbase reports, the number of coins held by whale entities — clusters of addresses controlled by a single network participant holding 1,000–10,000 BTC — accumulated more than US$3 billion in the last three weeks of July, while the Bitcoin [BTC] price ranged around US$30,000.

Last week we saw a big breakout to the upside.

Whether it will hold and set a new base, it’s too early to tell.

Instead of focusing on the price, you may wish to look at what the smart money has been doing.

And the smart money has been BUYING on dips, fear, and bad news consistently since the end of May…

|

|

|

Source: Glassnode |

See that? Price goes down…whale buying goes up.

What’s more, it appears the whales have been making a big effort to further decentralise their crypto holdings over this time. According to Glassnode, the amount of BTC held in cryptocurrency exchanges has actually been dropping. The whale investors seem instead to be shifting their growing holdings to cold wallet storage instead of leaving them on exchanges where they can quickly sell them when they want.

Translation:

They’re bulk buying on price weakness and

not planning on selling anytime soon

What does this tell you and I about where the smart money thinks the financial world is going?

Interesting, isn’t it?

This is just another twist in this fascinating stage in the evolution of what we call ‘the new game’.

When prices falter, clusters of addresses with the biggest holdings have actually been systematically adding to their hoard of cryptos.

While small holders and the media take another bearish turn on digital currencies, bitcoin ATMs have started popping up all over the US. They allow customers to walk up and trade up to US$18,000 cash for bitcoin. And they’ve more than doubled in number in the last year.

JPMorgan just became the first bank in the US to give financial advisers the go-ahead to offer retail wealth management clients crypto funds. And, keep in mind, CEO Jamie Dimon has been one of the loudest critics of crypto in recent years!

Another old gamer joins the new game.

As Nasdaq.com put it last week, it’s:

‘A move that signifies faster crypto mainstream

adoption than many had predicted’

The important point to note here is all these new game advancements have been happening WHILE cryptos have been in their recent, much-publicised doldrums.

The world’s most tapped-in investors are saying:

This is the future. I want to be invested. Lower prices mean I want more exposure, not less. Get me in.

It by no means indicates prices are going to rocket again any time soon. And no doubt, volatility will remain.

But, as journos and punters focus on the price lurches, wiser minds realise something far more profound is unfolding here…

This hype cycle is very different from 2013 and 2017.

The black swan of COVID-19…

The straining of the global financial system to deal with…

The unprecedented levels of crypto adoption by institutions…

The rise of something called decentralised finance (DeFi)…

And this year, a suspiciously coordinated effort to pour cold water on it all…

These are all new, unique inputs.

Put simply: We are entering a new epoch in finance and investing.

As I say, we call this epoch ‘the new game’.

The pandemic, and its ensuing monetary policies, pushed a huge crowd of new investors into crypto. Many of them just got scared off by the recent stress test.

But none of this changes the fact that, at the same time, the entire financial landscape is being rewired.

It’s a rewiring every bit as weighty as the introduction of computers, and then the internet.

If you can shut the noise out — focus on that one fact — and make the right moves, right now…

…you could win spectacularly.

You could be substantially better off than others by the end of this decade.

That requires, first and foremost, an understanding of this new game.

We’ve just finished a brand-new, five-part guide that helps you do that.

Regards,

|

Greg Canavan,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here