Gold closed last week at US$2,391 an ounce (AU$3,726), making another all-time high in US trading.

Some of you may’ve noticed it spiked as high as US$2,420 around noon Sydney time and stayed there briefly, see below:

|

|

|

Source: Kitco |

The spike in gold coincided with reports that Israel had fired missiles and rockets into Iran in retaliation to recent attacks.

Suddenly, the headlines pointed to how the latest military strikes could escalate into a world war. I’m sure if you watched the nightly news, they were running stories about it, complete with footages of leaders holding press conferences pontificating about how these conflicts must cease.

Never mind the fact that they prolong and escalate these by sending funds and doing deals with their allies, even their foes. That’s the two-faced nature of politicians.

Within two hours, the price of gold eased. The Iranian government came out to laugh off the Israeli strikes, calling them ‘a failed and humiliating attempt by the Israeli aviation’. Moreover, the Iranian government confirmed that its key nuclear facilities were unharmed. Therefore, it isn’t planning further responses to the latest attacks.

Anyway, tensions have eased for now. I’m glad about that.

Let me unpack the move on gold in this latest drama and how it sits within the context of the rally in gold we’ve seen since late-2022.

I want to help you distinguish between unfolding events that affect the financial system from those that might be a blip on the radar in the long-term outlook for gold.

The short and long-term drivers of gold

The most commonly stated reason for gold rising is during periods of major upheaval. These could include a sharp economic recession/depression, an outbreak of war or a major catastrophe.

However, the most common reason doesn’t explain why gold has rallied almost 10-fold since the start of the millennium.

There were times when the world was relatively stable (at least compared to the last five years) and gold rose steadily. And there were times when gold didn’t rise even as the world entered a period of instability.

Just look at how gold pulled back for several months in 2022 (below) not long after the Russia-Ukraine conflict began.

I know that most of you won’t need too much explaining, but I’ll do it for the benefit of those who recently joined Fat Tail Daily.

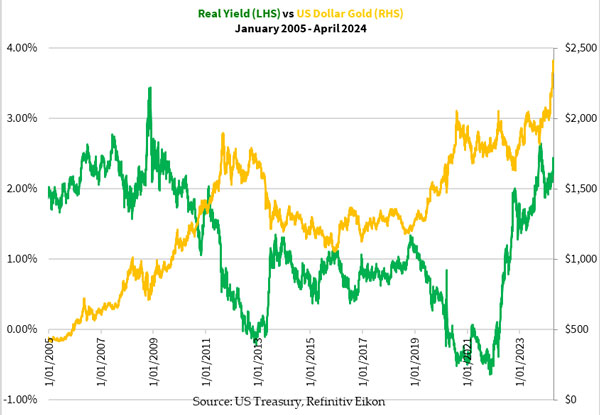

I’ve talked many times about how the most reliable driver of the price of gold is the US long-term real yield. This reflects how much return a US Treasury bond is expected to deliver over the long-term (around 10 years), after adjusting for inflation.

The two often move in opposite directions to each other, even on a daily basis as you can see below:

|

|

|

Source: US Treasury, Refinitiv Eikon |

There’re a few isolated cases where the two move in the same direction. These periods are particularly notable as they have major implications on the existing petrodollar system.

If you look carefully at the above figure, this happened in 2008, late-2010 and in the last month or two.

And the most recent rise in gold and the long-term real yield is worth noting.

Something is brewing with our financial system. It’s going to be big.

Let me clarify one thing though.

I’m not saying all the unfolding conflicts, humanitarian disasters and societal division aren’t important. But they’re the supporting cast in the main act.

The debt megalith and rising inflation

During the weekend, I recorded a video with my analyst, Trung, on our Australian Gold Fund website updating what’s been happening with the economy, the rally in gold and how that may affect the sentiment for gold stocks going forward, especially the smaller explorers.

You can check out the video here (please note these aren’t as professional a production as the Fat Tail in-house videos!).

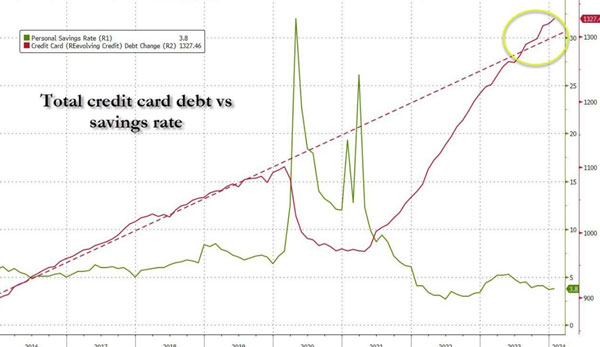

Trung shared a graph showing the relationship between the personal savings rate of US households and credit card debt. The trend made me skip a heartbeat.

Let me show you the chart:

|

|

|

Source: US Federal Reserve Bank |

Notice that the personal savings rate increased temporarily as the world locked down in 2020–21, only to plunge below the pre-2020 levels since.

More alarming is the credit card debt. This fell during 2020–21, possibly as households paid off some of their debt and spent less on travelling.

However, the credit card debt increased with a vengeance from mid-2021 onwards.

Households may’ve gone on a spending spree once the world opened up. But I suspect that is only part of the story. The rising interest rates from 2022 may’ve exacerbated the trend, which would’ve put pressure on households and businesses.

I’ve just talked about households. However, the situation is similar for businesses and corporate debt.

At the same time, the global lockdowns threw a spanner in the works for manufacturing and production. The world temporarily experienced deflation until society opened up.

The supply chain has yet to return to pre-2020 levels, however.

Production could not keep up with the demand for goods and services, further stirring inflation. The government stimulus caused a massive surge of cash but there weren’t enough products and services to go around, causing prices to rise.

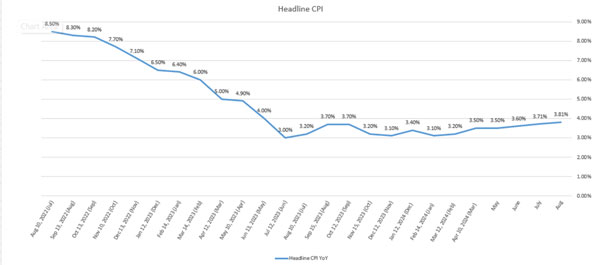

The US Federal Reserve may’ve stalled inflation briefly with the aggressive rate rise cycle. However, the figure below shows inflation could rear its ugly head once more:

|

|

|

Source: In-house research |

Interestingly, only recently in the March meeting did the US Federal Reserve announce that it expected to cut the Federal Funds Rate three times this year.

Looks like the committee has to return to the drawing board (surprise!).

Topping it off — De-dollarisation

It’s time to reflect on the litany of failures of the US Federal Reserve and central banks, governments and various financial institutions around the world especially in the last five years.

They haven’t delivered stability nor restored confidence. An absolute travesty if you ask me.

Such is their failure that you might even suspect that this is all part of a hatched plan…

The petrodollar system thrives on governments borrowing from central banks whose capital is built on debt, repaying it through taxing its people.

If you face no consequences for your actions, there’s little incentive to act responsibly. There’s little by way of accountability.

Some countries have caught up to this and they’re moving away from the petrodollar system.

In the past, the military might’ve slapped renegades back into line.

Russia and China have broken-ties with the system in recent years. And other nations are following.

The de-dollarisation process is gaining momentum.

For that reason, gold is once again gaining favour. Central banks are back in the market trying to secure more gold.

Getting back to basics with the ‘real money’

Before I wrap up, there’s a hidden danger with the rising price of gold. Even for those who like and own gold.

A rising price of gold coincides with the cost of living.

I wrote about this last year.

Since then, gold has rallied more than 25%.

This means our dollar’s purchasing power has declined by the same amount. In just six months.

Gold may or may not accelerate as rapidly over the coming months.

But I wouldn’t take my chances on gold giving back all its gains since the start of the year. Not when governments continue to throw cash at global wars from Ukraine to Gaza.

If you’re concerned about losing your purchasing power, find out how my precious metals investment newsletter, The Australian Gold Report, can help you survive the coming challenges.

And if you’re in the mood to punt a small proportion of your wealth in early-stage gold mining companies, there’ll be a special offer coming soon.

While the news cycle beats the drums of war, it’s important to focus on the main plot. Our petrodollar system is crumbling and you need to prepare for what comes next.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report