King Solomon wrote the Book of Proverbs containing many pearls of wisdom that are still relevant to this day. I want to highlight this saying from him:

‘Yet a little sleep, a little slumber,

‘a little folding of the hands to sleep,

‘so your poverty will come like a stalker,

‘and your need as an armed man.’

The Book of Proverbs 24:33–34, Modern English Translation

Australia has been a lucky country. Those who lived in the 1980s and 1990s experienced prosperity like we’ve never seen before.

As the world copped it hard with the subprime crisis, Australia managed to sail through that without too much damage. This is thanks to the resources boom and China’s growth engine cranking up off the back of our mineral exports.

That stroke of luck may’ve been a curse for you and me.

Our country is in a fine mess with soaring household debt to GDP (111.8% in December 2022), high inflation (6% year on year in the June 2023 quarter), falling living standards, and a significant proportion of the working-age population who’s unemployed (6.4%).

How did we get to this?

The answer is that we’ve been asleep at the wheel.

It’s well known that adversity builds character, while ignorance and comfort breed complacency. And we’ve had our lion’s share of ignorance and comfort.

That’s about to change since our government is tapped out with record debt. Plus, our leaders are pursuing shiny dongles such as ‘The Voice’ and the Net Zero agenda, both of which seek to redistribute our resources and wealth in less than productive ways.

Let me warn you that when the global economy slams into recession mode due to the sheer weight of debt, we’re on our own. So, you better get your houses in order!

Fooled by an optical illusion

We earn and spend dollars every day. So, it’s natural that we look at our wealth in dollar terms.

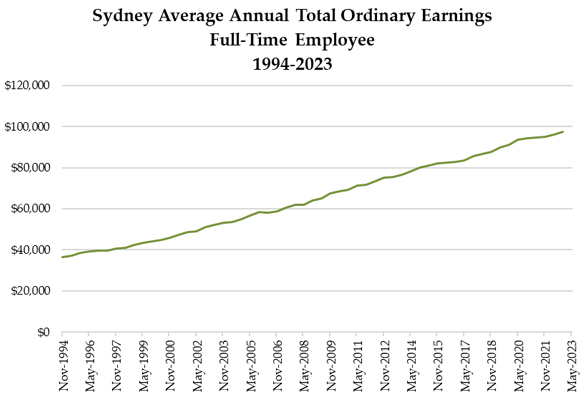

Let’s measure how our income has fared over the last three decades or so:

|

|

| Source: Australian Bureau of Statistics |

It’s been steadily rising at a rate of around 3.5%.

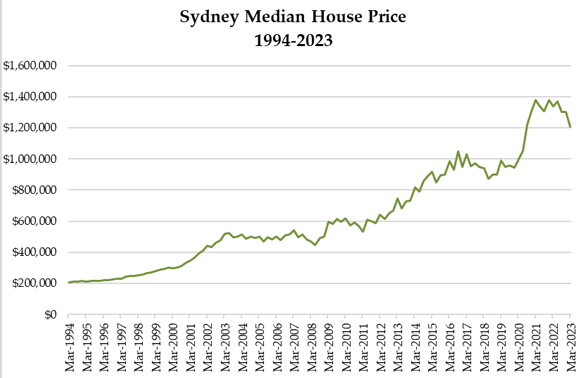

How about property prices? The Great Australian Dream has been to own your own home. Indeed, there’s a fascination with buying, renovating and watching prices rise, hoping that we can become rich owning bricks and mortar.

Here’s a figure showing how the median property prices in Sydney grew over the same period:

|

|

| Source: Australian Bureau of Statistics |

The phenomenal rise in property prices occurred after 2008 and it coincides with central banks worldwide cutting rates to almost 0%. The RBA was late to the party, cutting rates in 2019, which gave the already sky-high prices that extra boost.

And it’s because of property prices rising faster than income that household debt ballooned.

But all this is an optical illusion…

Waking up to a silent robbery

Looking at things in dollar terms wouldn’t bring you to the realisation that your wealth was stealthily slipping away since the late 1990s.

But it’s clear when you look at it in terms of gold.

Yes, gold — the very thing that many scoffed at, saying that it’s outdated and you can’t eat it.

But the difference between gold and the Australian dollar is that the former is constant, while the latter is a moving target.

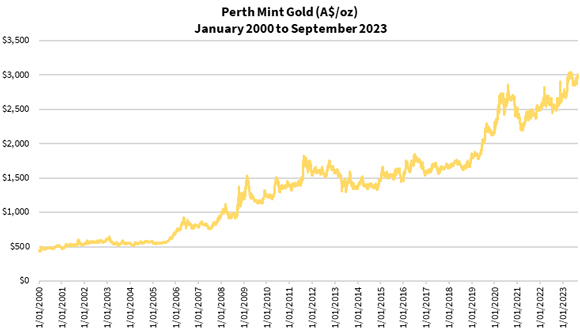

Just think how many dollars are needed now to buy the same amount of gold compared to the year 2000. Let’s have a look at this figure:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

In a way, the price of gold rose in a similar fashion as median Sydney property prices — more on that later.

The key is that the Australian dollar is buying less gold over time.

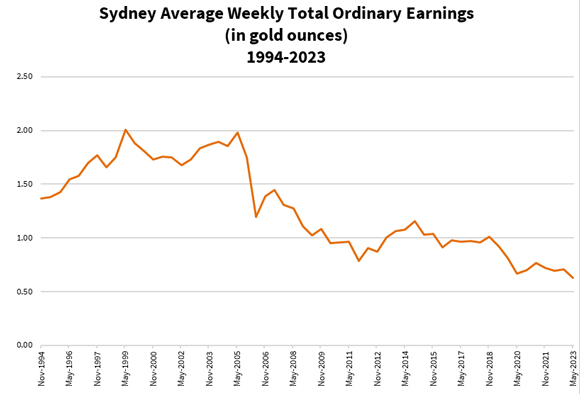

With that in mind, let’s have a look at how much gold an average Sydney worker could buy each week in the figure below:

|

|

| Source: Internal Analysis |

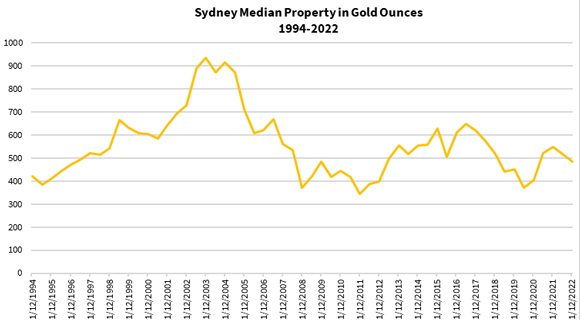

Now let’s see how the median Sydney property price moved relative to gold terms in the past 28 years:

|

|

| Source: Australian Bureau of Statistics |

The price of property may have risen quickly since 2008 and even more so in 2019. But in gold terms, properties didn’t become out of reach.

Clearly gold retained value and would’ve protected one’s wealth.

What’s sad is that Australians experienced peak prosperity in 1998–2004. We don’t know whether we can reclaim that back.

Yes, part of that arose from the RBA cutting rates and keeping it low for so long. Now that it’s raised rates quickly, many businesses and households are struggling.

But it’s our ignorance that has cost us much. And poverty is catching up on many without them realising it.

Never too late to change tack

I started to wise up on this just over a decade ago and changed my mindset to try to make up for lost time.

I believe that you can do the same. Focus on what’s ahead of you.

Gold has just surpassed AU$3,000 an ounce in the past week, just as the Australian dollar dropped below 65 US cents. This could well be a signal for you to act now.

You may even try to make up for some lost ground by investing in gold mining companies. It does come with increased risks and the dynamics driving its value is different to gold…but these dynamics could lead to greater rewards.

If you want to make this change now, you don’t have to do this alone. Let me take you on this journey with you. Learn how to get access to my ‘Ultimate Gold Gameplan’ here.

Regards,

|

Brian Chu,

Editor, The Daily Reckoning Australia