After covering China’s latest strategy, with BHP on Thursday, I thought it might be worth exploring our trading alternatives.

And specifically, how Aussie investors can benefit from a coming boom.

Because the Trump administration isn’t just talking about critical minerals anymore. It’s buying them. And our miners are in his crosshairs.

This week, the Department of Energy (DoE) announced a 5% stake in Canadian producer Lithium Americas.

Trump insiders had already tipped the market, causing the stock to jump nearly 100% before the official announcement.

The story is intriguing…

First, it marks the latest aggressive government equity play by this Administration.

Eyebrows were raised after the Trump admin took a 10% stake in Intel, and mouths were open after the watershed Department of Defence-MP Materials deal in July.

Now, the floodgates are open to ensure America’s strategic minerals.

The reason for all of this?

Breaking China’s dominance. These are the realities of our new era.

Just as China begins to play hardball with our trade, the US is there with open arms.

RIP globalisation…Hello regionalisation.

For Australian miners, the timing is auspicious. Fifteen critical minerals companies just returned from Washington.

Their stories paint a radically different picture from the Biden era.

Gone are the bureaucratic delays. In their place, a businesslike administration offering equity stakes, debt-equity hybrids, and prepaid offtake deals.

Any project that can secure America’s supply chains gets a hearing.

International Graphite CEO Andrew Worland summarised the message he’s getting from the Whitehouse:

‘You come to us with a proposal, and we’ll assess it and try to make it work.’

It’s like an episode of ‘The Apprentice’ for our mining juniors.

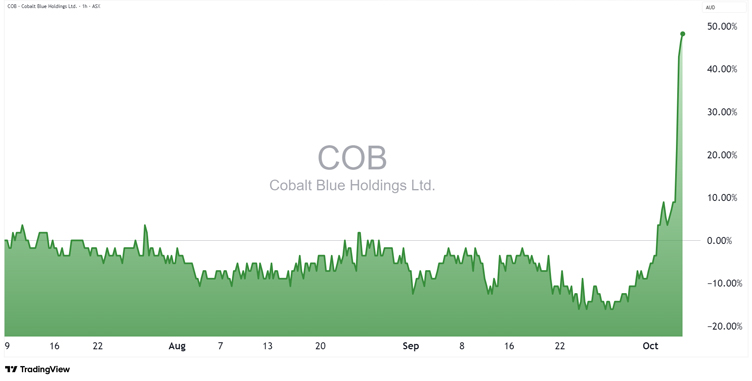

Some hit the limelight, some are forgotten. Just take mineral processing minnow Cobalt Blue [ASX:COB].

They were part of the delegation as their CEO sought funding for their proposed cobalt-nickel refinery in WA

Source: TradingView

Now I’m not telling you this is where funding is going, or where to invest — I have no clue who made a deal, or who’s going to win.

These miners operate in a realm completely dominated by China.

But these US deals offer the template to break the stranglehold. This isn’t traditional government funding. It’s Wall Street dealmaking from an administration stacked with former private equity executives.

Deputy Defense Secretary Steve Feinberg orchestrated the MP Materials purchase. He brought his Cerberus Capital playbook straight to the Pentagon.

And now, the latest news is that the US is offering to buy stakes in our critical minerals companies as part of a funding package.

Meanwhile, Australia’s own $1.2 billion critical minerals reserve moves forward. The UK, France, and Canada have all expressed interest.

Rumours are that Australia would sell shares of its ‘strategic reserve’ in exchange for cash investments and offload agreements.

Sounds like time to go shopping for juniors.

First, a Reality Check

Washington’s enthusiasm is real. But so are the challenges.

Lynas Rare Earths [ASX:LYC] warned last month that its Texas processing plant might not proceed. Trump funding went to a US rival instead.

The lesson? American largesse comes with America-first strings.

On top of that are the ridiculous capital costs.

Iluka Resources [ASX:ILU] massive refinery in WA is estimated to cost $1.8 billion and is still years away from commissioning.

Many mining juniors will rely on this plant to break their reliance on Chinese processing. But in the short term, things are moving.

China’s April rare earth restrictions sent shockwaves through Western supply chains, and European and US carmakers faced potential shutdowns.

Beijing’s message was crystal clear: We’ll weaponise our minerals dominance when pushed. We’ve yet to see Australia’s response.

Albanese heads to Washington on October 20.

His talks with Trump could include minerals alongside AUKUS.

Both sides need wins. Trump needs non-Chinese supply. Albanese needs investment to jumpstart what could be a huge growth industry for Australia.

The Waiting Game

For all the diplomatic progress, the fundamental question remains.

When will promise translate into profit?

The US wants projects operational by 2027. Australian miners say they’re ready. Chinese competitors keep flooding markets to maintain dominance.

The pieces are moving into place. This could be a transformative shift in global minerals markets.

Government equity stakes. Floor prices. Strategic reserves.

These aren’t normal free-market mechanisms. They’re tools of economic warfare in an era where smartphones and missiles depend on the same raw materials.

Will this translate into the long-awaited Australian critical minerals boom?

I think so. But it remains to be seen.

What’s certain is the game has changed. When the world’s largest economy starts writing equity checks to foreign miners, critical minerals have moved from the margins to the centre of great power competition.

Keep your eyes on the Northern Territory.

While most attention focuses on WA’s established operations, insiders are quietly positioning for what could be the next chapter.

The Northern Territory sits on untapped deposits. It’s close to processing markets. It may soon move from periphery to spotlight.

Our resident geologist, James Cooper, has the picks he thinks could become the next major forces in Australian mining.

Be sure to take a look.

Regards,

Charlie Ormond,

Small-Cap Systems and Altucher’s Investment Network Australia

Comments