The ROX Resources Ltd [ASX:RXL] share price is up slightly today, on news released by its joint venture partner at the Youanmi gold project.

RXL shares appear to still be seeking a floor after breaking the 6-cent per share level.

At the time of writing the RXL share price is up 1.61% to 6.3 cents per share, marking a retreat of 30% since reaching highs in July.

Source: Tradingview.com

New prospects add to portfolio, not to share price

RXL’s share price action today comes on the back of new drilling results released by its JV partner Venus Metals Corporation Ltd [ASX:VMC].

If you feel like this might be a bit of déjà vu, you’re not far off.

We received similar news last Friday from VMC, which received a very similar response in the share price.

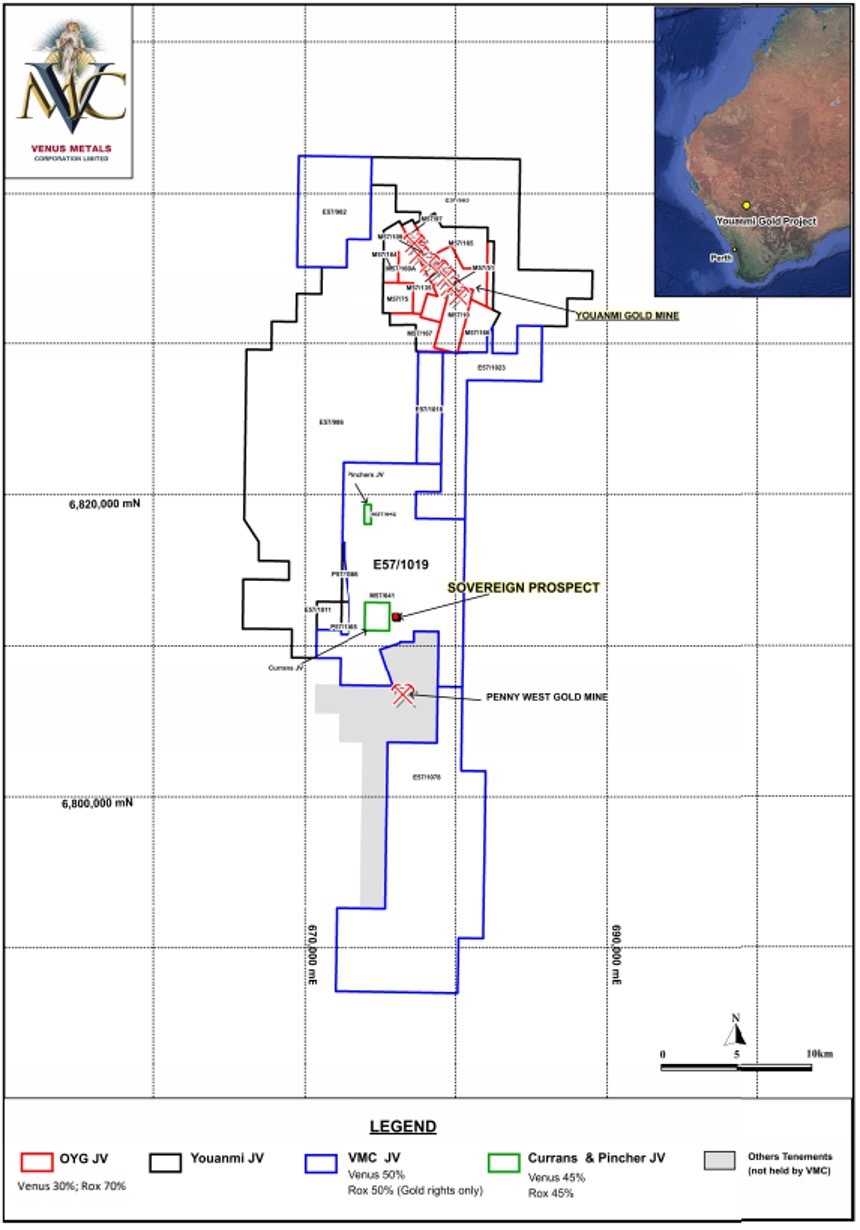

Today’s results come from the Sovereign prospect, located just east of Curran’s Find on RXL’s tenements.

Drilling followed up on previous results and extended the high‐grade gold mineralisation, according to VMC.

Source: Venus Metals Corporation

Best results include:

- 8m at 5.03 grams of gold per tonne (g/t) from 160m, including 2m at 15.83g/t from 160m, and 3m at 2.86g/t from 165m

Discover why this gold expert is predicting a HUGE spike in Aussie gold stock prices. Download your free report now.

Interpretation of recent ground‐magnetic surveys covering Curran’s Find and Sovereign Prospect shows prominent northeast and north‐northeast trending structures.

VMC say that this aligns with the orientation of high‐grade gold mineralisation at the Taylor’s Reef, Curran’s North, and Red White and Blue prospects.

So, why only the small bump in share price?

As you might have already guessed, the big jumps in share price for RXL have typically come from the Grace prospect at the Youanmi gold mine.

That’s not to write-off today’s results.

If a similar type of mineralisation trends northwards from the Penny West gold mine, RXL and VMC could have a seriously big gold mine on their hands.

But we just don’t know that yet.

Is ROX Resources’ share price stuck in the doldrums?

You can’t be blamed for thinking along those lines.

I think a more logical explanation of the recent share price action could be RXL is going through a price correction.

Interest in RXL may have pulled back slightly, with slower progress at the Grace prospect and slight spell in the gold price being possible contributing factors.

Though Grace remains a strong prospect for RXL.

With 50 holes still to be drilled and reported at Grace, we could see upwards momentum return in the coming weeks and months as these are reported.

With volatility easing in the gold price, we could see a steady upwards tick return as nations battle with devaluing currency. Which bodes well for Aussie gold stocks like RXL. Our resident gold expert Shae Russell reckons other Aussie gold stocks could be set to spike as Australia becomes the next ‘gold epicentre’. If you want to learn more, download your free report here.

Regards,

Lachlann Tierney,

For The Daily Reckoning Australia

Comments