As we’re about to head into 2022, it’s worth remembering that there are no new eras. Overvalued stocks eventually revert to the mean. Whether it happens this year, who can tell?

But this essay, written originally in The Rum Rebellion back in early November, should give you pause for thought…

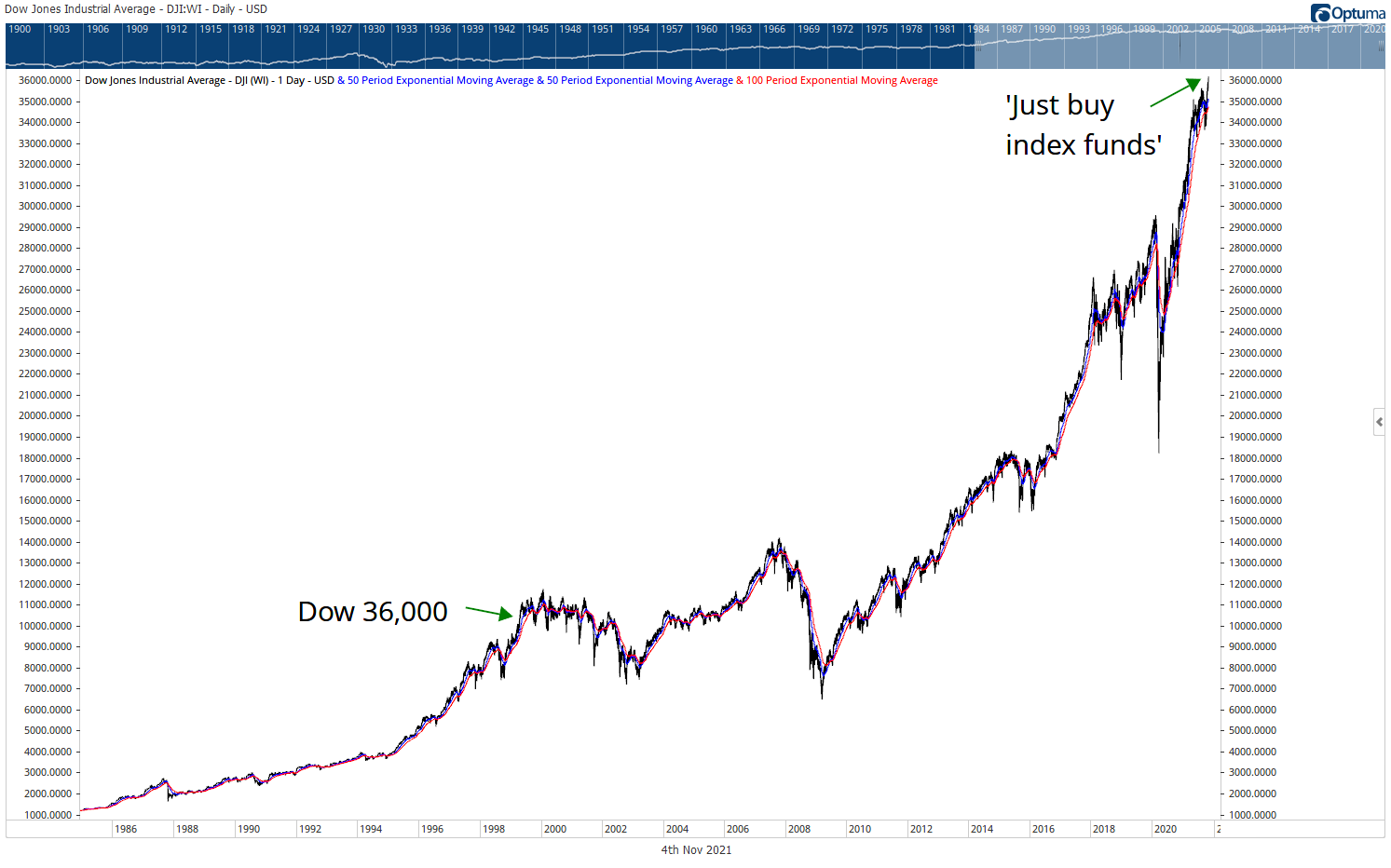

In 1999, James Glassman and Kevin Hassett published Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market.

For those who don’t remember, 1999 was the year before the market peaked. It was the infamous tech bubble. The bubble popped (on the Dow, at least) in January 2000. Stocks finally bottomed just over three years later.

This week, 22 years after the author’s prediction, the Dow reached its lofty perch of 36,000. So the book is getting a bit of publicity. Glassman even penned an op-ed piece for The Wall Street Journal, proving that the market, despite its best efforts, is yet to humble him.

‘The Dow Jones Industrial Average stood at 825.86 as trading closed on Nov. 2, 1971. It closed Tuesday at 36,052.63. That is almost a 43.7-fold increase. Do the math. If the Dow continues to rise at the same rate, 50 years from now it will be 1,573,865. In other words, Dow One Million.’

In 50 years, most of us will be dead. Glassman certainly will be. So I guess you can make these claims, based as they are on the iron laws of mathematics, without too much concern.

It’s a bit like a politician pledging net zero by 2050. They’ll be sitting back on a taxpayer-funded pension by then, watching some other hapless chump deal with the problems they created and/or ignored.

I bring Glassman, his book, and article up because the iron laws of mathematics don’t take into account human emotion. It’s a fact Glassman readily acknowledges — without a hint of irony (my emphasis added):

‘In 1999 Kevin Hassett and I published a book, “Dow 36,000: The New Strategy for Profiting From the Coming Rise in the Stock Market.” We thought the market would reach that milestone much sooner than it did. I think we underestimated human psychology. People are exhilarated by the vagaries of stock prices, but they are, at the same time, scared to death of losing what they’ve accumulated. The equity risk premium may be too high for a rational person examining history and economics, but it is a constant fact of financial life. And that’s a good thing! The high returns to stocks are the reward you get for conquering your fears and your greed.’

Glassman and Hassett published their book at the height of the dotcom boom peddling a new strategy for the coming rise in the stock market. And Glassman blames his wayward forecast on underestimating human psychology?

Ya think so!

I’m not having a go at the bloke for getting it wrong. Forecasting is a mug’s game. But investing is about the future and assessing probabilities, so we all have to make judgements about the future.

What I find interesting is that Glassman was obviously swept up in the hype of 1999. His book argued that stocks were significantly undervalued and would rise to 36,000 by 2002–04.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

As far as wild bull market predictions go, this was a doozy.

Now he’s telling us that making money in the market is simple!

‘Making money in the stock market is easy. Why do we make it so hard?

‘The best strategy for long-term investors is so obvious that I blush to write it down: Buy market index funds, preferably by making monthly automatic investments, and then forget about it. Certainly, those with shorter horizons or with the means to make riskier bets for higher rewards can do as they please, but for nearly all Americans the rules of the road are manifest.’

Making money in the market is not easy. Anyone listening to Glassman back in 1999 would know that only too well. That’s because we’re human. Not counting machines that can rationally see through every bear market to the charging bull on the other side.

Now he’s telling you to just plough your hard earned into an index fund and be done with it…

|

|

| Source: Optuma |

What he doesn’t say is that your long-term return is determined by the price you pay. Buying at the time of Dow 36,000 meant that in 2011, your capital still had barely moved. You would have only really started to generate decent returns in the last 10 years.

Likewise, going all in now on an index where ‘everyone’ is playing the index game, means you’re increasing the risks of earning very ordinary long-term returns.

The bulls might be back in town, but they’re selling you a story of past returns. In their eyes, past returns are an indication of future performance. That’s a completely wrong take at the bottom of a bear market and it’s a completely wrong take near the top of a bull market.

Let me say it again: the return you make largely depends on the price you pay. If you understand this, you understand more than most ‘professionals’ like Glassman.

One man who understands this more than any other I know is my good friend and fellow editor Vern Gowdie. Vern’s devotion to ‘the price you pay’ has been to his detriment over the past few years.

But using history as his guide, Vern is adamant that he’s right. His latest report highlights four potential ‘Code Red’ investments that could blow this market up.

I disagree with Vern on the scope of the bear market he is predicting. But I absolutely agree, when looking purely at the ‘can’t lose’ indices, markets are in dangerous territory.

As an antidote to today’s bullishness, I recommend having a read of Vern’s report, and having a long, hard think about it.

Regards,

|

Greg Canavan,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.