Ed Note: Brian Chu is in Hong Kong seeing family. He’ll be back on Fat Tail Daily duties next week. Today’s essay comes from Editorial Director, Greg Canavan.

Originally written for paid-up Fat Tail members, we wanted to let you in on this opportunity too.

Yes, everyone is talking about gold right now. But as you’ll see below, there is a certain part of the gold market that is yet to get any love. That may change in the months ahead…

***

We’re two weeks away from the US election.

That means over the next month you’re going to hear a lot about what a Harris or Trump Presidency means for the US.

Most of this will be noise, and you should ignore it. Except for one thing, which I’ll get to in a moment.

But does a Democrat or Republican in the Whitehouse really make a difference to the performance of the stock market?

According to a 2021 Forbes study, since World War II, the average annual return for the Dow Jones Industrial Average has been approximately 8.3%.

Under Democratic presidents, the average performance of the Dow was about 9.0%. Republican presidents presided over an average of 7.4%. However, when Republicans control both Congress and the presidency, stock performance averages 8.0%, compared to 6.7% under Democrats.

Whatever. For long-term investors, it doesn’t make a difference who the puppet president is.

However, there has been one major beneficiary of the election this year – gold. On Friday, US gold futures closed at a new all-time high of $2,730 an ounce. The asset class is up 32% so far this year.

What’s driving this move?

Look no further than the US fiscal deficit. Ryan Dinse touched on this with his comments in Friday’s Insider.

The federal deficit was US$630 billion in just the past two months (July and August…the September figures aren’t out yet).

That’s $630 billion in two months…

The 2024 deficit is currently at $1.9 trillion. With one month to go in the fiscal year, it will almost certainly be in excess of $2 trillion for the year.

A $2 trillion deficit is roughly 7% of US GDP.

That is insane!

The US economy is not even in recession…and the government is running massive fiscal stimulus!

No wonder stocks are in a bull market. No wonder gold is up 32% so far in 2024.

For years after the 2008/09 bust, everyone carried on about the Fed’s loose monetary policy and how it would eventually lead to inflation and soaring gold prices.

But it never happened. Easy money policy in the form of QE remains in the financial system. It doesn’t make it into the real economy.

Loose fiscal policy is different. When the government spends more than it brings in, the difference (the deficit) is a direct injection of money into the real economy.

That’s why you saw a big jump in inflation following the massive COVID-related fiscal deficit spending. Politicians will tell you it had something to do with broken supply chains.

But common sense tells you when you pay people to stay home and NOT produce, inflation will be the result.

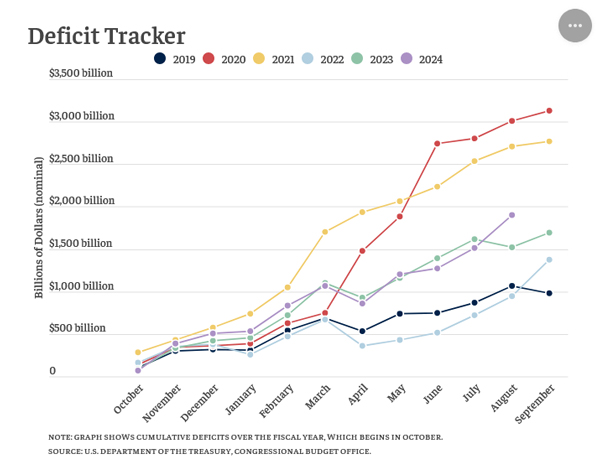

Not surprisingly, as shown in the deficit tracker chart below, the two biggest deficit spending years were 2020 and 2021.

But 2024 is set to be the clear winner for non-COVID-affected deficit spending.

| |

| Source: Bipartisanpolicy.org |

Yet you hear much less about loose fiscal policy than you did about loose monetary policy in the Bernanke and Yellen years.

This means this bull market in gold has been a very quiet one.

So far…

What has been absent is any sign of speculative stupidity. Companies remain disciplined and speculators haven’t pushed prices up to crazy levels.

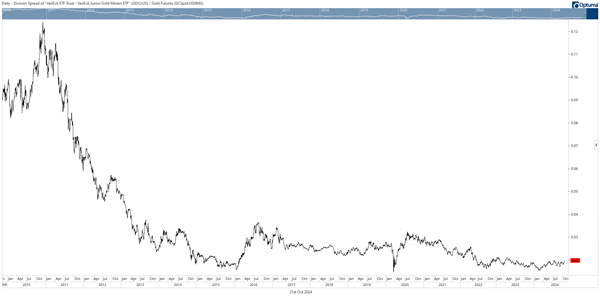

To show you what I mean, take a look at the VanEck Junior Gold Miners ETF. It’s up 70% from the lows of February 2024. But that hardly registers when you look at the long-term chart…

As you can see, the junior gold sector peaked way back in 2010. At the time, gold was on a tear thanks to post-GFC stimulus out of the US and China.

Then the sector went through a wrenching bear market. One that it is still recovering from…

| |

| Source: Optuma |

This is a chart of an asset class in a tentative upward trend after a decade of doing not very much.

This is not a chart of an asset class with any type of speculative fervour.

So if you’re a speculator interested in getting in on this gold bull market, you’re definitely not too late.

However, there is no guarantee that this will evolve into a crazy bull market and that someone will pay a big price for your shares down the track.

All I’m saying is that this isn’t a crazy bull market yet.

Here’s some more supporting evidence…

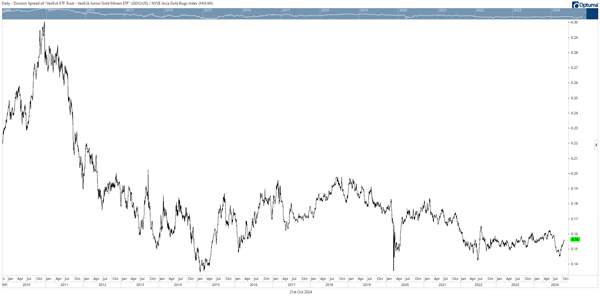

The chart below shows the gold junior ETF relative to the gold price. Back in the 2010/11 gold stock bubble, the ratio was 0.12. Now it’s 0.02. In other words, junior gold stocks have underperformed gold bullion by more than 80% over the past decade or so.

| |

| Source: Optuma |

What about gold juniors compared to their larger companions?

The chart below shows the performance of the gold junior ETF relative to the HUI Index, which is an index of large gold producers.

| |

| Source: Optuma |

Even here, gold juniors have underperformed the producers by about 50% since the December 2010 peak.

Whichever way you cut it, the juniors haven’t performed during this gold price upswing.

Still, we’ve encouraged you to buy gold juniors on numerous occasions over the past few years. That’s because we’ve considered the sector cheap on both an absolute and relative basis.

We’ve clearly been early on this call. No doubt it’s been a tough sector to be invested in over the past few years.

But it seems that the timing is lining up nicely here.

It is only a matter of time before some of those Federal deficit dollars find their way into the sector looking for some protection against this ongoing fiscal insanity.

And when the US gold juniors start running, you can bet that their Aussie counterparts should run too.

This is why Brian Chu’s Goldmine Summit, which streams later this week, is so timely and important. You can register your interest for free, here.

Brian will make the case for gold juniors, as well as reveal some of his top picks in the sector. So if nothing else, you’ll come away with a few ideas to speculate on.

That’s an important point, by the way. These are speculative stocks in a speculative sector. The gains can be exciting, but the price of admission is volatility, lots of it.

Not everyone can handle volatility. So just make sure you go into this with your eyes wide open.

If you do, and can hold onto the bull with a very tight grip, this could be some ride…

Regards,

|

Greg Canavan,

Editor, Fat Tail Alliance, The Insider and Fat Tail Investment Advisory

Comments