I’m going to start today’s article with a digression into Chinese history and military psychology.

I hope you get the drift of how the story relates to trading gold stocks. So bear with me…

It is 198 AD in Ancient China. The prime minister, Cao Cao, was consolidating his power in the Yellow River basin. He had secured the favour of the Han emperor whom he rescued three years ago amidst a chaotic struggle between the emperor’s regents. The emperor subsequently became Cao Cao’s puppet, until Cao Cao’s son dethroned him in 221 A.D. and set up his own kingdom.

Cao Cao’s next target was a neighbouring city, Nanyang. The prefect of Nanyang, Zhang Xiu, had a wise advisor named Jia Xu.

Despite commanding forces much smaller than Cao Cao, Zhang Xiu was a thorn in Cao Cao’s side, thanks to Jia Xu’s ingenious strategies.

Cao Cao’s large army besieged Zhang Xiu’s city. However, Cao Cao received news that the powerful warlord of Northern China, Yuan Shao, was planning to mobilise his forces for a sneak attack on Cao Cao’s base city, which was left open because of this campaign.

With the threat of having to fight two fronts and potentially suffering catastrophic losses, Cao Cao planned to lift the siege and return to his base. However, he feared Zhang Xiu’s army would pursue him and inflict heavy casualties. Therefore, he devised his plans to make a clean exit.

In Zhang Xiu’s base, his spies caught wind of the siege potentially lifting soon. They planned a counterattack. Jia Xu advised Zhang Xiu to hold off on pursuing Cao Cao. Zhang Xiu didn’t take heed.

One morning, the defenders woke up and saw that the enemy army had deserted their camp. Zhang Xiu led his forces in hot pursuit of their enemy. However, Cao Cao’s forces had prepared for this and laid an ambush, repelling Zhang Xiu’s forces.

Zhang Xiu returned to his base where he apologised to Jia Xu, saying, ‘I should have taken your advice and not pursue Cao Cao.’. Jia Xu responded, ‘Don’t waste any time. Regroup your forces and chase Cao Cao now. The time is right.’

Zhang Xiu was puzzled but took Jia Xu’s advice. His army caught up to Cao Cao’s army and inflicted significant losses against them.

When Zhang Xiu returned victorious, he asked Jia Xu to explain his advice.

Jia Xu explained, ‘Your military strength and leadership capabilities don’t match up to Cao Cao. He is cunning and meticulous in his plans, and there are high-calibre generals leading his army. When Cao Cao plans a retreat, he expects you to pursue at the first instance thinking this is an easy win. He will lead the retreat from the rear to ensure he can repel your pursuit. But when he successfully drove you back, he will ride at the front and increase the army’s pace to return home. Since their mind is set on retreat and not on fighting, you were victorious when you pursued them the second time.’

Feeling besieged with your gold

stock portfolio?

If you’ve invested in Australian gold stocks in the last three years, you may understand the difficulty of enduring more losses than gains during this period. This is especially true if you hold gold explorers and early-stage developers. It feels like you’re under siege from unfavourable economic conditions and companies underperforming in their operations, causing investors to shun them.

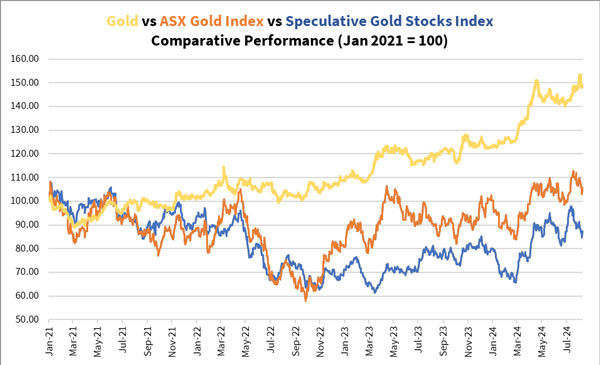

Have a look at the figure below showing the relative performance between gold and gold stocks since the start of 2021:

| |

| Source: Internal Research |

Gold has rallied more than 50% since the start of 2021. It fell for several months in 2022 before rising once again from late-2022. Gold’s rally gained momentum in March this year as the US Federal Reserve announced it was expecting to cut rates three times this year.

At the same time, gold stocks had a rollercoaster ride. Gold producers (orange line) sold off heavily from April to October 2022, but many have recovered most of their losses and even delivering moderate returns to their holders.

However, gold explorers and early-stage developers (blue line) fell more. Even though the index is higher than last year, several companies recently made new lows while many haven’t budged from last year’s prices.

Many of us probably added to our holdings in early 2022 as gold stocks fell, expecting a quick recovery. However, some of these purchases might have left us in the red even today, especially if these were gold explorers.

As the trend in gold stocks changed last year, and even gained momentum since March this year, some of you may be hesitant about what to do.

Should you buy into this rally or sell because this could be another false rally like those during 2021-23?

Reading the market like Jia Xu

I’m being a little cheeky by bringing in Jia Xu, given that he was a military adviser, not a stock trader. But if we apply his intuition (which many mining stock investment veterans also possess) to this market, we could be onto something.

The key is to look at the right signs and reflect on the market psychology over the last few months.

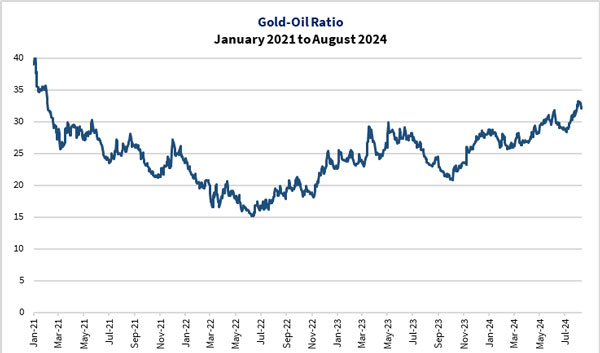

What’s different back in 2022 was that the price of oil was rising while gold started declining back in 2022. A combination of a sudden plunge in the supply of oil because of sanctions against Russia and central banks announcing it would raise rates to fight rampant inflation caused the gold-oil ratio to fall. With this, gold producers saw their operating margins cut down as they received less for their gold sales while production costs rose sharply.

Today, the price of oil is down around 35% from its peak in June 2022. Meanwhile, gold is almost 50% higher in almost every global currency. What favours gold further is that some central banks have started cutting the interest rate. The US Federal Reserve is likely to follow, which historically causes gold to rally.

Here’s the gold-oil ratio since 2021:

| |

| Source: Refinitiv Eikon |

We haven’t seen the ratio trade like this since the start of 2021. It bodes well for the operating margins of gold producers for the next quarter or two. Higher operating margins will boost investor interest in this space, as investors are willing to pay more for expected future profits. The rising interest in gold producers could likely spill over into gold explorers and early-stage developers, with punters clamouring off the back of the gold stock fever.

How discernment stacks the odds

in your favour

The optimistic scenario I laid out just then is something I hope will play out. However, it pays to exercise some caution, especially given that the current economic and market conditions could increase the volatility of the gold stock prices. The rising Japanese yen and its spillover effects could propel gold higher as investors seek safety. Meanwhile, they could dump gold stocks because of their riskiness!

Furthermore, while a rising price of gold and favourable gold-oil ratio could be the tide to lift all gold stock boats, it doesn’t always apply. Some gold explorers are running low on cash right now after three and a half years of drilling and development. They may take the chance to sell new shares as market interest returns to this space, diluting their capital and causing their share price to stagnate while their peers rally. Alternatively, their projects and company strategies don’t deliver as expected, causing investors to sell as they chase another company that has been kicking goals.

Recapping on what I’ve covered in this series so far, successful gold stock investors employ the following strategies:

Not assume that a large gold producer doesn’t necessarily deliver the best reward-for-risk tradeoff…

Recognise that the relative price of gold and oil, rather than just gold itself, may be a useful predictor of the operating performance of gold producers…

Use the Lassonde Curve to distinguish which gold stocks are worth holding and to avoid…

Develop a discernment that incorporates reading the market correctly, finding the right companies and knowing when to hold and when to fold.

Hop on your horse and gallop carefully!

Even the most experienced mining stock legend won’t make the right call every time. But having no discernment and randomly picking gold stocks is a sure way to throw away your hard-earned savings.

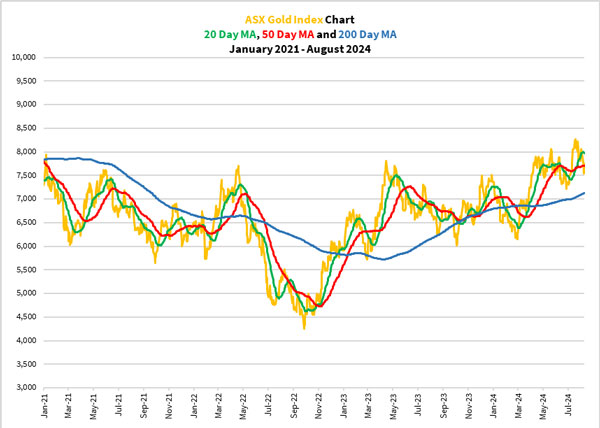

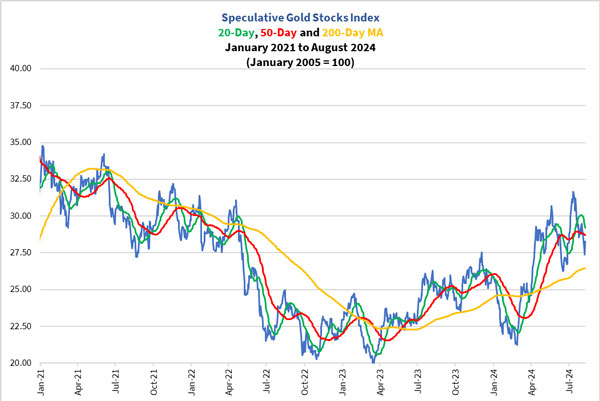

If you look at the ASX Gold Index [ASX:XGD] and the Speculative Gold Stocks Index, they both have a bullish setup when you look at their moving-average trendlines:

| |

| Source: Refinitiv Eikon |

| |

| Source: Internal Research |

While there’s a chance their bullish trends could reverse if there is a sustained retreat, the economic and market conditions are favourable for gold and gold stocks. And should the markets tip over, both gold and gold stocks could dip first before staging a recovery based on what happened in the past.

In both my precious metals newsletter services, The Australian Gold Report and Gold Stock Pro, I’ve recently informed my readers to take a cautiously bullish outlook on gold stocks. This includes recommending them to secure some profits by selling small parcels in selected companies that have rallied strongly in the past 18 months.

At times like these, holding gold makes sense while undervalued gold stocks could deliver significant rewards beyond the short-term hiccups. As the market unwinds their positions on tech stocks and the largest blue-chip companies, you could be moving ahead of them by getting into an unloved space – gold and gold stocks.

If you want to get started, I suggest checking out this special offer and signing up for The Australian Gold Report. If things pan out as I expect, it could be a most rewarding move you make this year.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments