The investment community generally believes that a rising price of gold leads to better returns on gold stocks.

I briefly alluded in the last article how this isn’t always the case. Gold mining companies are businesses. A successful business is profitable, generates cashflows to help it expand, and rewards its shareholders with dividends.

It’s possible for gold to rally and gold stocks to deliver negative returns during the same period. This has happened for much of the last three years.

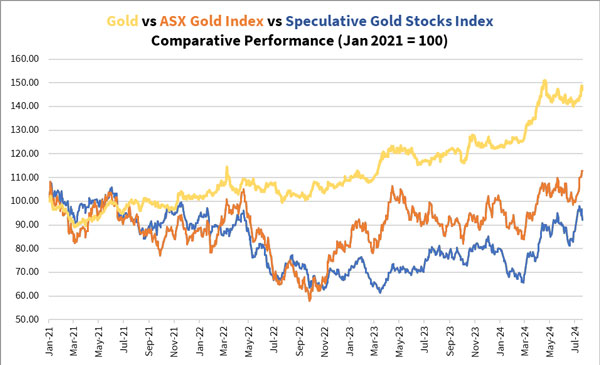

Let me show you the relative performance of gold with these two gold stock indices:

The ASX Gold Index [ASX:XGD] that reflects the performance of producers and late-stage developers.

And my Speculative Gold Stocks Index, my very own in-house index that tracks the performance of selected explorers and early-stage developers.

Here they are below:

| |

| Source: Internal Research |

Notice gold drifted down from May to October 2022 before recovering, while gold stocks tumbled. Similarly, since June 2023, gold stocks traded in a tight range as gold’s rally gained momentum.

Why did gold stocks trail gold significantly?

And is there potential for gold stocks to close the gap with gold in the coming months?

Let me share what I discovered in the first 18 months of going all-in on gold producers in 2013–14.

Finding a key performance driver

for gold stocks

Today’s article follows that of last fortnight’s in which I discussed the first strategy for successful gold stock investing. You’ll recall how I highlighted the importance of understanding the different risk profiles of gold producers, developers, and explorers.

I also discussed the prudence of having a larger proportion of your portfolio exposed to gold producers rather than buying speculative gold explorers who have yet to generate revenue.

Let me add more to that here.

My portfolio was pummelled during the first 18 months of my all-in investment in gold stocks. Instead of cutting my losses, I kept buying to reduce my average costs.

From July 2013 to August 2014, market conditions were hostile towards gold producers. Most producers faced difficulties. Despite some producers reporting revenues exceeding operating costs, their cash balance fell as they burnt through cash from mine maintenance and exploration.

Even our largest gold producer at the time, Newcrest Mining, was operating on a breakeven basis. A significant debt load weighed it down. The fact that the largest operator struggled to profit dampened investor enthusiasm in this space.

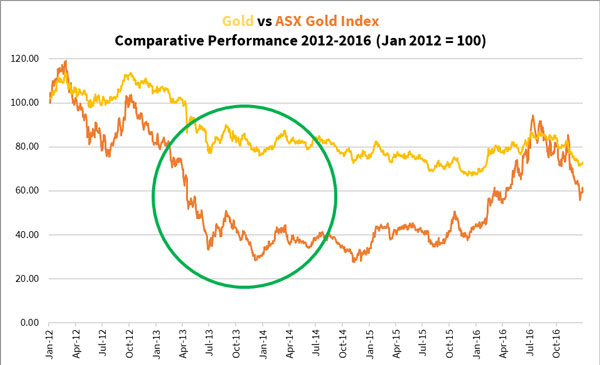

The price of gold in Australian dollars was grinding down during the period, though it didn’t fall like it did in early 2013. That caused gold producers to drop further, as you can see in the two figures below:

| |

| Source: Internal Research |

| |

| Source: Internal Research |

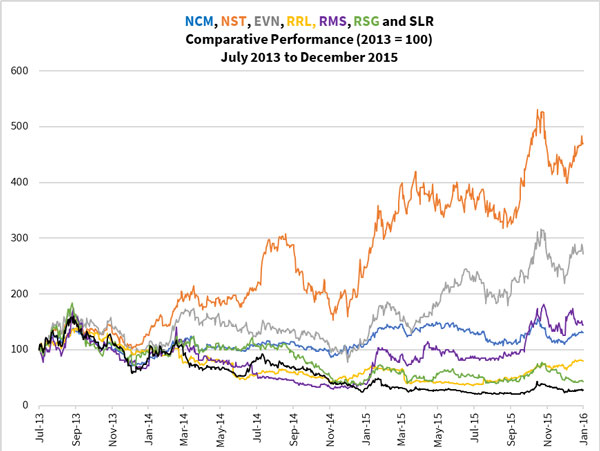

Most key gold producers, except for Northern Star Resources [ASX:NST], traded sideways or fell.

You’ll notice the trend started turning around at the start of 2015.

A few months prior, I saw signs of a potential turnaround for gold stocks. Something suggested to me the worst was over.

What signs did I see?

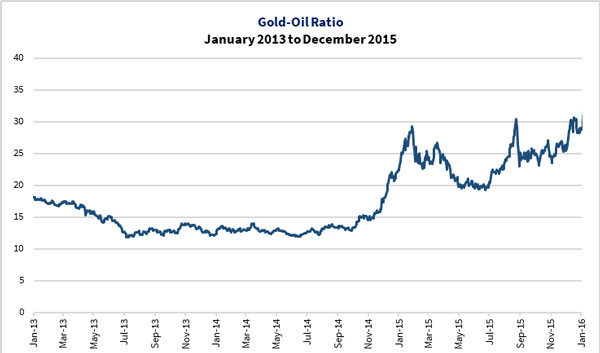

Have a look at this:

| |

| Source: Refinitiv Eikon |

This figure shows the relative price of gold and oil. I call this the gold-oil ratio. It shows how many barrels of oil an ounce of gold could buy.

Why does this ratio matter?

Gold mining companies extract and produce gold and other metals to sell for profit. They employ plant, property, equipment, and physical labour. Diesel is a major input for their plant and equipment.

The relative price of gold and oil will affect the profitability of gold producers. A higher gold-oil ratio will likely boost profitability, and vice versa.

Since discovering this in September 2014 after much analysis, I started using this ratio to help me anticipate how gold producers would perform in the coming quarter.

At the time, Saudi Arabia led the Organisation of Petroleum Exporting Countries (OPEC) in increasing production in response to the rise of the US shale oil industry. The price of oil almost halved within two months.

This was a much-needed break to help turn my portfolio around.

Testing my instinct and delivering results

I expected gold producers to generate a higher operating surplus for the 2014 December quarter, with the better-run gold producers reporting a bigger cash build.

I moved to add to my holdings even as they traded at ridiculously low prices. I focused on the mid-tier and junior gold producers that were at breakeven or operating at a small operating loss. These included Ramelius Resources [ASX:RMS], Resolute Mining [ASX:RSG], St Barbara [ASX:SBM], and Teranga Gold Corporation.

I figured these companies had the best potential to bounce when their operations reported a surplus. Their shares were trading at a deep discount as the market expected the worst from them. Any changes in their potential would deliver significant returns as their price rise would come from a small base.

However, the share price for most mid-tier and junior gold producers continued to fall before finding a bottom in November and December 2014.

By now, my portfolio had fallen by over 75% since July 2013. I was almost out of free cash to invest further.

Those two months were very difficult for me mentally. While I felt things would improve, the market didn’t seem to agree.

Things changed in January 2015.

Let me use Ramelius Resources’ [ASX:RMS] as an example. Ramelius Resources would become one of my three best-performing gold producers in my portfolio during the 2015–16 bull market.

The mine operation was consuming cash for a few quarters. Its cash and bullion balance was $16.9 million in the September quarter, with no debt.

Its shares were worth more than $1 at the start of 2012. By late-2014 it had fallen below 5 cents before bottoming at 3.9 cents on November 6, 2014.

It released its preliminary quarterly report on 7 January 2015 showing its operations had turned profitable. It ended the quarter with $24.7 million cash and bullion.

Shares closed at 7.7 cents on the day, and rallied above 10 cents the week after. The company would move from strength to strength in 2015–16, trading over 60 cents by August 2016.

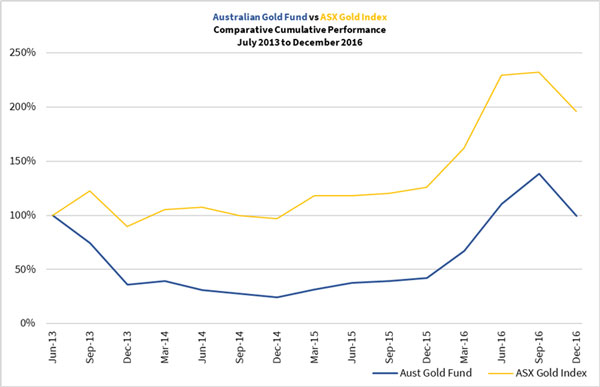

Ramelius Resources wasn’t my only big win in this cycle. The figure below shows how my portfolio performed relative to the ASX Gold Index from 2013–16:

| |

| Source: Internal Research |

This may not look too impressive, given I had underperformed the ASX Gold Index over this cycle. However, I was down by as much as 75% at one stage, recovering 300% from the end of 2014 to 2016. The ASX Gold Index only doubled during the same period.

My returns tripled that of the ASX Gold Index during the recovery.

After my success, I started developing a valuation approach and built my database to collect data to track the performance of gold producers over time. I even created my own unique valuation metric, the Valuation to Profit Margin (VPM) multiple, which I now share with the paid members of mygold stock newsletters.

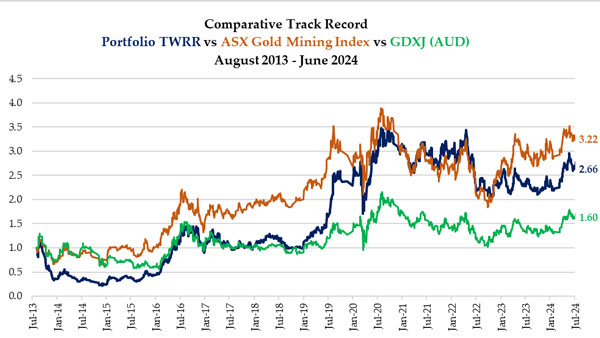

Armed with this new approach, my performance improved significantly as you can see below:

| |

| Source: Refinitiv Eikon |

Notice my portfolio caught up in 2019–20 in my second gold stock bull market. However, the ASX Gold Index moved ahead of me as I shifted my portfolio towards explorers and early-stage developers. I’m chasing the potential of explosive returns in the next gold stock bull market, which I believe is underway.

Success in harnessing fundamentals

and market sentiment

At this point, I want to clarify something.

While I’m proud to share my strategies and track record for gold stock investing, it wasn’t an easy journey. Neither will I say that it came without major errors and significant losses.

Despite notching several significant wins buying and holding stocks at the right time, I’ve bought and owned companies whose prices collapsed, with some even liquidating their business.

Fortunately, my gains far outweigh my losses, which I attribute to my valuation approach, analysis, and mindset. There’s no denying that luck played a factor, too.

My strength is in identifying the fundamentals that drive the value of gold producers, including the relative price of gold and oil, their financial position, profitability and cashflow generation potential. In addition, I study the quality of the mine operations and deposits to evaluate the business’ growth potential.

That said, it’s critical to account for market sentiment. At times, this can trump economic and company-specific fundamentals.

Gold can go out of favour to the extent that investors ignore gold stocks, even those of good quality. In turn, you might find them trading at ridiculously low prices. The reverse can happen when a bull market in gold can cause gold stocks to trade well above their future investment potential.

But emotions can drive the commodity markets, so prices can stray from fundamentals longer than you’d like.

Given this, there are two ways to manage your portfolio.

The first is you trade with the market and ride the momentum, assuming the market has accounted for the company’s potential.

The other is to focus on the fundamentals, often taking a contrarian position. This involves buying quality companies at a discount when gold stocks are out of favour or selling overvalued companies amidst a bull market.

Success lies in understanding the dynamics of gold and gold stocks to identify value. You can enhance that by correctly capturing investor sentiment and timing your trades accordingly.

It’s possible to marry both strategies together. That’d be ideal.

I don’t claim to have perfected the art of gold stock investing. However, I continually hone my knowledge and test new ways to improve my strategy.

As I wrap up, I’d like to invite you to join me in building a precious metals portfolio.

My precious metals investment newsletter, The Australian Gold Report, provides instructions on buying physical bullion and shares from a selection of quality gold producers and developers.

We also have a special offer for you. We believe the geopolitical tensions between China and Taiwan could escalate soon. Such conditions make it prudent for you to own some gold. This could spur the bull market for gold further, potentially making gold stocks even more attractive as it could multiply gold’s gains.

You can find out more about the opportunity here, Inside China’s Doomsday Vault.

That’s it from me, join me next week for my next strategy on how to successfully invest in gold stocks.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments