Gold is now creeping up towards US$2,500 an ounce. In US trading last Friday, it was within a whisker of that, as market indices worldwide look like they’re setting up for a correction.

Times like these should spur investors to start paying attention to gold stocks. That’s because gold’s rising momentum could cause gold mining companies to deliver much better operating margins.

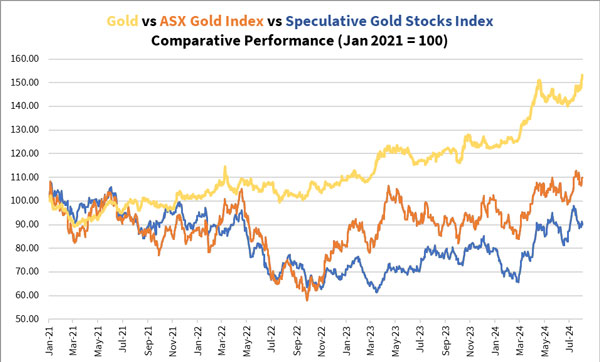

Given how gold stocks have trailed gold in the last three years (see the figure below), the prospect of outperforming returns makes them more enticing:

| |

| Source: Internal Research |

As you can see over the last three years, returns on Australian gold stocks were more volatile than trading gold. Buying and holding gold would’ve been the more profitable strategy, hands down.

But if my predictions turn out right, Australian gold stocks might hand you handsome profits in the future.

Are we setting up for another

gold stock bull market?

Most investors like to run towards a hot market. That’s where the action is. There’s more turnover volume, so you can ride the trends and chase momentum.

On the other hand, an out-of-favour market is harder to trade. It’d require you to be a contrarian, waiting for other investors to jump on board. During this period, the price might grind down either from dilution of company capital (if it’s shares in a company) or long-term holders giving up and selling out.

As a contrarian myself, I see gold stocks underperforming these three years to justify why you want to buy them in the coming months.

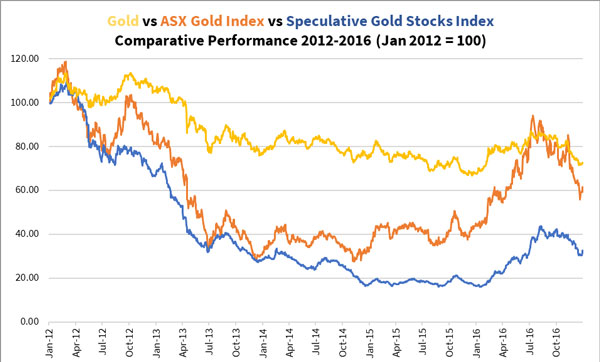

To illustrate my point, let me show you how gold stocks outperformed gold in the last two gold bull markets.

The first is 2012–16 after a brutal gold bear market of 2013–14:

| |

| Source: Internal Research |

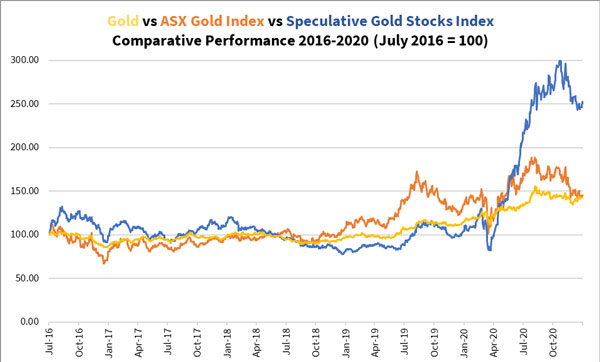

And here’s what happened in 2016–20, the most recent gold bull market:

| |

| Source: Internal Research |

Notice Australian gold mining stocks outperformed gold on both occasions. The more established gold producers delivered outstanding gains relative to gold in 2015–16. And the early-stage gold mining companies shot the lights out in 2020 after gold producers led the rally in 2019.

What’s happened in the last three years is unusual, leading me to believe gold stocks are positioning themselves for exciting opportunities to benefit. It’s about the right conditions to set up the rally.

In my update two weeks ago, I explained how gold stocks are driven by the gold-oil ratio rather than the price of gold itself. Knowing that helped me improve my success and allowed me to enjoy some exceptional returns:

| |

| Source: Australian Gold Fund |

But this isn’t about me, let’s talk about how you can improve your chances of success.

The Lassonde Curve: How to help you stick to your game plan

Last week, I discussed how you must consider your game plan to contend with the unusual risk profile of gold stocks. I briefly mentioned there are producers, developers, and explorers within the gold stocks universe. These companies have different characteristics requiring you to tailor your strategy right if you want the chance to reap the rewards.

Often, gold stock investors fail because they do not understand the individual company’s operations, asset quality, management quality, and financial position. Add to that a failure to plan or exercise discipline.

Last week I discussed investing in gold producers and how volatile they can be. Today, we’ll talk about how a neat rule-of-thumb can help improve your chances of success when investing (probably more apt to call it speculating) in developers and explorers.

There are more undeveloped gold mines in Australia than those in operation. Over 200 such companies are listed on the Australian Stock Exchange, and many more private investors own mine properties.

This is fertile ground for speculation but one littered with substantial losses. Undeveloped mine properties don’t generate revenue and require funds for exploration and development. As these funds go into the ground, management must raise more. This dilutes the share capital, often causing the share price to fall.

Few gold mining companies discover an economically viable deposit, secure funding, and build the infrastructure to start production. The years leading up to it could see shareholders endure share price stagnation, operational hiccups, director and management changes, and ramp-up troubles. Companies like Gold Road Resources [ASX:GOR], Regis Resources [ASX:RRL] and West African Resources [ASX:WAF] that successfully discovered and built a profitable mine operation are few and far between.

There could be as many as 5,000 mining ventures that don’t deliver for every discovery that eventually becomes a viable mine operation. For that reason, the most successful mining investment legends like Rick Rule, Eric Sprott, Brien Lundin, Robert Friedland, and Pierre Lassonde have a game plan and adhere to it. Their strategy is to identify the companies with quality mine assets and management teams and invest a small initial stake, building these up when the company achieve milestones. They monitor the progress based on the company’s strategic plans rather than the share price movements.

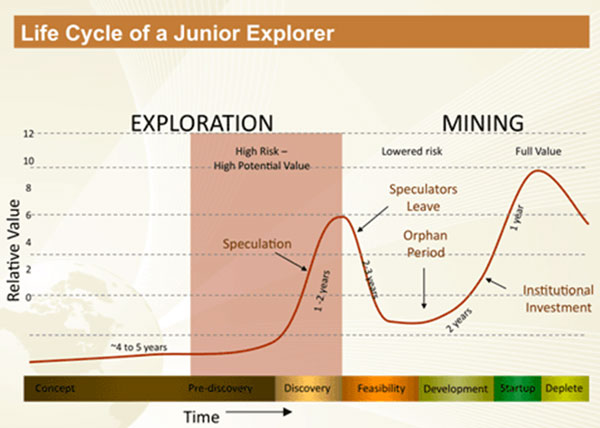

A rule-of-thumb commonly used in this circle is to select mining stocks using the Lassonde Curve. This curve roughly estimates the relative value of mining companies in different stages of their lifecycle. I’ll reproduce this curve below:

| |

| Source: Brent Cook’s Exploration Insights |

Most mining investors deem two stages in the mining lifecycle particularly profitable. These are when (1) a mining company confirms a quantifiable amount of minerals in the ground and (2) when the company begins building infrastructure in a deposit to begin production.

From what I know, those who enjoy the biggest gains in this space are investors who held these stocks for years and watched these companies fulfil their goals. They won’t get every call right.

Some companies will fail to deliver and shareholders suffer significant losses, even all their invested capital.

Others may receive a takeover bid, like Musgrave Minerals, Tietto Minerals, and Filo Corporation [TSX:FIL], cutting short one’s potential gains.

Discoveries and takeover bids can come out of nowhere. In the last 18 months, we saw some companies whose share prices jumped in a spectacular fashion.

Let me list a few of them to jog your memory:

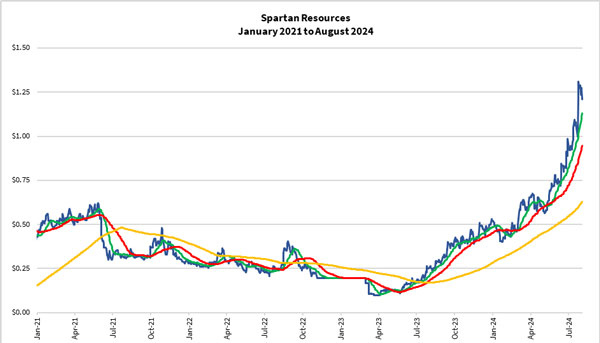

Spartan Resources [ASX:SPR]. The announcements of resource upgrades in the Never Never and Pepper deposits transforming the once unviable Dalgaranga mine, located in Western Australia, into a potentially lucrative mine. Its shares are up over 1,000% since its lows last March.

| |

| Source: Refinitiv Eikon |

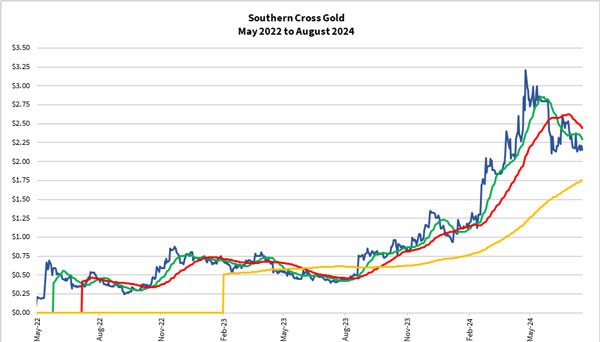

Southern Cross Gold [ASX:SXG]. The announcements of high-grade gold and antimony veins stretching hundreds of metres in its Sunday Creek prospect in Central Victoria. Its shares have rallied more than 400% since last June.

| |

| Source: Refinitiv Eikon |

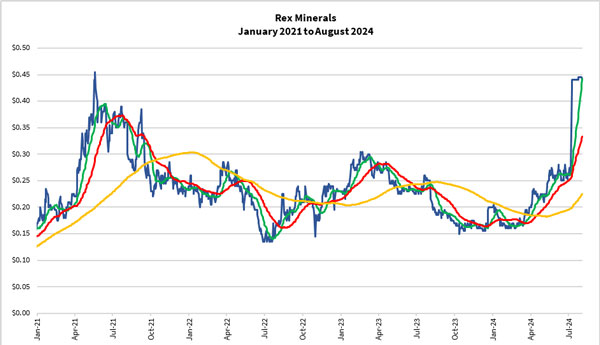

Rex Minerals [ASX:RXM]. The company’s share price surged over 50% in early July after it received a takeover offer from a subsidiary of an Indonesian conglomerate. For over two years, the company’s share price stagnated and the timing of the deal surprised many.

| |

| Source: Refinitiv Eikon |

These companies shared two common elements: management quality and a track record of tangible results. Good management begets success. Similarly, good mine properties reveal themselves through consistently strong drill results and resource upgrades. These qualities don’t guarantee success, but they certainly tilt the odds in your favour!

Eye on the goal: How share price movements can help and distract

Finally, I want to note that successful gold stock investors consider share price movements. But with gold explorers and early-stage developers, there’s more value in following the company’s story and progress.

The share price can often distract investors from their long-term goal of making outsized gains from these companies. It can cause investors to sell too early and miss the milestones that send the price soaring.

That’s not to say one should ignore the share price movements altogether. The price signals what the market (and insiders) read of the company’s future potential. Sometimes the share price rises or falls due to rumours and confirmations of such. At other times, it may just be noise or movements in the underlying commodity that have no bearing on the company’s intrinsic value.

At Fat Tail Investment Research, we’ve got good news for you. A few editors offer different ways to help members build their wealth in gold stocks (and other assets).

If you want someone who can read the markets with precious and time your trades, look no further than my colleague, Murray Dawes. He’s recently instructed his newsletter readers to add gold stocks to their portfolios.

Besides gold, he’s seeing an opportunity in copper as well. You might want to click here to learn more about why.

Alternatively, if you want to focus on gold stocks and find the companies that have the potential to follow the successes of Spartan Resources, Southern Cross Gold and Rex Minerals, consider my precious metals newsletters.

The Australian Gold Report is a one-stop service aimed at helping you build a precious metals portfolio, from physical bullion to established gold producers. I’ve thrown in three early-stage gold stocks so you can have a chance at earning multi-fold gains.

Or if you’re adventurous and want to go straight into speculating in explorers and early-stage developers, check out my premium newsletter service Gold Stock Pro.

But beware, it’s not for the faint-hearted!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments