I have a good friend from church who I’ve known for almost two decades. We’ve gone through thick and thin. We knew we’d have each other’s backs when needed.

What helped us get along so well is probably because of the contrasts in our characters. I’m generally more risk-loving and an upfront guy, while he’s more cautious and reserved in nature.

In 2014, he went slightly out of character on his caution and decided to take a plunge in gold stocks as well. To his credit, he got in at a better time than I did.

However, the first few months of his foray were challenging for him as the majority of the gold producers he bought continued to decline.

It was in October 2014 when we had dinner one night and we chatted about our portfolios and our respective outlook…

He told me he’d been reading Jesse Livermore’s book ‘How to trade in stocks’. One of the lessons Jesse Livermore taught was having stop-losses and sticking to them to minimise the pain.

My friend had set a stop-loss limit of 20% on some of his holdings. He had sold some of his stocks already as they hit their limits.

I was alarmed that he set a shallow stop-loss limit and I suggested that he re-consider his strategy. He was a little resistant at first because the losses were mounting, and he thought this strategy might lessen the pain. I showed him some macroeconomic trends to back up my case, including how the gold-oil ratio was starting to rise, and a few larger gold producers were generating a modest operating margin for the September quarter.

Happily for him, he widened his stop-loss limit and allowed the paper losses to convert into solid gains in 2015. He did pretty well in 2016 when the bull market kicked into full gear.

However, unlike me, my friend was happy to put more of his wealth in other things than gold stocks afterwards. The ride was a bit too wild for him and he found his calling elsewhere.

Different space, different rules

Last week I talked about how gold stocks don’t necessarily track the price of gold. Instead, I observed that the gold-oil ratio is a better driver for the value of gold stocks, owing to the impact it has on how much cash surplus producers make. I also talked about how the gold price cycle plays a big part in driving investor sentiment, and this suggests there are two approaches you can take to increase your chances of success investing in gold stocks.

It might just be me playing in the gold stock space the wrong way all this time or gold stocks operate differently to other assets. But one thing I’ve learnt from experience is that gold stock investing requires you to throw out the window some of the consensus wisdom of how to successfully invest.

What I wrote in the introduction is another example.

Now I want to clarify that you shouldn’t take my views as financial advice or adapt it yourself without proper research and reflection. My risk appetite isn’t something that most people can stomach.

Let me discuss in more detail what I mean about the risks associated with gold stock investing.

Gold stocks aren’t just a single asset class as the name suggests. Within it, you’ve got producers, developers and explorers. Even within producers, the larger producers behave differently from the smaller ones. And I won’t even mention explorers, early-stage and late-stage developers. They’re totally different games in themselves!

I only invested in producers back in 2014. Even today gold producers form the bulk of my gold stock portfolio. Despite some producers having a market value in the billions of dollars, these companies have high volatility because their value is driven heavily by the prices of the commodities they produce. In turn, commodity prices can vary wildly, driven both by industrial demand and the desires of financial institutions.

More than a bet on the price of gold…

Some of you might be familiar with a financial option contract. But I’ll explain briefly for those who aren’t familiar with this.

An option is a contract that allows you to buy an asset in the future for a pre-determined price. For example, let’s say you want to buy gold in the future but want to pay no more than today’s price of $2,392 an ounce. A call option contract makes that possible. You just have to pay a small premium today to the counterparty who will sell the gold to you in the future if you elect to exercise that option.

If the price of gold falls below $2,392 in the future, you can buy it on-market and let the option expire. But if gold rises, you can exercise the option and pay just $2,392 an ounce, allowing you to profit from the price differential.

Likewise, if you believe the price of gold could fall in the future, you can use a put option to lock in the current price to sell some gold.

Now how is a gold producer like a call option on the price of gold?

A gold producer explores, extracts and sells gold for profit. It incurs operating, administrative, and other costs. In short, a gold producer’s cost of producing gold is like the exercise price of a call option. What differentiates a gold producer and a call option on gold is that the producer’s costs vary. Meanwhile, a call option’s exercise price usually doesn’t (you can get exotic options with interesting features, but we’ll leave it at that).

The factors that drive a gold producer’s value include the prices of gold and other metals it produces, input costs, operating costs, staff costs and economic factors. I’ve mentioned how these can cause the price of gold producer stocks to vary widely quickly. In that sense, gold stocks behave almost like stock options, which are notorious for their risk profile.

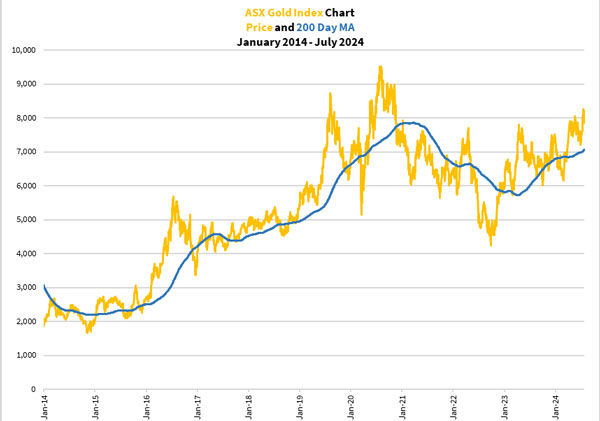

Let’s have a look at how volatile the ASX Gold Index [ASX:XGD] has been over the past decade:

| |

| Source: Refinitiv Eikon |

This is the index that smooths out the volatility of individual gold producers. Let me show you the price history of a few key gold producers:

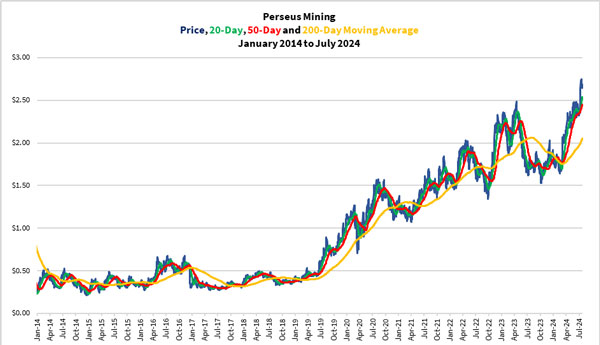

| |

| Source: Refinitiv Eikon |

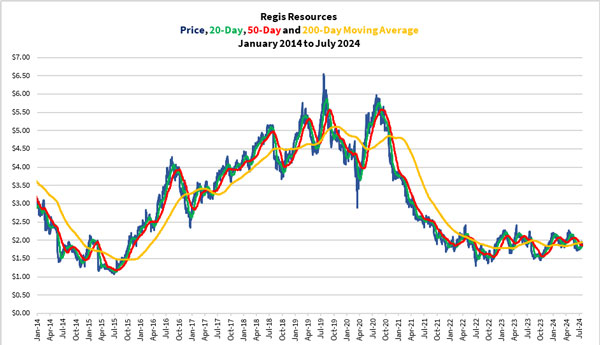

| |

| Source: Refinitiv Eikon |

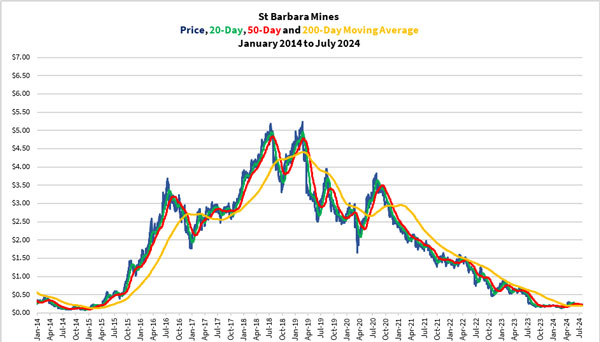

| |

| Source: Refinitiv Eikon |

| |

| Source: Refinitiv Eikon |

You can see how some producers such as Northern Star Resources [ASX:NST] and Perseus Mining [ASX:PRU] went from strength to strength. Meanwhile, Regis Resources [ASX:RRL] and St Barbara [ASX:SBM] shareholders have now the golden years to reminisce as the share prices tanked.

But these companies share a rollercoaster ride in their share prices. No producer is immune. The road to multi-fold gains and withering losses is paved with false breakouts, sharp corrections, price spikes and troughs. It’s a challenge to stay on course to enjoy those exciting percentage returns. At the same time, you want to cash out of a loser before it burns up your savings.

My experience is that the biggest winners are those who know the risk profile in this space, work out their risk tolerance and can patiently live through the gold price cycle, focusing on sorting out quality gold stocks from the chaff. These are the gold stock investors who secure multi-fold gains.

Work out your game plan

For every gold producer, not just the four I’ve shown you above, is a rich and interesting history. Understanding the gold stock space and these company’s unique stories is the first step to ensuring your success.

Not everyone is made for investing in gold stocks. And those who start this journey may find it intimidating to fly solo.

This is where I’d like to invite you to consider taking the first step with me. Not only do I research deeply in this space, I have much experience with these companies as I’ve been a gold stock investor for over a decade.

If you’ve found your calling after reading my series, consider signing up to my precious metals newsletter, The Australian Gold Report. You can learn to build your precious metals portfolio and start buying a handful of quality gold producers that I’ve reviewed and deemed to have good potential.

I’ve also teamed up with Kerry Stevenson from Making Money Matter recently. We both share a passion for bringing to the Australian public the merits of investing in precious metals to preserve purchasing power and build one’s wealth.

Next month Kerry is hosting The Australian Gold Conference in Crown Tower Barangaroo in Sydney. It’ll be a two-day event beginning on Tuesday, 27 August. I’m both a panellist and presenter at this conference. If you’re a serious precious metals and gold stock investor, I strongly urge you to attend.

Furthermore, there’s another event, Eureka 2024, happening on the evening before the conference. This is the opportunity to bring your family and friends to get them started on learning about the wealth-building potential of precious metals and how to get started.

I’ll leave you with a brief video featuring Kerry telling you about the events. Click the video image below to view:

Kerry is kindly offering a 10% discount to Fat Tail Daily readers.

Please use the code FATTAILGOLD when you register to attend.

If gold isn’t your treasure, check out

this special offer!

Now, if precious metals aren’t for you but small-cap stock investing is, my colleague Callum Newman is offering a special deal to sign up for his premium newsletter, Small Cap System. Callum has worked with Peter Bakker to refine an algorithmic trading system focused on helping members time their trades with the smaller end of our market.

Recently, Callum helped his members score a tidy profit in a gold developer Spartan Resources [ASX:SPR], among many of his successes. And he’s signalling that there are more opportunities on offer in gold stocks and other small-cap companies.

Jump onto this video or click on the thumbnail below to find out more:

That’s it from me for this week. Tune in next week for another strategy to help you succeed in gold stock investing!

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments