No doubt you were glued to the TV this week, watching the big event of global importance.

Queensland regained their underdog status for the State of Origin opener this year. Until about two-thirds of the way through the game. A couple of fends led to tries and victory for the Maroons.

Yes, here comes the metaphor.

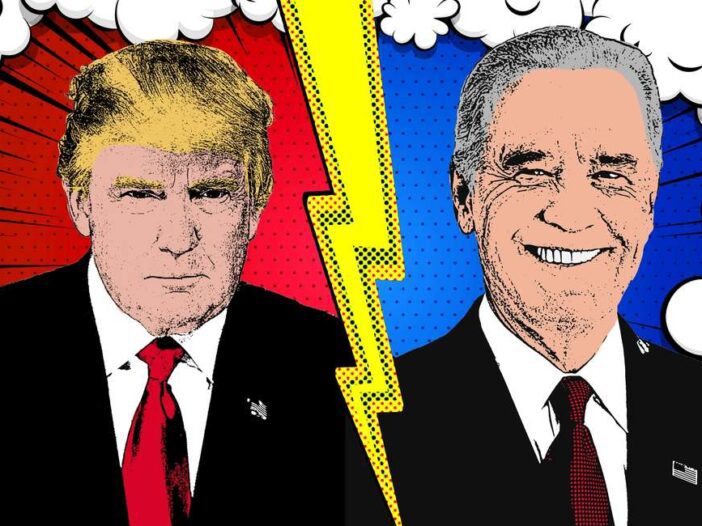

Fends and underdogs featured in the disunited states of the US too. The election put on a great show. Not that anyone knows quite what to make of it. Financial markets least of all.

As I write this, betting odds are back to favouring Biden after a huge swing to Trump and back again on election night. My own prediction of a close enough result for a prolonged legal battle is now a favourite.

Financial markets went haywire amidst all this drama. The US election results, not Origin…

Not only could stocks not agree on which outcome is likely, they couldn’t agree on which outcome is good either.

Stay up to date with the latest investment trends and opportunities. Click here to learn more.

Can you figure it out? Have a go…

Biden is pro-lockdown. Which would be awful for the economy and financial markets. Cases are rising again in the US. And Europe’s return to lockdown sunk markets last week. What would a Europe-style lockdown do to the US?

Biden also wants to raise capital gains taxes. So Americans have an incentive to sell stocks now to escape them. This could trigger a sell-off too. But it seems to be doing the opposite as I write this, with stocks surging on Biden’s surge.

With the US Senate up for grabs, things become even more complex. One theory going into the election was that a Biden presidency with a Republican Senate would be optimal for stocks. Because the Republican Senate would prevent Biden from reversing Trump’s decent economic policy, while Biden could clean up the US’ foreign relations policy (in favour of corporate interests, not Uighurs). It’s a bit like having the Blues’ defensive line of the first half, but the Queensland halves in attack. Or something like that.

So, what do you make of the results by the time you read this? Do you know what they mean for markets going forward? I won’t.

Anyway, the US election is history; even if the outcome remains uncertain at the time I write this. Now what for Aussie investors specifically?

Well, that we can guess at. Australia’s key exposure to the US election is in the US’ foreign policy. Biden and Trump have completely different positions on China — our key trading partner.

Trump was willing to fight a trade war, even if it sunk his beloved stock market.

Australia took a hit from this too, by backing Trump for our national security. China hit back by banning Aussie exports. That’s a big news story right now, which means you can read about it elsewhere. We’ll ask what this means for stocks.

It suggests a Biden presidency will be good for Aussie exporters, and a Trump one bad.

But which of the two will it be? I’m not sure it’ll be decided for weeks if legal challenges gain traction. So what should investors do?

Focus on what we do know.

And yes, there are some things we do know already.

Elections and Investing

COVID-19 is likely to have a much bigger impact than the US election for Aussie investors. The budget deficits and economic impacts of the virus make past electioneering battles around the Western world look pathetic.

Deficits no longer matter. MMT (Modern Monetary Theory) is de facto policy already, upending the big debate we were supposed to have about it. Australian stocks got smacked back to 2007 levels by COVID and are lagging the recovery badly.

Stocks plummeted as the first lockdowns began. Will they again, as they did last week?

When COVID-19 truly breaks out in Australia, we’ll be the only nation suffering while others have reached some level of herd immunity. So, do we stay in isolation from the world, or manage an outbreak?

Meanwhile, the most important institution in the US didn’t even get a mention in the election. The Federal Reserve will continue on its merry way with QE (quantitative easing). And that’ll dominate any political drivers of financial markets.

Jerome Powell, head of the Federal Reserve, and the most important politician in the US, can choose to finance deficits or not. He can inflate financial markets, lend limitless amounts for free to businesses and even prop up the Aussie banking system in secret, as his predecessor did in 2008.

Even the president of the US can’t do that. Not to mention the absence of political accountability for the Federal Reserve president, which is less than the leaders of the EU face.

Speaking of which, it’s not just the US printing money, of course. Central bankers around the world are now entirely unleashed. Governments need them to print money, so they are suddenly allowed to do it. The law is a question of circumstance in politics.

Except in one place, where some legal constraints remain: Europe’s eurozone.

In the latest European currency union — the euro has many failed predecessors — they’ve put a criminal lawyer in charge.

I don’t mean criminal law; I mean she’s a criminal who used to be a lawyer. Her crime? Financial negligence while finance minister of France. Just the sort of person you want in charge of a money printing machine when the law constraining it is the key problem.

But will she be able to convince the Germans to put up with money printing to save Italy, Spain and Greece from their COVID crisis? I’m not so sure given Germany’s history with money printing.

I supposed you could sum up today’s Daily Reckoning as, ‘You should’ve watched State of Origin instead’. The US election changes precious little for Aussie investors in the scope of things. Other stories matter dramatically more. But we don’t pay as much attention to them.

COVID is threatening stocks and sovereign debt crises. Central banks are printing money like mad. Europe’s financial fragility is on a knife-edge.

But all eyes are on the US instead of Wayne Bennett. Their loss…or yours if you don’t own gold.

Until next time,

|

Nickolai Hubble,

Editor, The Daily Reckoning Australia Weekend

PS: Free report reveals why Australia is set to become the next ‘gold epicentre’ — which could result in a HUGE spike in Aussie gold stock prices. Click here to learn more.