West African junior miners Mako Gold [ASX:MKG] released results from RC drilling, confirming new mineralised zones north and west of its Napié Project in Central Côte d’Ivoire.

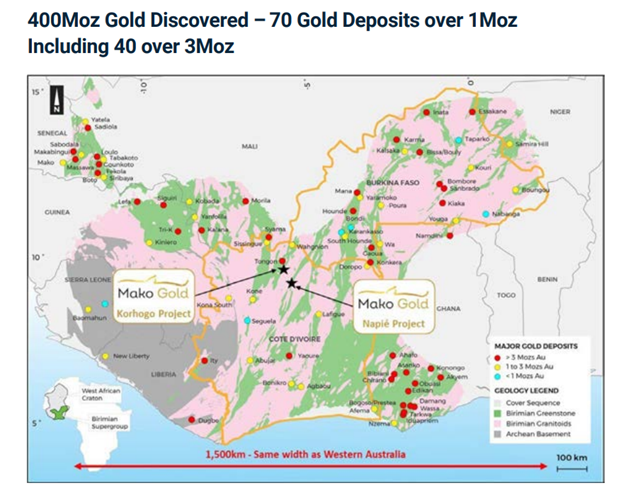

Mako is a mineral exploration company focused on discovering large gold deposits in the highly prospective and underexplored mining regions of West Africa, particularly Côte d’Ivoire.

Shares reacted to the news with scepticism today, with shares down by 3.23% at three cents per share.

The company’s portfolio consists of the Korhogo Manganese project and its flagship project Napié Project which covers a strike length of 30 kilometres. Nine months ago, Mako consolidated its ownership of the Napié Project, increasing its ownership from 51% to 90% after entering into a binding agreement with Perseus Mining [ASX:PRU].

It’s been a tough year for the junior miner with suppressed commodity prices and slower-than-hoped exploration of the Napié sheer. Investors have remained cautious about joining the highly speculative venture.

Source: TradingView

Blue Sky at Napié Project

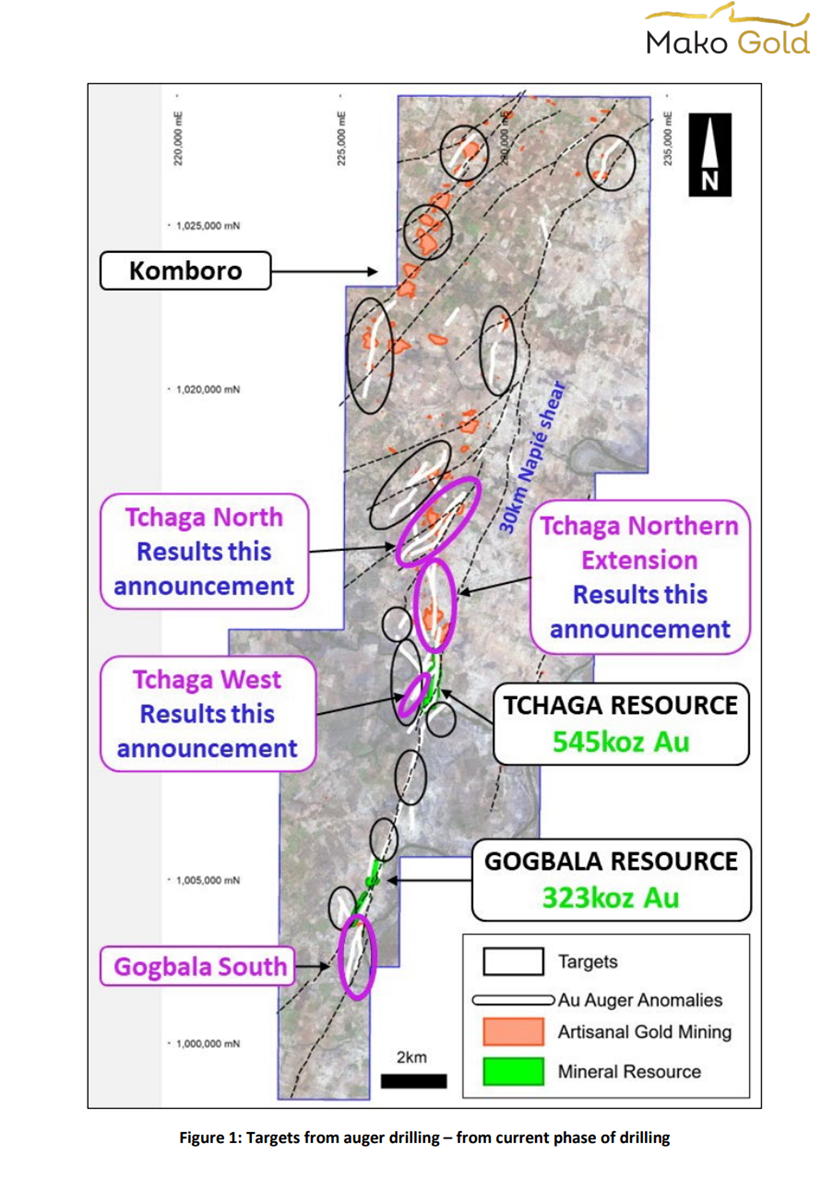

Further positive results were released today for the Côte d’Ivoire Napié project indicating a large underlying resource of gold in the Tchaga West portion of the sheer.

RC drilling confirmed two new mineralisation zones both north and west of the existing resource with several high-grade intersections within the 400-metre spaced testing fences.

Tchaga West’s significant gold mineralisation includes:

- NARC830: 6m at 6.03g/t Au from 91m; including:

- 3m at 8.46g/t Au from 93m

- 1m at 15.16g/t Au from 93m

- NARC829: 2m at 1.91g/t Au from 54m

- NARC827: 3m at 1.14g/t Au from 61m

- 3m at 8.46g/t Au from 93m

Tchaga North: gold mineralisation showed:

- NARC819: 1m at 44.86g/t Au from 6m

- o NARC810: 8m at 2.23g/t Au from 19m; including:

- 3m at 4.05g/t Au from 23m

- NARC815: 2m at 4.27g/t Au from 88m

- NARC807: 4m at 1.34g/t Au from 83m

- NARC803: 1m at 3.94g/t Au from 21m

Before the latest rounds of testing, Tchaga and Gogbala prospects were announced with a maiden Mineral Resource Estimate (MRE) of 22.45Mt at 1.20g/t Au for 868,000 ounces of gold.

This MRE within these two sites constitutes only around 4.4 kilometres of the total 30 kilometres Napié fault, which is yet to be fully explored — with only 13% systematically drilled.

Source: Mako Gold

Today’s results confirm what many already assumed about the area’s potential. It’s not a shocking result, but it highlights the project’s potential growth into a multi-million-ounce gold deposit.

Mako’s Managing Director, Peter Ledwidge, commented:

‘We are very excited to have discovered high-grade gold on several new prospect areas which were identified as high-priority targets following our recent 25,000-metre auger drilling program.

‘Considering the very wide-spaced drilling with spacing of drill fences at 400 metres, intersecting gold mineralisation on one or more sections is highly encouraging. We also see great potential for further gold zones to be found at Napié, given the result reported today represent only four out of 15 targets identified from our recent auger drilling.

‘Our next step is to commence a diamond drilling program, which is set to kick off within the coming weeks, to follow up the mineralised trends on sections which returned positive results.’

The Napié project covers an area of 224 kilometres squared and is in the highly prospective Central North of Côte d’Ivoire, known as the Birimian greenstone belt.

Mako is part of a growing cohort of miners in the region who are discovering large deposits. While the north is relatively underexplored, Mako has been able to leverage nearby projects which have already developed local infrastructure, such as roads to the City of Korhogo 30 kilometres to the northwest.

Source: Mako Gold

In August of 2021, Mako completed the sale of its third project, Niou in Burkina Faso, to Nordgold, retaining a 1% stake.

So, what’s next for this mining junior in this high-risk, high-reward mine?

Mako Gold outlook

As results continue to trickle in for the Napié project, there is little doubt that the company is sitting on a sizable resource that could see the company company’s share price and coffers rise dramatically.

The big question of execution still hangs over the mining junior. The company’s management comprises of African mining veterans, so there should be less concern for the company to execute the project than other factors.

The extended spacing of the sampling shows a company that is aware of how to save capital at this stage and solidifies my faith in the company’s ability to create a productive mine.

However, concerns about the area’s stability could be the factor that adds risk to the project beyond its remoteness.

Côte d’Ivoire patched some of its wounds since the 2002–2007 civil war divided the country between the Muslim rebel-held north and the Government-controlled Christian south.

But then there was the 2019 acquittal of ex-president Laurent Gbagbo for his role in post-election violence when he refused to concede in the 2010 election. Violence ensued that ultimately killed 3,000 people.

The case has reopened wounds and threatens to create an unstable environment for Mako to operate.

‘…years after the tragic crisis experienced by our country, those same actors risk fuelling the antagonism of the past and the political violence which ensued,’ remarked Drissa Traoré of the International Federation of Human Rights.

While this has been a relatively robust nation for several years, the risk still stands for Côte d’Ivoire and Mako Gold.

The long-term prospects for gold prices may make this company on your watchlist.

What else can you do with future signals flashing golden opportunities?

Your golden opportunities

Protect your wealth and seize new opportunities in today’s rapidly changing environment with our exclusive free report on gold.

Learn from leading gold expert Brian Chu how to pick gold.

Understand why gold is such a powerful asset to own right now.

Find the best places to buy gold (and where not to…) and choose the right type for your needs.

Click here to download your free report and join our experts as we cover gold and commodities.

This report is only available for a limited time, so don’t miss out!

Regards,

Fat tail Commodities