At time of writing, the share price of Lithium Australia NL [ASX:LIT] is up a significant amount, 25.9%, trading at 17 cents.

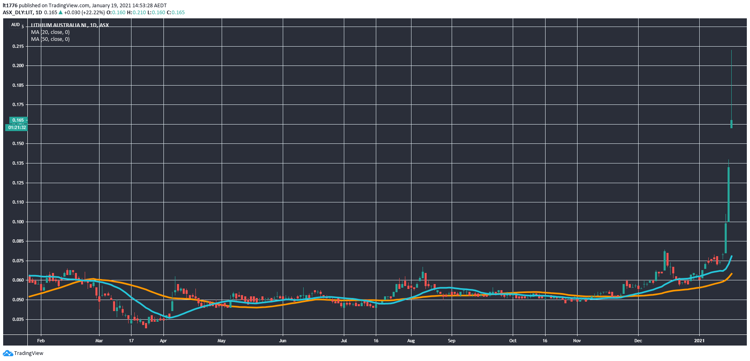

It’s certainly a meteoric rise for the LIT share price as you can see it gapping up below:

Source: tradingview.com

At one point, the LIT share price was trading as high as 20.5 cents. We look at today’s announcement, which included battery market projections.

LIT announcement included plenty of research

With a headline that reads ‘Lithium ferro phosphate battery market — 500% expansion by 2030’, here are the key points from the announcement:

- ‘Lithium ferro phosphate (‘LFP’) type lithium-ion batteries (‘LIBs’) reduce battery industry dependency on energy metals such as nickel and cobalt while providing safer power storage.

- ‘It is anticipated that LFP will become the fastest growing sector of the LIB market, particularly with respect to electric vehicle (“EV”) penetration into the automotive market and the increased use of battery energy storage systems (“BESS”) for reliable power distribution from renewable energy sources.

- ‘Lithium Australia’s battery R&D subsidiary VSPC is well-positioned to service LFP markets outside China.’

It’s an extensive announcement that compiles a range of data that is usually hard for investors to find all in one place to LIT’s credit.

And based on the market reaction that’s playing out at the moment, some investors clearly found it compelling.

If you are interested in the battery market, particularly LFP batteries, it’s worth a read.

Outlook for LIT share price

Such large rises usually involve a retracement, from experience.

But you can never write off a frothy market that increasingly has an appetite for lithium stocks.

Interestingly, the LIT announcement made mention of a supply chain shift away from nickel and cobalt.

So it would be wise to watch these particular commodities closely to see if it plays out that way.

If you are interested in lithium stocks, then we’ve got a great resource for you. In this report you will find out all about three particular lithium companies that should be on your radar.

Regards,

Lachlann Tierney

For Money Morning

Comments