And not just because the Aussie dollar is plunging, either.

The same record was hit in at least six currencies I could find.

Even in US dollar terms, gold hit a high going back to 2013.

In fact, the price finally managed to break US$1,500.

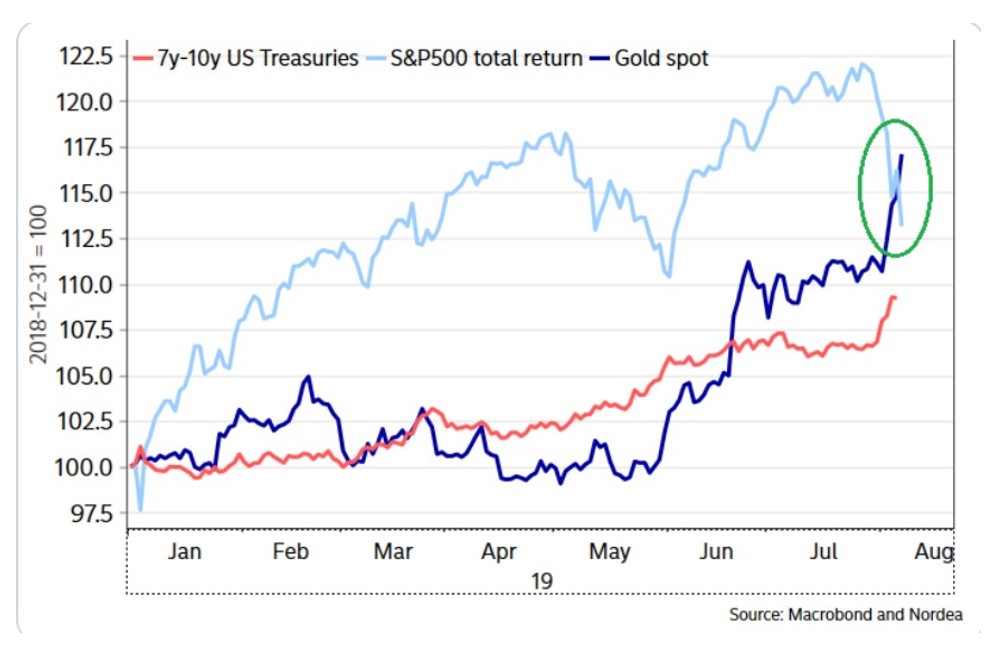

The Market Ear points out that gold is doing better so far in 2019 than the US stock market.

Gold beats US stock market

|

|

|

Source: The Market Ear |

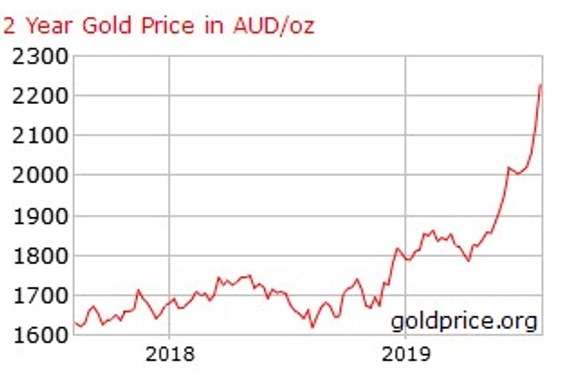

The next two charts show the 10-year and two-year gold price in Aussie dollars.

|

|

|

|

|

Source: Goldprice.org |

Not bad while financial markets go haywire.

All this is precisely how things are supposed to play out, if you’re a Jim Rickards’ Strategic Intelligence subscriber.

Just when markets take a hit, the gold price spikes. And the Aussie dollar adds gains.

[conversion type=”in_post”]

Oopsy

But what exactly has changed?

One argument is all about the big gold buyers. Basic supply and demand in the gold market itself. The actions of governments and central banks.

First, a bit of context. Back in 1990, a bunch of European governments signed the Central Bank Gold Agreement. It’s better known as the Washington Agreement on Gold, even though the US government didn’t sign up.

The idea of the agreement was for central banks to coordinate their gold sales to avoid price instability in the gold market. It’s a bit like OPEC, but in a much smaller market.

Gordon Brown’s decision to sell about half of the UK’s gold in 17 auctions between 1999 and 2002, for an average price of US$275 per ounce, took place under the agreement. The $3.5 billion in sales would now be worth almost $19 billion.

Oopsy.

The Swiss and the IMF were major sellers under the agreement as well. It was renewed in 2004, 2009, and 2014. But it is about to lapse and there’s no interest in renewing it.

Why? Because the big sellers have stopped selling gold as much, or at all. And their colleagues at governments and central banks around the world have turned into big buyers. So the gold market’s ability to absorb sales has improved.

Central banks in emerging markets are buying in large quantities, and taking physical delivery too. The Financial Times has the data:

‘Data released by the World Gold Council last week showed central banks, led by Poland, China and Russia, bought 374 tonnes of gold – the largest acquisition of the precious metal on record by public institutions in the first half of a year. Central banks accounted for nearly one-sixth of total gold demand in the period.

‘The pattern advances on last year’s activity in which central banks hoovered up more gold than at any time since the end of the gold standard (where a country could link the value of its currency to the precious metal) in 1971.

‘The shift in attitude towards gold since the financial crisis was highlighted by a European Central Bank decision last week to cease an agreement to limit sales of gold, as the region’s institutions are no longer selling it in large volumes and are instead now net purchasers.’

So there might be a radical change in the supply and demand for gold underway, with a sustained seller turning into a major buyer.

Melt-up or meltdown?

Another argument is anticipation of central bank stimulus. Lower interest rates and more QE are good for gold.

Gold may not pay any interest, but neither does much else these days…in fact, other safe havens cost you interest, thanks to negative rates.

Shae Russell has previously pondered whether this’ll happen in Australia too.

QE means more money sloshing around the system and devaluing money suggests gold will go up in price.

In other words, thanks to central bank action, gold melts up when everything else melts down. Is that what’s happening now?

Perhaps.

Markets certainly took a tumble last week.

Then there’s the de-financialisation idea.

Financial markets and institutions are so interconnected, they’re bound to get into trouble at the same time.

The wealthy who don’t want to risk being in financial markets can no longer just keep their money in the banking system.

Rules on bank bail-ins apply in Australia too.

Under the plans, bank deposits can be used to rescue a bank. So simply selling your investments to wait out a crash doesn’t work anymore.

Gold will embarrass monetary policy makers

You have to own something, outside the financial system.

Gold is an opt-out opportunity that allows a clean break from financial assets. Not much else is liquid enough to offer the same sort of protection.

The big weakness in the argument for investing in gold remains. You might’ve noticed the common factor in the discussion above. All the explanations for gold’s rise hinge on governments and central banks.

Gold is a politically sensitive asset, giving it political risk.

Not only that, but the amount of financial gold being traded vastly outweighs the actual physical metal. So prices are set by futures instead of gold supply and demand.

How much can gold go up before it becomes too much of an embarrassment for the monetary and political authorities? Before gold fever strikes in a way that hampers the war on cash? Before the authorities use the paper gold market to crush the price of physical gold?

It looks like we’re going to find out the hard way.

The time to take physical possession of your gold is drawing near.

|

Until next time, |

|

|

Nick Hubble, PS: Discover how some investors are preserving their wealth and even making a profit, as the economy tanks. Download your FREE report by clicking here. |