Meta-description: Flight Centre said its recovery is on track after posting record COVID-19 period sales revenue in March.

FLT reported that March revenue exceeded its previous COVID-19-period record, with March turnover totalling more than $100 million higher than February.

While Flight Centre Travel Group Ltd [ASX:FLT] was optimistic about its recovery, the market was more subdued.

At the time of writing, FLT’s share price traded lower at $16.15 per share, down 4.5%.

The peak of Australia’s COVID restrictions last year saw FLT shares bottom out at $8.92 in March 2020.

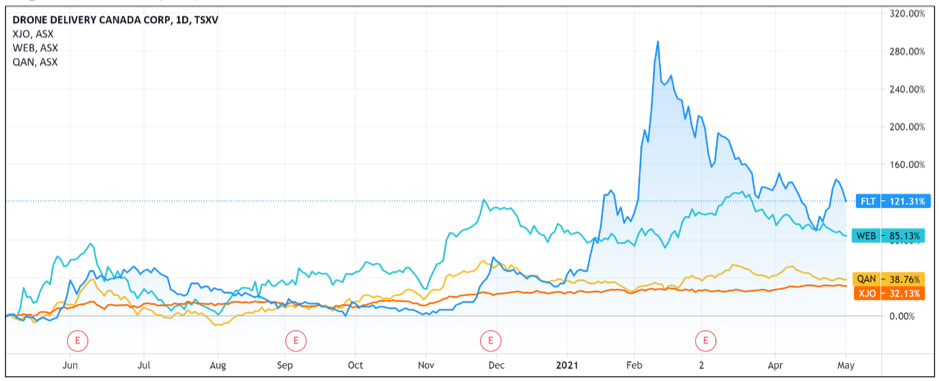

Since then, the stock rose along with the economic outlook.

Year-to-date, FLT shares are up 2% and 70% over the last 12 months, outperforming the ASX 200 by 35%.

Source: Tradingview.com

FLT sales growth

Presenting at the Macquarie Conference, Flight Centre reported ‘significant uplift globally’ from the end of FY21 Q3.

March turnover was up 32.7% month-on-month, taking gross quarterly total transaction value (TTV) above $1 billion for the first time since the COVID crisis.

The company is currently expecting further growth in April.

Flight Centre revealed that its corporate business is tracking at 29% of historic total TTV at the end of Q3 (FLT based its March TTV comparisons on FY19 data).

The company reported Australia is recovering faster than FLT’s global corporate business but at a lower-than-normal revenue margin.

The global leisure segment is tracking at 14% of historic levels at the end of Q3.

FLT costs

Flight Centre revealed it was achieving its cost target, with fixed costs tracking $70 million per month.

While fixed costs remained stable, variable costs increased ‘slightly’.

The increase was in line with FLT’s expectations and was driven by rising incentive payments to staff given sales growth.

To drive productivity gains and further growth, the company reported investments in major technology initiatives in both the corporate and leisure segments.

Flight Centre also flagged it will lose $5–7 million per month in JobKeeper wage subsidies during Q4.

However, the company expects to recoup the losses if state governments ‘keep borders open’.

FLT also reported $1.5 billion in cash at the end of the quarter, with about $1.1 billion in total liquidity.

A $400 million convertible note issued last November helped repay $100 million in short-term band debt in FY21 2H.

Flight Centre said its monthly operating cash outflows remained ‘steady’ during the quarter with $30–40 million in outflows per month.

What’s next for FLT?

Flight Centre is targeting its corporate business to hit 50% of pre-COVID TTV by 31 December and expects the segment to return to profitability ahead of the leisure segment.

The 31 December target assumes effective vaccine rollout and border stability.

Looking out, Flight Centre stated it is still targeting a return to profit before tax during FY22 in both corporate and leisure segments.

This depends on a stable cost base and consistent revenue growth.

FLT expects if FY21 2H underlying losses to be ‘broadly in line’ with 1H losses.

Further, 2H sales revenue gains are expected to be offset by JobKeeper cutbacks in Q3 and the termination of JobKeeper in Q4.

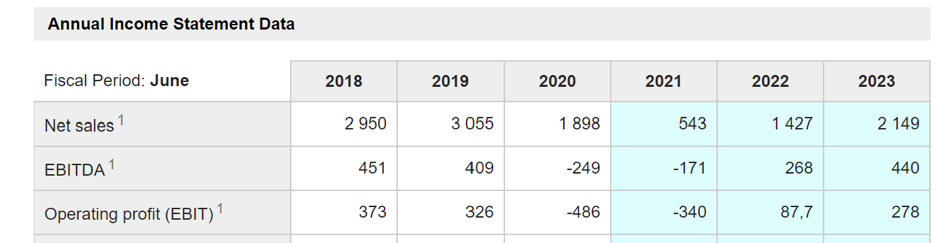

Source: MarketScreener

The company’s profit before tax guidance for FY22 is largely in line with analyst forecasts surveyed by MarketScreener.

However, analysts also forecast that FLT sales will still come in below 2018 levels even in 2023.

Flight Centre noted that the key to its near-term recovery is domestic borders staying open and more international corridors or travel bubbles forming.

To the latter end, FLT expects transatlantic corridors to open in early FY22.

The company is also seeing ‘strong and immediate rebounds in leisure and corporate sales when restrictions are lifted’, demonstrating a pent-up demand FLT can capitalise on.

While the economic outlook is no doubt better than it was in March last year, Flight Centre still must contend with plenty of uncertainty on its road to recovery.

Its steady operating outflows of $30–40 million translate to $360 a year at the conservative range.

All the while parts of the world are battling severe third waves despite vaccine rollouts, prompting snap travel bans and further restrictions.

And the UK market, dubbed a ‘material contributor to group results’ by FLT, is still seeing only a ‘modest recovery to date’ with travel restrictions still in place.

All in all, while Flight Centre is seeing a path to recovery, today’s share price fall suggests investors are less optimistic.

If you’re unsure about Flight Centre’s medium-term prospects and wish to explore stocks that may have a higher upside, I recommend reading our high value small-caps 2021 report.

In the report, our market expert Ryan Clarkson-Ledward reveals four undervalued stocks that could potentially soar in 2021.

Regards,

Lachlann Tierney,

For Money Morning

Comments