In today’s Money Morning…Tesla shares fly on ARK’s price target…probabilities and the fear of looking foolish…be selective when looking at tech stocks…and more…

BTFD stands for buy the um…dip.

And there’s been a heap of chatter about rising bond yields sounding the death knell for many people’s favourite tech stocks.

In the US this could be the FAANG or FAMGA stocks.

Or in a more extreme case, the ultra-popular Tesla Inc [NASDAQ:TSLA].

In Australia we have a similar bunch of stocks, called the WAAX stocks.

This includes, WiseTech Global Ltd [ASX:WTC], Afterpay Ltd [ASX:APT], Appen Ltd [ASX:APX], Altium Ltd [ASX:ALU], and Xero Ltd [ASX:XRO].

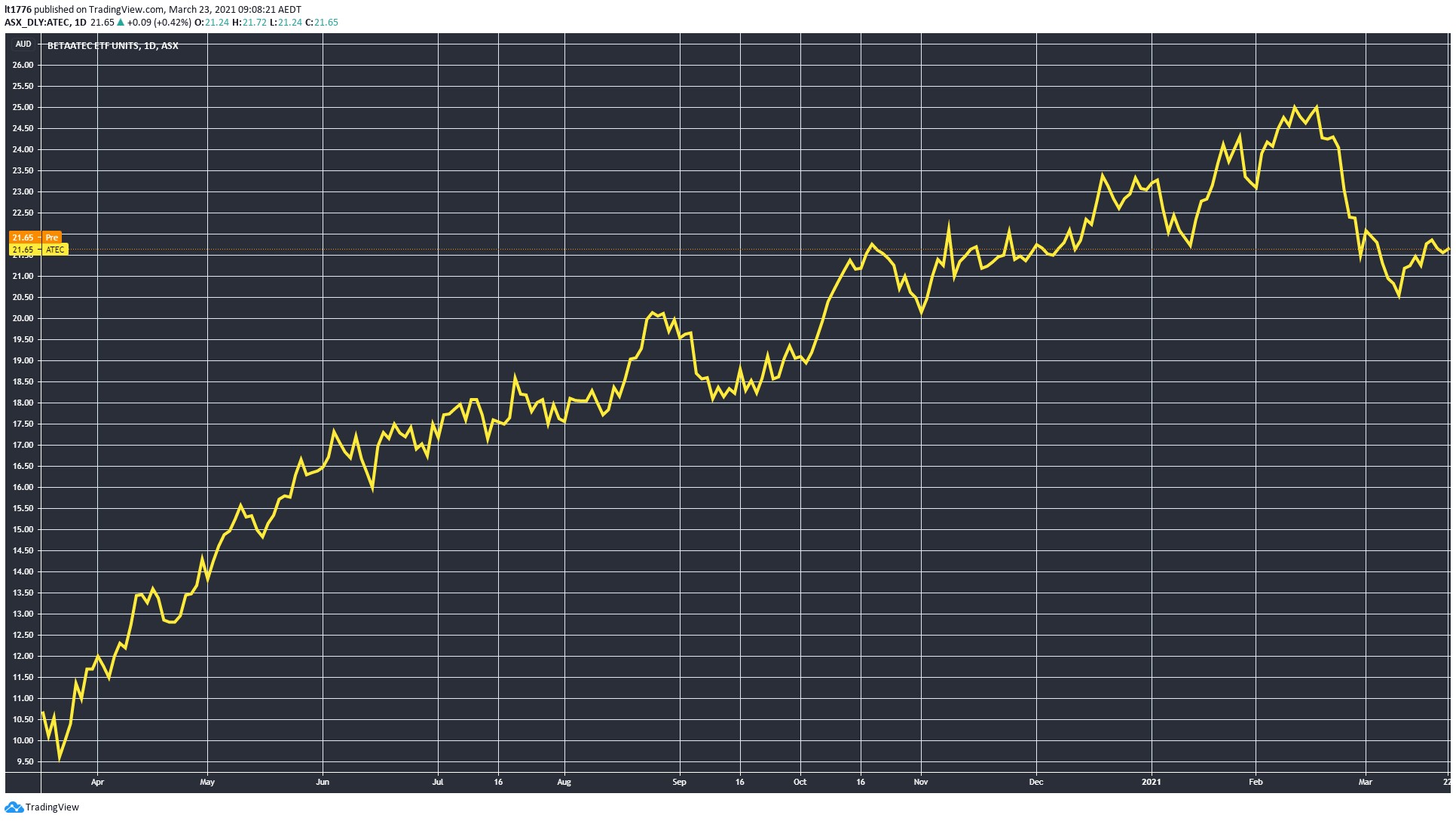

Many of these stocks are captured by the BetaShares S&P/ASX Australian Technology ETF [ASX:ATEC].

Which as you can see is down from a February high:

|

|

|

Source: Tradingview.com |

So, when I say BTFD on certain tech stocks, what do I mean?

Let’s take a quick look at what happened in the US overnight to understand what’s going on.

Tesla shares fly on ARK’s price target

Yesterday, Ryan wrote to you and talked a bit about what ARK Invest does.

ARK Invest represents the cutting edge of tech investing on Wall Street, and they cop a fair bit of flak for how they go about things.

Overnight in the US, they actually managed to move the TSLA share price with a simple prediction.

That is, they set a price target of US$3,000 on Tesla shares.

‘Tesla Inc’s 2.31% gain to $670 was the fourth-largest boost to the S&P 500 after Ark Invest, founded by star stockpicker Cathie Wood, raised the company’s price target on Friday using 34 inputs in a Monte Carlo model.’

A Monte Carlo model is:

‘Used to predict the probability of different outcomes when the intervention of random variables is present… and it can help to explain the impact of risk and uncertainty in prediction and forecasting models.’

US$3,000 TSLA shares sound nuts, I know.

But I’m generally onboard with what ARK Invest is saying here, and I’ll explain why.

Probabilities and the fear of looking foolish

If you want to think like ARK, be sure to listen to this podcast featuring their Director of Research, Brett Winton.

In it, he says the following:

‘A lot of finance is a reputation game, and people are worried about looking wrong and foolish.’

And because of this, he says, investors do not efficiently price assets.

This is where Monte Carlo models and variance come into play.

As I wrote in a brand-new recommendation coming out today after the market closes:

‘In many ways we are aiming for wild success via variance.

‘Not by controlling variance, but by giving it room to work in our favour.

‘This is how you can make outsized returns in a market that seeks to eliminate uncertainty.

‘To capitalise on this uncertainty and get variance working in our favour, we drill down on the companies that benefit from one or more megatrends.’

This is exponential investing in a nutshell.

Ryan and I aren’t afraid of looking foolish. We suggest investments based on sound reasoning on the probabilities as to what the future will look like.

Which is why I am saying tech isn’t dead.

There’s a very, very strong possibility that tech will dominate our future lives.

In that sense, the bond yield story may be a smokescreen for the short-sighted.

Be selective when looking at tech stocks

There’s a whole host of tech stocks ticking along with their projects that sit well outside most investors’ line of sight.

Specifically, ones that aren’t in ATEC or on the S&P/ASX All Technology Index [XTX].

And if you listen to one portfolio manager quoted in the Australian Financial Review:

‘That’s the game — to work out which ones have fallen too much, or which ones are vulnerable to sell-off, and you buy in the weakness…You need to [also] pick the ones where growth will beat consensus over time.

‘It’s not just the larger names; there are also mid-sized names that are out of favour and aren’t getting a lot of attention.’

Over recent weeks, I’ve seen a number of our tech stocks in Exponential Stock Investor sell off a fair bit.

These are even smaller than those ‘mid-sized names’.

But if you look at their projects, combined with the probabilities around what the future could look like, I’m not worried.

Many of these small tech stocks are very high risk, to be sure.

And we don’t always get it right.

That being said, if they dip below their buy-up-tos, you can also be sure that I’ll be reminding subscribers to BTFD.

The world is only going to get more techy, not less techy, if you take a long-term view.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.