The Afterpay Ltd [ASX:APT] will launch a new money and lifestyle app in October 2021 in collaboration with Westpac Banking Corp [ASX:WBC].

Money by Afterpay, which began its staff pilot today, will include a ‘competitive’ 1% per annum interest rate with no fees.

The app will focus on helping customers ‘trust themselves with money management.’

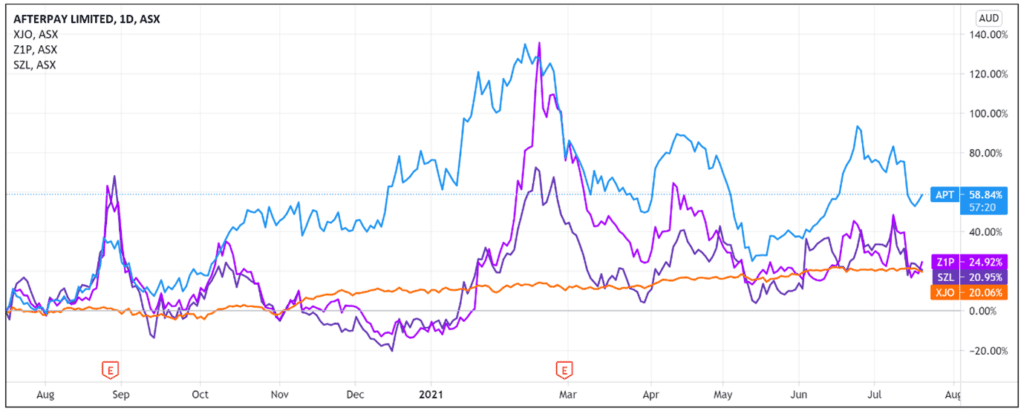

The market’s response was modestly positive, with Afterpay shares up 3.3% at noon.

After a steady rise that saw APT’s share price peak at $160 in February, the BNPL stock has pulled back in recent months, down 8% year to date.

Afterpay’s Money app

From October, Afterpay’s Money app will be available to more than million Australian Afterpay users as the BNPL leader seeks to leverage its younger customer base and enter the banking sector.

The app will only be available to those with existing APT accounts and will use their Afterpay email and password to log into the app.

Afterpay said users could make the Money app their ‘primary money management app’ within minutes of opening an account.

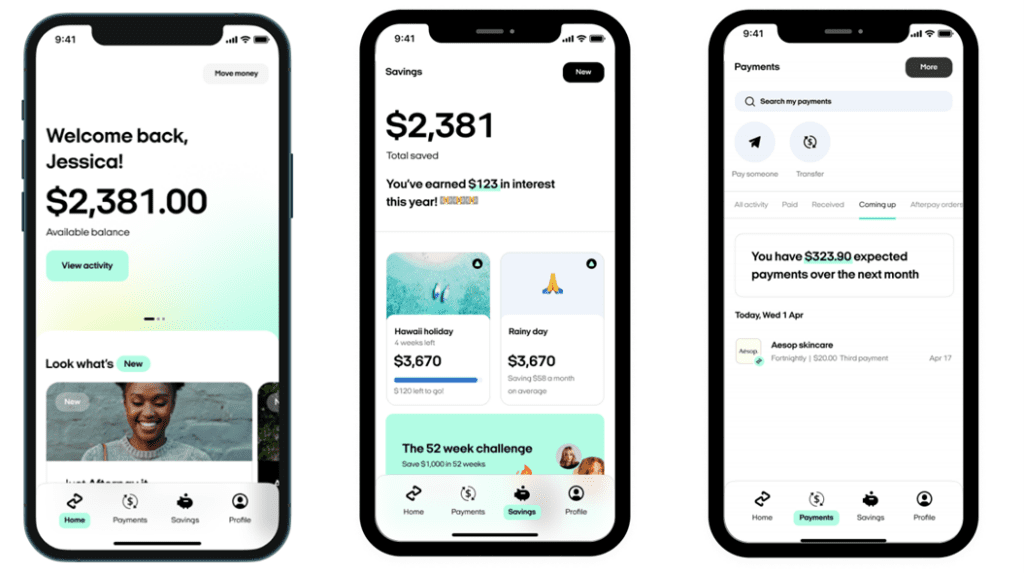

Once active, the Money app home page will display the user’s BNPL balance, upcoming orders and instalments, and daily spending and savings accounts.

Afterpay said the Money app would offer customers a ‘single, seamless view of their finances.’

Afterpay obtained an Australian Financial Services Licence (AFSL) from ASIC in anticipation of the October rollout.

The licence permits Afterpay to distribute deposit products, debit cards, and provide general financial product advice.

While the AFSL is an important licence to obtain, Westpac will act as the app’s regulated deposit account and card issuer.

Savings with 1% interest rate

A key feature of Afterpay’s Money app is the ‘simple, yet compelling,’ savings offer.

Afterpay said customers could earn a ‘competitive’ interest rate of 1% per annum on up to 15 different savings accounts.

Why so many accounts?

So customers can open separate accounts for different savings goals.

The simple interest rate coupled with 15 savings accounts stems from Afterpay’s wish to ‘help ease the mental load so often associated with navigating complex requirements and terms and conditions just to receive a decent interest rate.’

According to the federal government’s Money Smart site, a competitive savings account will offer an interest rate of ‘around 1.5%.’

For reference, Afterpay’s partner on this project — Westpac — offers a 0.40% per annum variable savings interest rate, which can grow to 3% per annum for users under 30 who make five eligible purchases a month.

The extra hoops required to eke out more interest from Westpac’s savings account could support Afterpay’s argument that the current landscape lacks a simpler offering.

The app will demand no special requirements like ensuring your account balance grows each month.

‘Money basics with no fees’

Afterpay also said the proposed app would not charge customer fees.

The company thinks this makes the app an ‘ideal primary account for customers to directly deposit their salaries and view their complete financial position in one place.’

Afterpay Money will offer users one daily account along with a physical debit card, digital wallet offerings, and the ability to make and receive real-time payments.

While the app won’t charge user fees, Afterpay noted fees may still be charged by other financial institutions a user transacts with, non-major domestic ATMs, and overseas ATM operators.

Incumbents enter the fray

Today’s announcement continues Afterpay’s inroads into the space dominated by traditional legacy players.

But that hasn’t stopped the big incumbents from going the other way and encroaching on Afterpay’s BNPL turf.

Last week we saw PayPal launch its BNPL option while Apple announced plans to let shoppers pay in instalments.

Is the growing competition from established players like PayPal and Apple a death knell for BNPL upstarts?

Not necessarily, according to Sezzle CEO Charlie Youakim.

He thinks the entry of established players underlines further the popularity of the BNPL payment option:

‘Their [Apple’s] entry does reinforce what we already know—that BNPL is here to stay, and increasingly relevant.

‘It is rapidly becoming a preferred payment option for next-gen consumers seeking a fresh approach to accessing and using credit, as well as, in the case of Sezzle users, building credit worthiness.’

Importantly, Youakim argues the increased relevance of BNPL mitigates competitor risk.

If the pie is fixed, more competition leads to a smaller share. But if the pie keeps growing, there’s more to go around.

‘There is lots of room in this space for new players to compete and even join forces to support BNPL’s evolution into a mainstream and dominant payment solution – and a gateway to extended or traditional credit.’

‘Is this the end?’

When Commonwealth Bank of Australia [ASX:CBA] announced it would launch its BNPL offering, I asked Ryan Dinse, whom I work with on the publications Exponential Stock Investor and Small-Cap Momentum Alert, what he thought CBA’s foray meant for BNPL players.

His thoughts remain applicable today:

‘Although some see this as a threat to BNPL pioneers like Afterpay, in my experience big institutions that try and copy innovation, usually fail to make too much of a dent.

‘There are a few reasons for this…

‘The main two are they don’t have the skillset or internal culture for the constant innovation needed to make new models succeed. As my old soccer coach would say, “they’re looking for where the ball is, not where it will be.”

‘And secondly, they’re making too much money in the short term from the status quo to really embrace disruptive models.’

Take Visa as a case study.

In July 2019, the financial services giant announced it was trialling its instalment payment capabilities where Visa cardholders can access BNPL without engaging third-party apps.

This prompted business outlet SmartCompany to run this headline:

‘Visa announces buy-now pay-later offering: Is this the end for Afterpay?’

While Afterpay shares plummeted on the day of Visa’s announcement, it is safe to say this was not to be the end.

Since the start of July 2019, APT has gained more than 300%.

APT Share Price ASX outlook: one ‘mega app’?

A lot seems to be happening in the financial sector.

Fintechs like Afterpay are beginning to take on legacy players at their own game with things like the Afterpay Money app.

And giants like CommBank, PayPal, and Apple are taking on the BNPL stocks by rolling out their instalment options.

What can we make of these developments? What will the landscape look like in five years?

In Afterpay’s case, if it is true that the BNPL market will only continue to grow, absorbing large and small entrants alike, then its foray into personal banking could be a smart diversification move.

It can retain its BNPL market leader status while its new Money app can mitigate risk if big players like PayPal and Apple eat away at its BNPL market share.

Indeed, Lee Hatton, Afterpay’s executive vice president leading the banking strategy, said the company plans is to create a ‘mega app’ for all financial needs.

As the fintech sector begins to see traditional and disruptor companies converge, it is important now more than ever to be aware of where the sector that’s set to inform our habits is heading.

So, if you’re interested in the changing payments landscape and wondering if there are other fintech investing opportunities apart from the saturated BNPL space, check out our free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: The Next Afterpay? Discover three promising Aussie fintechs that are currently trading below $1. Click here to learn more.