Three things I am pondering today…

1. It’s a very exciting time here at Fat Tail.

Yesterday our new point man for US tech, crypto, AI and all things innovative — former hedge fund manager James Altucher — went live with his way to play the upcoming Starlink IPO.

I was watching his presentation yesterday and was struck by what an extraordinary career he’s had. He brings thirty years in the markets, for starters.

It was around 2013 that I found myself reading his posts on life, markets, and creating wealth and personal fulfilment.

Little did I know I’d be working with him 5 years later. The most extraordinary changes can take place in a short place of time.

Case in point is James’ thinking on Starlink, Elon Musk’s communication network. It barely existed five years ago.

Now here is a clear way the entire deliverability of the internet could be upended for good…and worldwide.

It could conceivably also be part of how Elon Musk becomes the world’s first trillionaire…an unimaginable thought about anyone 20 years ago.

Even if you don’t care to invest in the idea, you need to be watching your back.

Communication companies here on the ASX could see their business model broken or diminished over time. This includes Telstra [ASX:TLS] and Aussie Broadband [ASX:ABB].

Don’t forget that as well as Elon Musk sending Tesla into the stratosphere, he diminished the traditional automakers by snatching their markets and growth outlook.

Starlink is both a threat and an opportunity. Give yourself the opportunity to be on the right side of the trade by going here.

2. Warren Buffett just released his latest annual letter…

I hate saying it, but we may not be reading his thoughts for much longer.

Buffett is 94, and even he is warning he’s unlikely to be writing Berkshire’s reports soon enough.

One point that Buffett makes in this year’s letter is that he never hires based on where a candidate went to school.

He writes…

‘Look at my friend, Bill Gates, who decided that it was far more important to get underway in an exploding industry that would change the world than it was to stick around for a parchment that he could hang on the wall. (Read his new book, Source Code.)’

As it happens, I just finished Source Code. It’s Bill Gates’s memoir of his early childhood into the early Microsoft years.

Bill had a wonderful family and a comfortable childhood. But he doesn’t spare himself.

He admits he was cocky, difficult, often rude and, for his parents, generally a pain in the arse.

There was no such thing as autism then, at least as far as Bill knew, but he’d be declared wide on the spectrum today.

What Bill loved was maths and computers.

Back in his day, a computer was rare, and Bill had to go to extraordinary lengths at times just to get access to one. Even then it was limited and expensive.

Bill latched on to one idea. Personal computers were coming, and software was the right market to go after.

He dropped out of Harvard — breaking his parents cherished dream — to make Microsoft happen.

Bill was then on the biggest trend of the next 25 years. You know the rest…

Who could have guessed that a scrawny kid with a squeaky voice would become the youngest billionaire in history?

That said, the explosive growth in the computing industry lifted many, many others too. Steve Jobs and Apple spring to mind instantly.

AI today is likely to do the same thing.

That’s another reason we’re thrilled to be bringing James Altucher to Fat Tail.

AI, at least for now, is mostly a US trend, and that needs a focus on the US market that James is best to provide.

3. Right now we have a bit of a market shakedown going on…

You can’t really see it going off the ASX/200 Index but a wave of selling is washing through the market currently.

It’s been a tough week for a lot of stocks.

Any misses or disappointments from the latest batch of earnings releases are getting hammered.

However, these periods, while not much fun, are always instructive. You can see which stocks get bought back up after a selloff or hold the line in the first place. That indicates they are in ‘strong hands’.

I’d suggest one of my small cap recommendations — Develop Global [ASX:DVP] — is one of these.

The share price is holding up under considerable pressure in the market. One likely reason is that it’s a prospective copper producer, and the copper price is going higher in 2025 so far.

You can see that here…

| |

| Source: Trading View |

Develop is right in the sweet spot to trend higher off this if it continues. It’s also run by Bill Beament, who has something of Bill Gates’ tenacity, except for mining and not computers.

Of course, there are no guarantees here, small caps are risky after all, but…

…like Buffett says, an explosive trend is the best bet over everything, and copper has every chance of being one of these over the next five years.

You can read more about Develop Global (and Bill Beament) here.

Best wishes,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

***

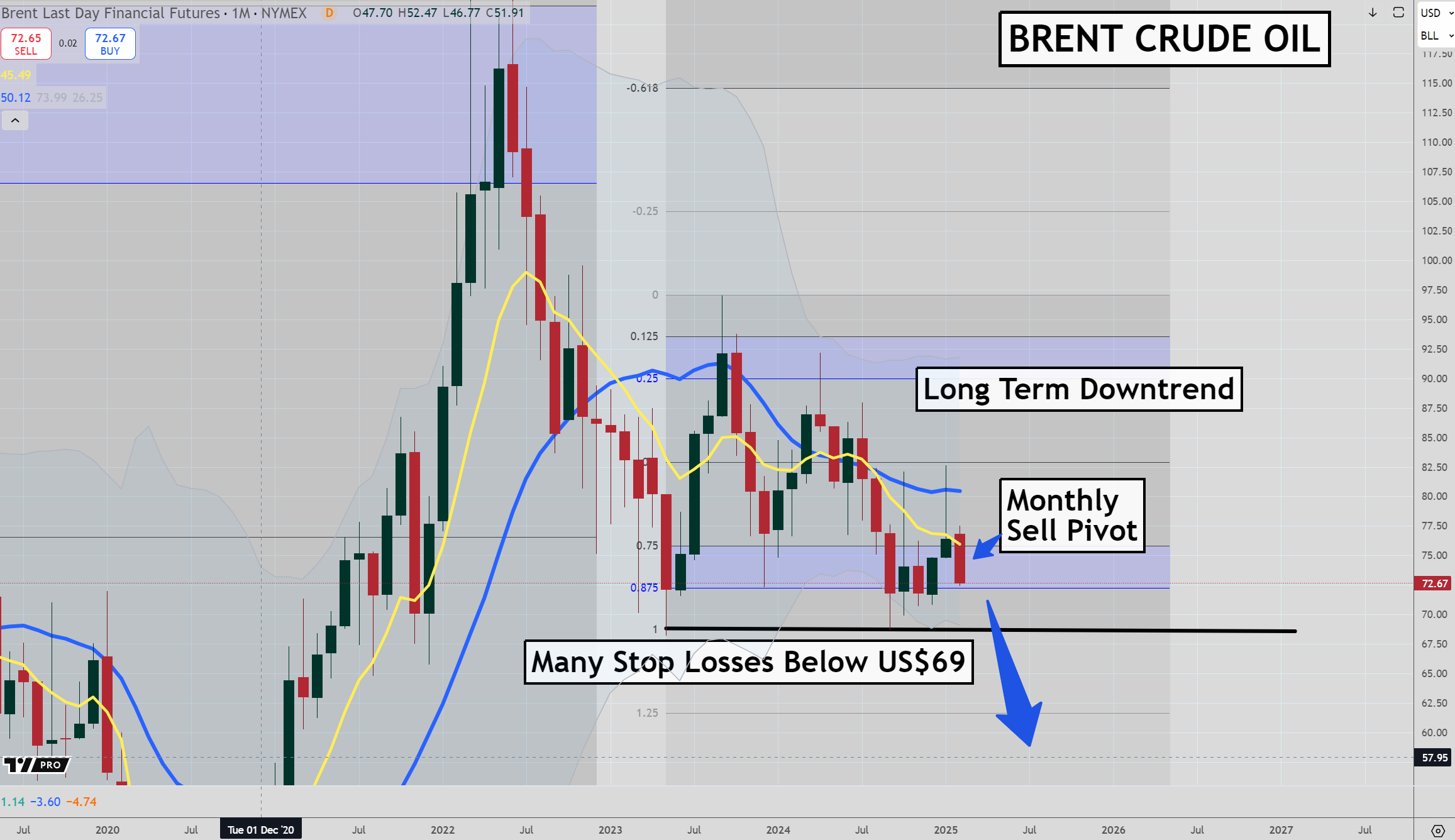

Murray’s Chart of the Day

| |

| Source: Tradingview.com |

Sharp sell-off in oil is on the cards

The oil price is under pressure and there is a set of dominoes lined up below current prices that could set off a chain reaction to the downside.

After treading water for two years above US$69, Brent crude is getting ready to test that level again for the third time.

The long-term downtrend in oil remains, and February will see confirmation of a monthly sell pivot and failure below the 10-month exponential moving average.

Unless support comes soon there is a chance we could see the price heading below US$69 where plenty of stop-losses should be lined up.

The very long-term outlook for oil demand remains robust, so a sharp sell-off below $69 could end up being a great buying opportunity into oil and gas stocks.

Regards,

|

Murray Dawes,

Editor, Retirement Trader and Fat Tail Microcaps

Comments