The online payment solutions company appears to be bucking the trend of the market. With a market cap of $870 million, the Zip Co Ltd [ASX:Z1P] share price last closed at $2.23.

Today we look at what the future might hold for the Zip share price.

Source: Optuma

2020 started with a bang for many businesses around the world until the onset of the COVID-19 virus. COVID-19’s spread outside of China resulted in upended profit forecasts, plummeting share prices, and generally caused pandemonium across the board.

With businesses having to react quickly to the changes, we are now starting to see the fruits of those reactions and what companies have done to protect themselves in the context of the pandemic.

Source: Optuma

Z1P share price smashed, but what are the latest results showing?

Zip Co suffered a huge drop in share price with the onset of COVID-19, falling 76.56%.

With their target demographic including millennials and casual workers, the future would appear to look bleak. Layoffs and cuts to working hours have eroded their purchasing power. And that problem is now one for Zip Co.

Despite the immediate gloom, a few big factors weigh in the favour of Zip Co. The first is their online presence, which becomes even more meaningful in a world where shops are closing and consumers are confined to their homes. Another is the strength of their balance sheet according to Morningstar analyst Mark Taylor.

With their quarterly results being released on 8 April, the company has shown growth across all significant metrics, with Managing Director Larry Diamond noting:

‘[Zip is] well funded and uniquely positioned to trade through the current environment, given our product differentiation, strong proprietary credit platform, healthy repayment profiles and penetration into defensive, everyday spend categories.’

Moving forward through COVID-19

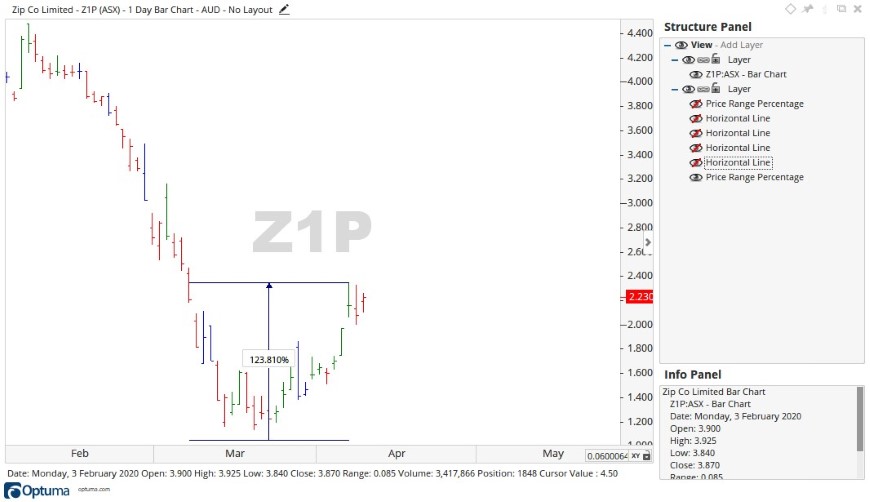

Today the Zip Co share price shot up another 6.4% to a price of $2.37, at the time of writing. Looking at the most recent low of $1.05, the Z1P share price has since exploded up 123.81%.

Source: Optuma

Given how they are repositioning their online presence around everyday spend, Zip Co could continue its rise moving up towards resistance levels of $2.79, $3.20, and $3.68.

Source: Optuma

Beyond technical aspects, a lot also depends on market sentiment in the wake of stimulus.

There is a lingering fear out there that this current relief rally is a smokescreen for what is to come.

Regards,

Carl Wittkopp,

For Money Morning

PS: Here’s a two-pronged strategy that could help you overcome the financial implications of the COVID-19 pandemic.

Comments