I hope you’re enjoying a pleasant Easter. I just took the kids to Sea Life on the Sunshine Coast. They wanted to see imitate the penguins. Before eating sushi down the road for lunch.

Seeing the penguins made me realise how much my life has changed. I used to spend my time playing bagpipes on St Kilda Pier, just outside the former Fat Tail Investment Research offices.

Back then, environmentalists would chase me away because I was ‘disturbing’ the penguins that live there. But where else in Melbourne can you practice the bagpipes? And I never heard any of them complain…

Little did any of us know back then what the future would hold. That I’d go on to have three children, despite playing the bagpipes.

And that the penguins from St Kilda Pier would go on to play a crucial role in the global tariff wars that sank the stock market last week.

What could be stranger?

You see, Trump didn’t just take on the might of the EU and China with his trade war. He also tariffed several tiny islands inhabited by nought but penguins…

The penguins’ fate in the trade wars promptly lit up the internet. Social media is now obsessed with the issue of penguin’s industrial might.

Penguin trading prowess is the fuel of global Trump derision in dozens of languages.

Jokes, videos and songs about Trump’s stupidity are being produced on an industrial scale daily. Sales of penguin trade war merchandise is through the roof.

If the AI videos are to be believed, the penguins have even sent trade delegations to Washington to negotiate terms.

The world is so busy mocking President Trump it almost forgot about the tariffs and stock market meltdown.

But it’s not yet clear who will have the last laugh. A bit like when Trump warned about Germany’s reliance on Russian gas in 2018, the entire UN laughed at him in utter disbelief…

But what on earth have penguins

got to do with a trade war?

Not much, because Trump tariffed them.

But if he hadn’t, the penguin colonies of the Antarctic would have become a major industrial power by now.

On a scale that’d make the imagination of the comedians on social media look boring. And at a pace that’d make the Industrial Revolution look slow.

How?

Well, the trouble with trade is that its classifications are incredibly arbitrary. And the trouble with tariffs and sanctions is that rely on those trade classifications.

This creates loopholes the size of an Antarctic island.

Some of these are familiar to you already…

Russian oil can suddenly become Turkish to get around sanctions on Russian oil.

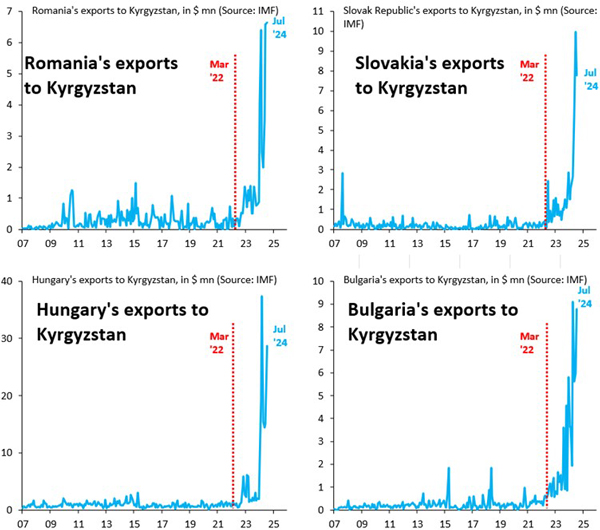

The EU bound exports of every central Asian country have gone absolutely bananas ever since the Europeans sanctioned Russian goods.

What I didn’t know until this week is that those sanctions evading trade flows go both ways. European countries’ exports to central Asian countries are soaring too:

|

|

| Source: Market Watch |

You’ll find the boom matches a corresponding decline in exports to Russia very nicely…

This means the European economy is evading its own sanctions by both buying and selling goods via Russian satellite states.

But back to our point about penguins.

Under rather flexible trade classifications, European cars can suddenly come from Mexico, where free trade deals with the US apply.

Australian LNG can suddenly be Japanese, because the Japanese bought too much and decided to export it again. And American gain-of-function research can be branded “Chainese”.

You get the idea. It’s a game of rerouting trade through friendly jurisdictions for tariff, sanction and rules evasion. And what jurisdiction could be friendlier than a penguin colony?

And so we get to the penguins at last

Nobody will laugh if you ask how much of Mexico’s trade surplus with the US is really just EU goods passing through to evade trade barriers.

But ask whether penguins might pass off Chinese goods as their own and nobody will take you seriously.

The question is why.

While the world mocks President Trump for placing tariffs on uninhabited Antarctic islands, a few enlightened researchers have actually taken a look at the figures. And you wouldn’t believe what those penguins have been up to!

In 2023, the French Southern and Antarctic Territories suddenly exported $4.55 million worth of goods to the United States! These exports included paintings, non-fillet frozen fish, crustaceans, fish fillets, and nitrogen heterocyclic compounds.

Who knew the feathered locals were so gifted? So industrialised? So skilled with at filleting fish and producing industrial chemical compounds?

And it’s not just the penguins of the French Southern and Antarctic Territories that are major players in world trade.

Here’s the leftwing paper The Guardian begrudgingly admitting that their brethren of Heard Island and McDonald Islandsare an industrial power too:

The export figures from Heard Island and McDonald Islands are even more perplexing. The territory does have a fishery but no buildings or human habitation whatsoever.

Despite this, according to export data from the World Bank, the US imported US$1.4m (A$2.23m) of products from Heard Island and McDonald Islands in 2022, nearly all of which was “machinery and electrical” imports. It was not immediately clear what those goods were.

In the five years prior, imports from Heard Island and McDonald Islands ranged from US$15,000 (A$24,000) to US$325,000 (A$518,000) per year.

Now, all this was before the latest tariffs apply. But the point is that trade can quite easily be rerouted via locations that are nominally absurd in order to evade trade barriers. The practice accounts for a good chunk of central Asia and Mexico’s economy these days…

And everybody knows it. It’s not like the Europeans don’t know their Russian trade is merely making a stopover in Kyrgyzstan.

So, when our prime minister says this, you know he’s being disingenuous:

‘Norfolk Island has got a 29% tariff. I’m not quite sure that Norfolk Island, with respect to it, is a trade competitor with the giant economy of the United States, but that just shows and exemplifies the fact that nowhere on Earth is safe from this.’

For tariffs to work, nowhere can be safe. That’s the whole point.

Wherever is safe would soon become the world’s number one smuggling port for US bound goods. Even if it’s a penguin colony.

Of course, politicians are used to politicians that provide loopholes for each other. And banks presume there will be hidden ways for trade to flow. But in this case, Trump seems to have annoyed them all. Their cheap shots are a sign he’s getting somewhere.

None of this is to say that tariffs are good. Only that the penguin-themed criticism of President Trump is as deranged as ever. In ways that are blindingly obvious to anyone who bothers to take a closer look.

Our political leaders presume you won’t.

So, perhaps Trump’s trade teams know what they’re doing. And not just about tariffing penguins either…

By the way, the trade war isn’t just destroying wealth. It’s also creating interesting opportunities.

Can you imagine how much real estate on Heard Island would’ve been worth if Trump had missed tariffing it? A warehouse there that employed penguins to assemble Volkswagen would’ve been worth billions.

Well, the same effect is taking place inside the world of finance. Trade financing flows that are not subject to government control are becoming rapidly more valuable.

Trump’s tariff crackdown is creating the use-case-scenario for an investable asset nobody saw coming. I suspect it’ll be on par with the recent explosion in gold.

Until next time,

|

Nick Hubble,

Editor, Strategic Intelligence Australia

Comments