The Zip Co Ltd [ASX:Z1P] share price rise after acquiring European BNPL provider Twisto and UAE-based Spotii, expanding its market reach.

The acquisitions will have a combined enterprise value of about $180 million with transaction consideration of approximately $160 million.

The Z1P share price was up 2% at the time of writing.

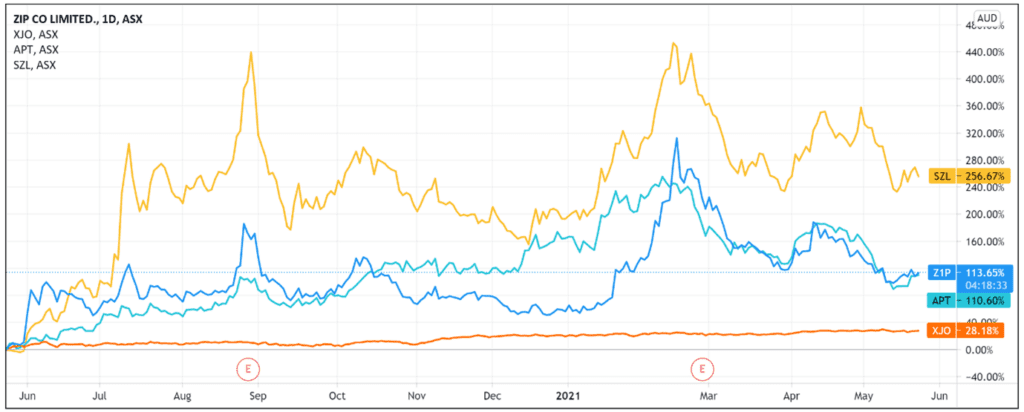

While down 19% in the last month, Zip shares are still up 35% year-to-date and up 110% over the last 12 months.

Z1P expands into Europe and the Middle East

Zip’s ASX announcement today revealed the buy now, pay later (BNPL) provider agreed to acquire the remaining shares of European BNLP player Twisto Payments and UAE-based Spotii Holdings.

Z1P referenced the success of its QuadPay acquisition, noting that today’s additions build on its ‘playbook of successfully identifying, completing, and integrating strategic acquisitions’.

Twisto and Spotii are now integrated into Zip’s Single Merchant Interface (SMI).

Zip expects to complete the Spotii purchase in Q3 CY21 and the Twisto purchase in Q4 CY21.

Zip acquires Twisto

Acquiring Twisto complements Zip’s entry into the UK market and gains the BNPL player a foothold in ‘one of the largest eCommerce markets globally’.

Z1P estimates that the EU is the second-largest e-commerce market with $1.1 trillion in annual volume.

A big reason for the Twisto purchase lies with Twisto holding a European Payment Institution licence.

This licence grants it the right to provide payment services across all EU member states.

Twisto boasted over one million customers and 14,000 merchants with an annual run rate of $12 million in revenue and $230 million in total transaction volume.

Zip will purchase the remaining shares in Twisto for approximately $140 million.

Zip acquires Spotii

According to Z1P, the Spotii purchase establishes it as a leading player in the Middle East, a region that is increasing its online spending by 25% annually.

Founded in 2020, Spotii currently has 650 merchants with total transaction volume growing at an average of 90% month-on-month, according to Zip.

Zip will pay US$16 million for Spotii shares it does not already own, implying an enterprise value of US$20 million.

Interestingly, Spotii was co-founded by Ziyaad Ahmed who was previously a senior analyst at Afterpay in the US.

Zip could look to leverage Mr Ahmed’s insider knowledge of its biggest rival’s operations in the US now that Spotii is part of the Zip family.

It also raises questions whether Afterpay considered acquiring its former analyst’s start-up but lost out to Z1P.

Zip share price: what’s the outlook?

The gains of BNPL stocks rest upon strong customer and merchant metrics.

The more customers joined and the more merchants signed on, the more investors were excited about a BNPL provider’s prospects.

Immediate profitability did not matter nearly as much as rapid growth in these metrics.

For instance, Afterpay Ltd’s [ASX:APT] FY20 statutory loss after tax was $22.9 million.

Zip’s FY20 loss after income tax was $19.9 million.

But while both BNPL giants posted net profit losses, Afterpay and Zip did record strong growth in transaction volumes.

Afterpay’s total transaction volume grew 112% and Z1P’s grew 91% in FY20.

So with Zip acquiring two BNPL providers, it also acquires the chance to continue growing its customer and merchant numbers.

But having made the strategic acquisitions that could boost metrics crucial to Zip stock’s past gains, the market’s response was relatively muted.

How come?

For one, the acquisitions were flagged last year.

Following a $120 million institutional placement, Z1P invested in minority stakes in Spotii and Twisto last December.

Back then, Zip Chief Executive Larry Diamond described the investments as ‘small equity bets’.

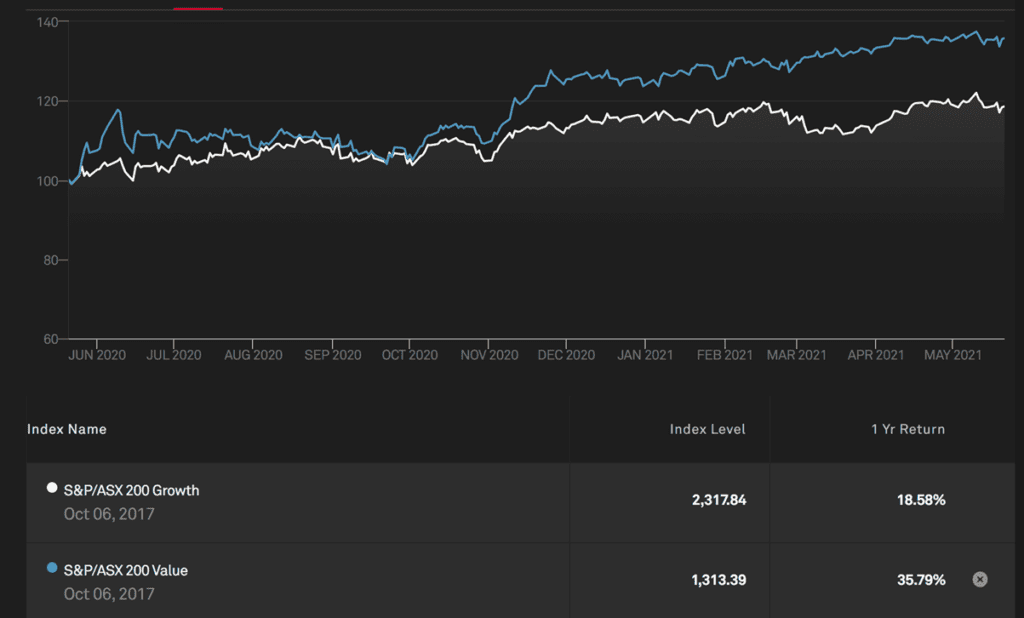

Secondly, another explanation could lie with the recent rotation to value stocks as general discomfort around inflation sees growth stocks cede ground.

Source: S&P Global

Source: S&P Global

As the above chart illustrates, the S&P ASX 200 Value Index has outperformed the S&P ASX 200 Growth index over the last 12 months.

Zip’s new acquisitions could bring further customer and merchant growth, but in the current climate investors may be wondering how these acquisitions will impact Zip’s profitability.

It could be the case that the market recognises Zip and Afterpay’s track record of improving transaction volumes, customer numbers, and merchant numbers.

In which case these acquisitions don’t reflect any new information regarding Zip’s top-line growth prospects that hasn’t already been baked into Zip’s share price.

Z1P shares are likely to be more sensitive to how — and how soon — the company’s business model can turn its strong customer and merchant numbers into healthy profits.

Whether you’re a big fan of BNPL providers or not, it’s clear that fintechs will play a significant role in society.

As technologies advance, so too will our approaches to personal finance, banking and payments.

As investors, it’s important to keep abreast of trends that will shape and reconfigure our society for years to come.

That’s why I recommend reading Money Morning’s free report on three innovative Aussie fintech stocks with exciting growth potential.

Download the free report here.

Regards,

Lachlann Tierney,

For Money Morning

PS: Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.