Did you hear Bitcoin is edging nearer to all-time highs?! It’s ‘only’ 30% off November 2021’s record!

Did you hear this chipmaker called Nvidia is worth more than Amazon and Google?!

Did you hear artificial intelligence is going to be huge?!

Yeah. Duh.

But did you hear gold explorers might be in deep value territory?

Uh…

Who the hell is talking about gold stocks now?

Brian Mr Gold Chu.

I’m convinced Brian is the guy in the Aussie gold space. He knows all the deposits. All the grades. All the companies. All the economics.

(In this week’s What’s Not Priced In, for example, he reeled off all the recent mergers off the dome for three minutes straight. He’s on top of it all).

And what’s Brian up to?

Hunting value among the gold explorers. That’s where he’s seeing the bargains. Brian is more bullish on the juniors than the producers.

This week on What’s Not Priced In, he explains why. Other topics discussed:

- Resilience of AUD gold price

- Divergence between Aussie gold price and ASX gold stocks

- Brian’s proprietary Speculative Gold Stocks Index shows explorers in the dumps

- Thoughts on Silver Lake Resources and Red 5 merger

- Will we see more mergers and acquisitions in the gold sector?

- ‘Disappointing’ December quarter results for producers like Evolution Mining

- Outlook for ASX gold stocks and why Brian is liking the explorers

- Deep value ‘net-net’ stocks among the juniors

Proprietary methods

What do good investors have in common?

Sound systems.

Sound logic.

Unique insights.

An edge.

I’ve written about this before. Outsize returns jump from out-of-the-box thinking.

You can’t expect better returns than the market by thinking like everyone else.

So where are edges found?

An investor can interpret readily accessible data differently to the herd.

Or find data few are privy to.

Or construct metrics that do a better job of forecasting than established ones.

Or piece together disparate data points into a coherent argument few appreciate.

In Brian’s case, he loves generating proprietary data. That gives him something the market doesn’t have.

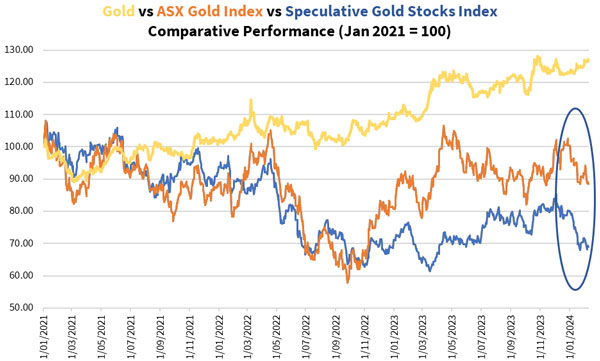

For instance, Brian, along with his analyst, constructed his Speculative Gold Stocks Index. It tracks the performance of Aussie juniors.

What it shows is bleak.

| |

| Source: Brian Chu |

Despite the steady rise of the Aussie gold price, Aussie gold stocks have floundered in recent years.

Especially the juniors.

Why have gold stocks underperformed?

Why the divergence?

I posed that question to Brian. We spent a good chunk of the episode pondering reasons.

Macro popped up.

If you’re listened to any episodes this year, you’d know what Greg Canavan thinks of macro now.

Brian heard our misgivings about the utility of macroeconomic pottering. But he pushed back.

Gold, he said, is all about macro. But it doesn’t mean you forget the fundamentals. If you’re buying gold stocks, their business is your business.

As Brian said to me:

‘The mainstream narrative drives sentiment in gold stocks, more so than gold as we’ve seen the last three years. Meanwhile, the most astute gold stock investors will focus on the micro by building up a portfolio for the right time when the macro aligns and gold stocks explode, especially the explorers.’

The business side of gold mining is another reason for the divergence.

Gold miners ride the volatility of their underlying commodity. But they also ride the volatility of their operations.

Gold stocks have staff.

Gold stocks have expensive equipment.

Gold stocks have ore bodies that can be recalcitrant.

Gold stocks also have market expectations to handle. And with a high Aussie gold price, expectations were high.

High expectations can be an albatross. Wherever there are expectations, disappoint is not far behind.

Even Brian was disappointed by the December quarter results posted by the producers.

Unwarranted pessimism leads to deep value

But he thinks the market has slid into pessimism now. Unwarranted pessimism.

And this souring sentiment is creating deep value, especially in the explorers.

Brian is even finding some ‘net-net’ stocks in the junior space.

He noticed some explorers trading at negative enterprise value. Meaning you can buy these companies for less than the cash they have on the balance sheet, net of debt.

This is rare.

And Brian wants to capitalise.

So I’ll leave the final word to him:

‘I can’t quite think of anything the market finds beneath contempt right now than gold stocks.

‘More specifically, gold explorers and early-stage developers.

‘The market doesn’t hate it. It’s beyond that. You only hate something you care about, right?

‘The market treats them as if they don’t exist.

‘Well, they’re all good reasons for people to ignore them.

‘And THAT is why I’ve been buying.’

Brian is holding an event next week where he’ll make the case for gold explorers.

If you want to attend, and ask questions (there will be a Q&A), you can register here.

Enjoy the episode!

Regards,

|

Kiryll Prakapenka,

Editor, Fat Tail Daily

Kiryll Prakapenka is a research analyst with a passion and focus on investigating the big trends in the investment market. Kiryll brings sound analytical skills to his work, courtesy of his Philosophy degree from the University of Melbourne. A student of legendary investors and their strategies, Kiryll likes to synthesise macroeconomic narratives with a keen understanding of the fundamentals behind companies. He’s the host of our weekly podcast What’s Not Priced In, where he and a new guest figure out the story (and risks and opportunities) the market is missing to give you an advantage. Follow via your preferred channel and check it out!

Comments