Xero [ASX:XRO] shares plummeted on Thursday after they released their FY22 results.

Xero, the online business platform for SMEs, saw its FY21 net profit turn into a FY22 net loss, despite a 29% increase in operating revenue.

XRO’s fall was likely exacerbated by another red day for the ASX, with the Aussie benchmark index tracking Wall Street lower on Thursday, as US inflation declined slower than expected.

The tech-heavy Nasdaq — often a bellwether for investor sentiment about risk-on stocks — closed 3.18% lower overnight.

America’s CPI print is worrying investors that high inflation is going to be more persistent than central bankers hope, leading to more aggressive monetary policy:

Source: Tradingview.com

XRO’s FY22 Results

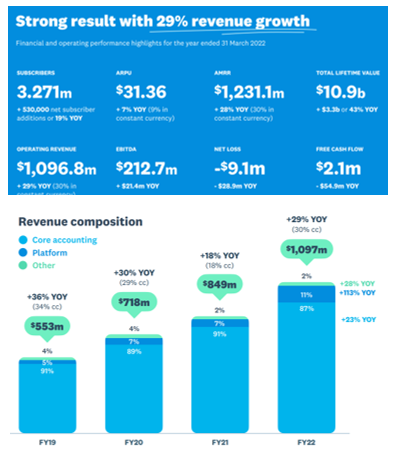

Here is a quick snapshot of Xero’s FY22 results.

- Operating revenue rose 29% to $1.1 billion

- Subscribers greet 19% to 3.27 million

- Average revenue per suer rose 7% to $31.36

- EBITDA rose 11% to $212.7 million

- Free cash flow tanked 96% to $2.1 million

- Net profit of $56.9 million in FY21 turned into a net loss of $9.1 million in FY22

Digging deeper, Xero said core accounting revenue was up 23% due to subscriber and ARPU growth, with platform revenue increasing 113%.

Xero said this was ‘driven by growth in payments, payroll and revenues from recently acquired businesses including Planday’.

Source: Xero

Regarding the net loss and dwindling cash flow, Xero argued that it was consistent with its ‘preference to reinvest capital generated back into the business’.

Of course, investors would likely want to see this capital reinvestment yield healthy returns down the track.

Source: Xero

Xero share price outlook

Xero offered the following thoughts on its long-term outlook:

‘Total operating expenses (including acquisition integration costs) as a percentage of operating revenue for FY23 are expected to be towards the lower end of a range of 80–85%.

‘Long-term aspiration Xero’s FY23 outlook, outlined above, includes an anticipated operating expense ratio for FY23. While there isn’t a specific timeline, Xero’s long-term aspiration is to see significant improvement in its operating expense ratio as Xero and the global cloud accounting industry continues to develop.

‘Having said this, Xero’s operating expense ratio, and its component parts, could vary from period to period as we identify growth opportunities that are consistent with our long-term objectives and adapt to market conditions.’

While the tech sector has suffered in this down market, another sector is holding firm as snarled supply chains and demand push energy prices higher — energy.

But there is an unheralded opportunity within the energy sector that doesn’t involve fossil fuel stocks.

To find out more about an Aussie small-cap that is angling to assist Europe in resolving its energy crisis, click here.

Regards,

Kiryll Prakapenka,

For Money Morning