The Worley Ltd [ASX:WOR] share price is up 4.2% today after releasing an investor day presentation.

Worley Ltd’s [ASX:WOR] share price were up as much as 6.2% in early trade before retracing somewhat to exchange hands for $10.92 per share at the time of writing.

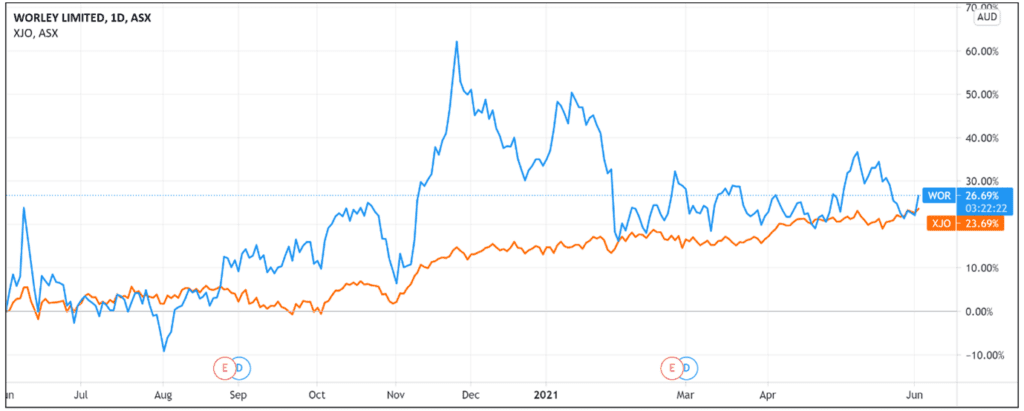

Despite today’s rise, the industrial engineering firm has underperformed the ASX 200 benchmark, with Worley’s share price down 5% year-to-date.

WOR on track for improved H2 FY21

Worley, who provides engineering design and project delivery services to energy, chemicals, and resources sectors, announced today it remains on track to deliver an improved H2 FY21 performance.

The investor presentation highlighted the company’s sustainability focus.

One of Worley’s key messages today was that sustainability is ‘already a growing part of our business with more favourable gross margins’.

This is corroborated by yesterday’s announcement that Shell awarded Worley a services contract to assist in developing a 200-megawatt electrolysis-based hydrogen plant in Rotterdam.

Worley is contracted to provide early engineering services for the plant, which will be powered by renewable energy.

Once complete, the plant is set to become one of the largest commercial green hydrogen production facilities in the world.

In Worley’s view, these contracts provide a ‘higher rate of future growth’, with WOR’s traditional business still expected to form an ‘important’ part of its future.

Worley’s sustainability push

The company’s investor presentation reported that sustainability opportunities have a ‘more favourable gross margin’ compared to Worley’s other services.

Elaborating, WOR highlighted that in H1 FY21 it delivered $1.2 billion in sustainability revenue at better margins.

The company said the better margin is ‘mostly due to the type of work performed’.

For reference, Worley reported a total underlying EBITDA margin on aggregated revenue of 4.6% in H1 FY21, down from 6.1% in H1 FY20.

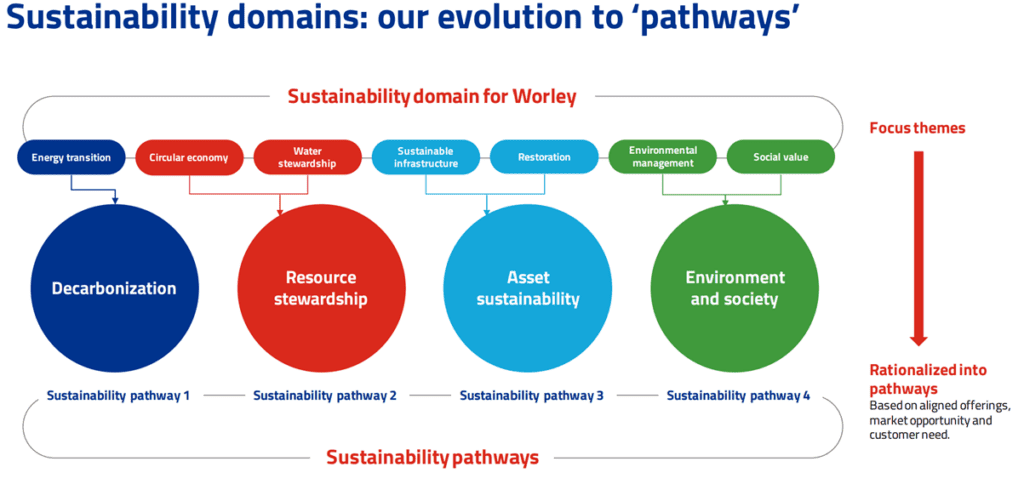

Worley outlined four sustainability ‘pathways’ it will target to boost revenues and gross margins: decarbonisation, resource stewardship, asset sustainability, and environment and society.

In terms of its decarbonisation pathway, WOR stressed that it has already worked on over 700 wind power projects, 350 solar power projects, 70 hydrogen projects, 220 nuclear projects and 220 distributed energy, EV and storage projects.

WOR’s decarbonisation segment stands to benefit from large expected investment inflows.

Citing IEA’s statistics, Worley suggested that decarbonisation investment needed to reach net-zero by 2050 would be more than US$1 trillion per year. Source: company presentation

Source: company presentation

Worley aims for its sustainability pathways to be the ‘most significant part of our business’.

WOR Share Price ASX outlook

Worley said it’s on track for an improved second-half performance in FY21.

The company also reported its operational savings program is on track for a $350 million run rate by June 2022.

WOR’s order backlog stands at $14.1 billion, which is up from $13.5 billion in 1H FY21.

Worley also said its global sales pipeline is increasing and that the company is ‘pleased with the level of work we are winning.’

Worley isn’t the only company pivoting to sustainability.

Governments and private interests the world over are converging on sustainable practices and renewable energy.

So if you’re wondering exactly what this trend means for savvy private investors, I recommend reading our free report on the renewables revolution.

There, our energy expert Selva Freigedo reveals three ways you can capitalise on the $95 trillion renewable energy boom.

Regards,

Lachlann Tierney,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here