‘[China’s] days as the world’s factory are done.’

That is the conclusion that the world’s largest electronics manufacturer has come to.

Foxconn — which is famous for assembling iPhones (among other devices) — has conceded that Trump has won his trade war.

Going on to state that:

‘No matter if it’s India, Southeast Asia or the Americas, there will be a manufacturing ecosystem in each.’

In other words, manufacturing as we know it is about to change drastically. With the likelihood that you’re going to see the words ‘made in China’ on fewer goods in the coming years.

That’s not to say, Chinese manufacturing will disappear overnight.

Far from it — they will still be a powerhouse producer.

But, they will have far more competition to deal with now. With plenty of other emerging economies beginning to flex their manufacturing muscle. As well as a pandemic-induced resurgence of self-sufficient strategies.

And for Australia, this will likely be one of the biggest challenges facing our future. A wake-up call that will force industry and policy alike to adapt to a new reality. One that won’t be able to rely as heavily on China as we have up ‘til now…

[conversion type=”in_post”]

Dead last

See, when it comes to manufacturing, Australia is downright terrible.

I wish that weren’t true, but the figures don’t lie.

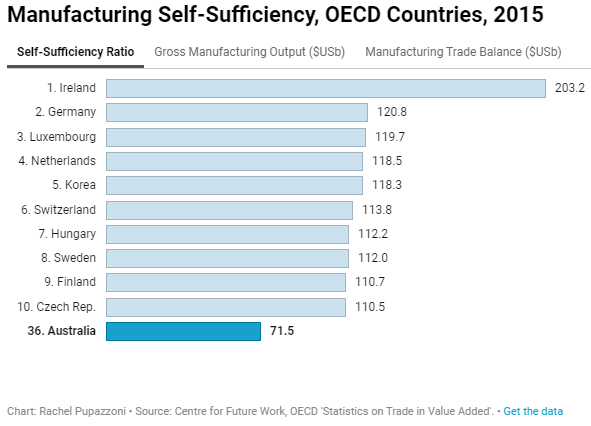

Of the 36 OECD member nations (as of 2015), Australia ranked dead last for manufacturing self-sufficiency. Outing us as a nation that relies on others to make the goods that we want and need.

|

|

|

Source: ABC / OECD |

We use roughly $565 billion worth of manufactured goods every year. But, only produce $380 billion worth.

A gap that has left us in a predicament. Because as the world moves away from China, we need to find a workable solution.

Indeed, it is a topic that my colleague Greg Canavan has been following very closely. Deciphering how and where this Sino-Australian split will hit our economy the hardest. If you have the time, I highly recommend you read his full report on the matter, here.

However, while our manufacturing dearth is certainly a concern, it is also an opportunity.

Just because we’re last right now, doesn’t mean it has to stay that way. With a little support and the right direction, Australian manufacturing could flourish again.

And I’m not the only one who believes in this idea.

Andrew Liveris — the ex-CEO of the Dow Chemical company — has been onboard with a local manufacturing renaissance for some time now. Looking to work with local politicians on effective policy, just like he has done for US leaders.

Which is why he believes ‘new-collar work’ could be the answer to our prayers.

Assembly lines meet tech

The key point to reviving local manufacturing will (and must be) innovation.

You shouldn’t expect Australia to start making Holden Commodores again, for instance.

Instead, we need to explore new areas of expertise. Addressing industries or sectors that we can excel in. All while recognising and incorporating the growing inclusion of tech solutions.

As Liveris puts it:

‘We should have a policy that works with the private sector to help focus in on the sectors we can be good at … that we can actually scale and create those jobs for the next generation.

‘It’s a “new-collar worker”. We can create half a million new-collar jobs with very high salaries in the digital-meets-manufacturing world.’

This is the key distinction. Because we’re simply not going to be able to compete with the kind of cheap labour that others can provide.

Instead, we need forward-thinking and high-skilled manufacturing. The kind of work that relies and is fuelled by innovation.

What exactly that will look like, well no one knows.

That is the challenge. We must work together to find the right solution.

For investors though, it is a challenge that I would keep a close eye on. Because one way or another, Australian manufacturing is going to change. Likely to become a far more technical sector.

Because of this, I’d be looking to forward-thinking companies like Altium Ltd [ASX:ALU]. A stock that has made a name for itself producing printed circuit boards and other electronic design solutions.

Or even more ambitious ventures such as Titomic Ltd [ASX:TTT]. A much smaller company that is pioneering large-scale 3D-printing solutions. One of our leading competitors in the burgeoning additive manufacturing sector.

And this is just the tip of the iceberg.

As the full effect of shifting global supply chains is felt, others will join in. Looking to stamp their authority on this much needed manufacturing boom.

That is something you cannot afford to ignore.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.