At time of writing, the share price of Wisr Ltd [ASX:WZR] share price is up more than 1% after a strong run, trading at 27.5 cents.

As you can see below, over the last 12 months, WZR shares are in an upward trend even after a sell-off at the tail end of August:

We take a look at the latest announcement out of WZR with regards to a launch of something called asset backed securities (ABS), which WZR pursued to fund their growth. We then turn to the outlook for the WZR share price, and fintechs more generally.

Key points from today’s WZR announcement

Here they are:

‘- $225M of asset-backed securities (“ABS”), supported by a pool of fully amortising unsecured consumer personal loans…

‘- Top tranche AAA rating (Moody’s), which is exceptional for an inaugural issuer, providing strong external validation of the quality of the Wisr business operations and the underwriting platform

‘– The introduction of new high-quality investors, both domestic and international, to the Wisr funding platform

‘ – A day one weighted average margin of 1.5% + 1m BBSW which is a material reduction in current cost of funds (reduced by circa 1.5% or 50%)

‘– Release of capital for Wisr given the size of the equity contribution relative to the Wisr Warehouse’

And here it is in layman’s terms.

Investopedia is useful here:

‘An asset-backed security (ABS) is a type of financial investment that is collateralized by an underlying pool of assets—usually ones that generate a cash flow from debt, such as loans, leases, credit card balances, or receivables. It takes the form of a bond or note, paying income at a fixed rate for a set amount of time, until maturity. For income-oriented investors, asset-backed securities can be an alternative to other debt instruments, like corporate bonds or bond funds.’

Making it even simpler, WZR is packaging up its loans and selling the income stream from its loans with the safest loans making up (the top tranche) the biggest chunk of the total issuance of the ABS, as per Moody’s ratings scale.

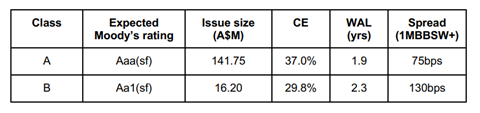

You can see a breakdown of what WZR calls ‘The Wisr Freedom Trust 2021-1’ below Tranches A and B:

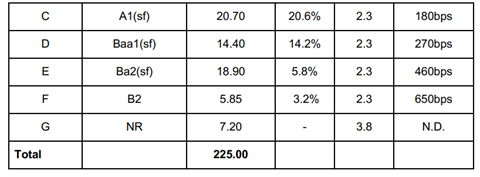

And the rest of the Tranches below:

Another key takeaway — this decreases the cost of funds.

The BBSW meaning ‘the Bank Bill Swap Rate (BBSW), or Bank Bill Swap Reference Rate, is a short-term interest rate used as a benchmark for the pricing of Australian dollar derivatives and securities—most notably, floating rate bonds.’

Bottom line, this move allows Wisr to grow and increase margin on their loans.

Outlook for the WZR share price and fintechs

Looking at the chart at the start, WZR looks to have punched through the first line of resistance and is could punch higher to say 32.5 cent mark.

This was certainly a positive announcement for the company, but risks are always out there.

It’s worth remembering that these loans are unsecured.

The macro picture is clouded by the potential for a bond yield rise pivot to companies with existing profits (value stocks), as well as inflation concerns and an accompanying Fed rate hike.

Inflation remains low in Australia for now compared to the US, but it’s something to keep in mind.

Fintechs as a whole, particularly the small-cap ones, are treading water based on what I’m seeing around the market.

That being said, there’s plenty to like about the technological evolution of money, and the stocks that work on this theme.

The Big Four banks are definitely soaking up the capital on some better-than-expected earnings, but will it hold?

My answer is no. Competition from companies like Wisr could eventually eat into their bottom line and market share over the next two years as margins get squeezed by what is essentially a zero cash rate coming from the RBA.

If small-cap fintechs are on your radar, be sure to check out this particular report, which profiles three of them.

It’s an intriguing read, and features a couple stocks you may not have heard of before.

You can download that right here.

Regards,

Lachlann Tierney

For Money Morning

PS: Discover three innovative Aussie fintech stocks with exciting growth potential. Download your free report now.