The WiseTech Global Ltd [ASX:WTC] is surging after FY21 results show EBITDA growth of 63% on positive FY22 outlook.

WTC’s full-year EBITDA exceeded its prior guidance, the WTC share price is rising 63% to $206.7 million.

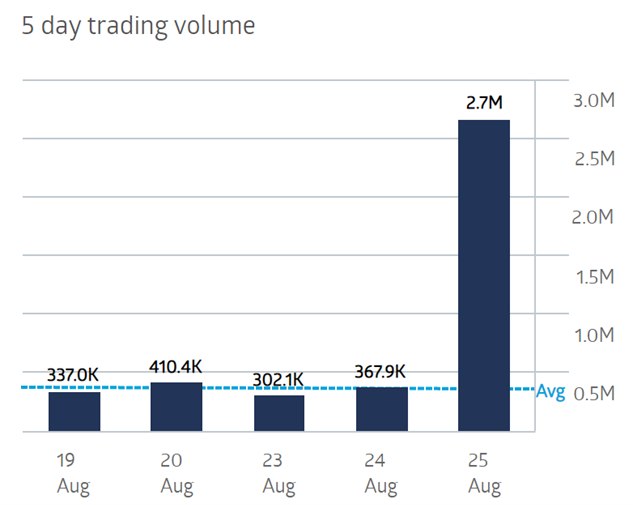

The buying activity this morning was so great that the WiseTech stock entered a trading halt after the ASX sought clarification on the significant jump in trading volume and share price.

Responding that it was not privy to any information not already released that could explain the trading activity, trading of the WAAAX stock resumed.

At the time of writing, the WiseTech share price was up 31%, trading at $47.74 a share.

WiseTech records strong revenue

In its FY20 annual report, WiseTech expected FY21 revenue to grow ‘between 9% to 19% to $470m to $510m, and our EBITDA to grow between 22% to 42% to $155m to $180m.’

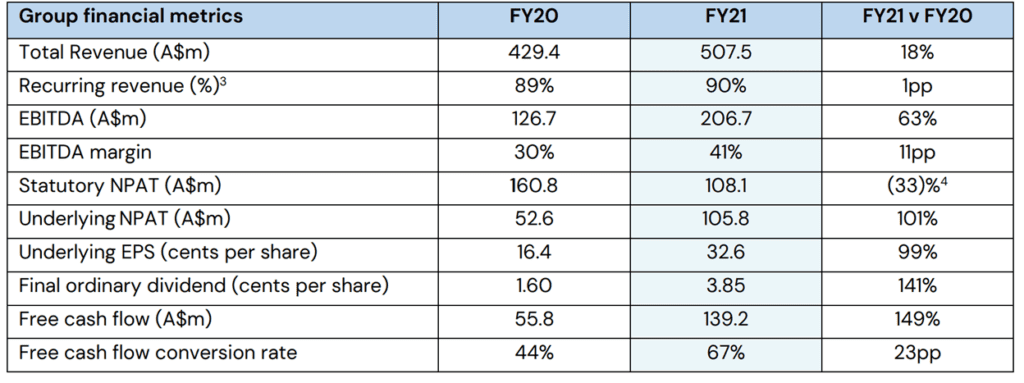

In FY21, WiseTech posted total revenue growth of 18%. Revenue jumped from $429.4 million in FY20 to $507.5 million in FY21.

The tech stock attributed the revenue increase to growth stemming from its CargoWise platform and other acquisitions.

That said, $23.4 million of total revenue growth was impacted by unfavorable foreign exchange (FX) movements, compared to $12.1 million FX benefit in FY20.

However, if you exclude the FX impact, WTC’s total revenue grew by 24% (or by $101.4 million) in FY21.

Of the registered $101.4 million revenue growth, $97.3 million was recurring revenue and $4.2 million was non-recurring revenue.

CargoWise revenue grew 26% to $68.6 million. But if you were to exclude the $13.6 million FX headwind, CargoWise revenue grew by 31%.

WiseTech beats earnings guidance

Additionally, expecting EBITDA to ‘grow between 22% to 42% to $155m to $180m’ in FY20, WTC ended up growing EBITDA by 63% on FY20.

FY21 EBITDA came in at $206.7 million.

EBITDA margin jumped 41% — up 11% on FY20, reflecting enhanced operating leverage and cost reductions.

CargoWise’s FY21 EBITDA margin was 55%, representing a 7% increase on FY20.

All up, the improved performance saw WiseTech end the financial year with underlying NPAT growth of 101%, coming in at $105.8 million.

Free cash flow, likewise, rose in FY21. WTC’s free cash flow jumped nearly 150% to total $139.2 million compared to $55.8 million in FY20.

The strong cash position meant WiseTech was able to bump its final ordinary dividend to 3.85 cents per share, representing a 141% increase on the FY20 final dividend.

WiseTech Founder and CEO, Richard White said:

‘Our strong CargoWise revenue growth in FY21 demonstrates industry recognition of our customer value proposition.

‘We have continued to gain momentum in our market penetration with six new CargoWise global rollouts by large global freight forwarders secured in FY21, and the signing of FedEx post 30 June 2021.

‘Importantly, we have a strong pipeline of potential new global customers, which we are actively pursuing.’

What’s next for WTC shares?

WiseTech founder Richard White thought his company was benefiting from the ‘acceleration in structural shifts from legacy systems to integrated global software solutions.’

These favourable structural shifts have led WiseTech to expect FY22 revenue growth of 18–25%.

This would represent revenue of $600–635 million.

WTC also expects EBITDA growth of 26–38%, representing EBITDA worth $260–285 million.

Finally, Mr White reiterated that WiseTech will ‘remain focused on R&D that delivers breakthrough products that enable and empower those that own and operate the supply chains of the world.’

WiseTech was once a small-cap trading for $4 a share in 2016. Its gains since highlight the potential of investing in the small-cap sector.

Of course, small-caps come with elevated risk and there are hundreds to sift through. It requires a lot of patience, research, and time to separate the worthwhile opportunities from the duds.

Thankfully, our market expert Murray Dawes just released a new report profiling seven stocks he thinks offer great potential.

These are small-caps with exciting ideas aiming to disrupt large industries.

If you want to read Murray’s report, you can access it here.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here