You may have heard in the past week that China has announced the discovery of the world’s largest gold deposit.

Chinese state media first broadcast this on Xinhua, Thursday 21st November.

Geologists have estimated an ore reserve of 300 tonnes of gold from 40 gold veins within 2,000 metres underground in the Wangu gold field, located in Pingjiang County in the Hunan province. Within the first 3,000 metres, there’s an estimated 1,000 tonnes of gold reserves.

The estimated value of 1,000 tonnes of gold is currently US$81.65 billion (~AU$126.75 billion).

As this announcement made its rounds, people wondered why the price of gold increased, rather than fall. After all, this big discovery would increase the supply of gold.

Or does it?

For me, I think this announcement shouldn’t make much difference to the price of gold.

Moreover, I would go so far to say the media is hyping this up.

Puzzled why I think this way?

I want to be clear about one thing.

I’m bullish on gold. I haven’t changed my mind.

Returning to the Wangu gold field, I’ll say the deposit is huge.

To give context, 1,000 tonnes of gold reserves is around 31.1 million ounces. Australia’s largest gold deposit is Cadia, with around 14.7 million ounces of gold reserves.

The initial drill results reported shows the gold grades are as high as 138 grams of gold per tonne of rock.

All this sounds impressive.

Yet I don’t believe this discovery will move the price of gold by much. Any moves in gold in the recent week or the future will have little to do with this discovery.

A bucket of water in a pond

I’ve written in the past about how the dynamics for the price of gold and most commodities differ from what you’d expect.

Physical supply and demand don’t move the prices. The digital contracts traded in the commodities markets do.

Each day, around US$160 billion worth of gold contracts are traded, according to The World Gold Council. That’s equivalent to 2,000 tonnes of gold.

The daily turnover is significant, considering the world had only mined a little over 210,000 tonnes of gold as of the end of 2023. Mining adds 3,000 tonnes each year.

If you put that into perspective, can you see how a 1,000-tonne discovery is unlikely to move the scales of supply and demand?

Certainly not when the price is driven by traders moving digital contracts rather than mining companies, jewellers, refiners, central banks and individuals buying and selling bullion coins and bars.

It’s like pouring a bucket of water into a pond.

Media hype and correcting the record

Perhaps you may recall in mid-2022, news quickly spread about the world’s largest gold discovery in Uganda, in East Africa. The government’s spokesperson claimed to have uncovered 31 million tonnes of gold-bearing ore in Karamoja, near the Kenyan border. Geophysical and geochemical analyses concluded this ore would contain an estimated 320,158 tonnes of refined gold, worth US$26.4 trillion today.

That’s 50% more gold than what we’ve mined over time!

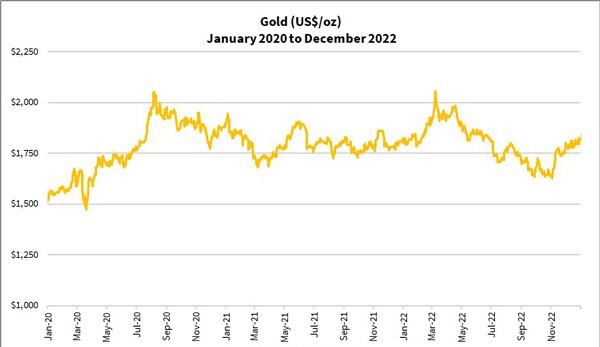

You might recall that the price of gold fell from US$2,056 in early March 2022 to US$1,620 in November the same year:

| |

| Source: Refinitiv Eikon |

Did the gold discovery cause this decline?

No!

During this period, the US Federal Reserve and central banks worldwide rapidly raised interest rates to combat inflation. The Uganda gold discovery didn’t have anything to do with it.

Moreover, a closer inspection of the numbers would reveal an absurdity in the reports. I’m surprised none of the larger news organisations, including Reuters, picked this up. They just ran with the report like everyone else.

Let’s go back to the claim that the deposits contained 31 million tonnes of ore, which would produce 320,158 tonnes of refined gold. That would imply the contained gold grade is approximately 10.3 kilograms per tonne!

Even 10.3 grams of gold per tonne would be a bonanza! Australia’s highest grade mine in operation at Fosterville in Central Victoria produces gold at 8.61 grams per tonne in the most recent quarter (2024 September quarter). In its glory days in 2020, the grade was around 24 grams per tonne.

How hype could spur a gold stock bull market

Media hype or not, I believe the news of the discovery of Wangu will spur investor interest in gold mining stocks.

Gold mightn’t move because of this discovery, as I explained above. But once you’ve piqued investor interest, funds could start flowing into the space.

If you’ve followed my work, you know I’ve been bullish on gold stocks for over three and a half years. Even during their darkest days in 2022-23.

We’ve enjoyed some exciting returns, especially in the past year. However, many companies are still trailing behind. But gold stocks aren’t in a bubble like we saw with lithium, rare earth elements (REE), nickel and uranium.

If you’ve bought gold stocks already, I’m sure you’re enjoying the gains some of your holdings have delivered you. And you might be waiting for those lagging to close the gap.

If you haven’t moved into this space, now’s a good time to consider doing so given the latest news. But you don’t want to buy random stocks, expecting they’d deliver results. You must be selective as there are companies that could disappoint.

To find out more about how to build a precious metals portfolio to deliver you solid opportunities in the long-term, join me here at The Australian Gold Report.

Alternatively, if you’re interested in the broader mining sector, check out my colleague, James Cooper. He recently presented an opportunity that you shouldn’t miss, find out here.

P.S: During the video, Brian misquoted figures regarding the size of the gold contracts, the daily trading volume and the market value of contracts. Please note the numbers quoted in this article are correct.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report

Comments