Perth-based explorer Wildcat Resources [ASX:WC8] has surprised investors again with further promising intercepts from its recently acquired Tabba Tabba Lithium-Tantalum Project in WA.

The company acquired the project in May this year and has seen much of its gains come off the back of the purchase due to the site’s potential.

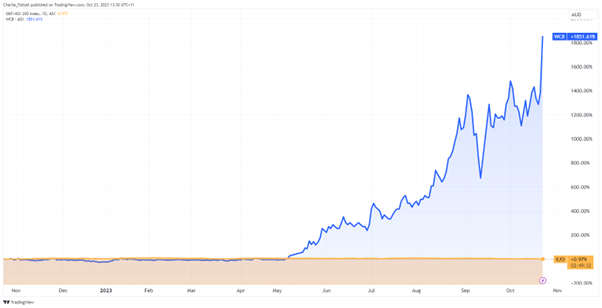

The company has been considered overpriced by some market analysts, who have watched in disbelief as the company’s share price rose a staggering 2,400% in 2023.

Today’s impressive intercepts have added another 30% to the share price, trading at 60 cents per share.

Let’s get into the details of the find.

Source: TradingView

Thick intercepts hint at tier 1 discovery

The Pilbara region in northern WA has been known for years as holding colossal potential, with vast iron ore deposits and the current largest hard-rock lithium mine in the world, Pilgangoora mine, owned by Pilbara Minerals [ASX:PLS].

These and other monster lithium projects in the region now produce approximately 20% of the global lithium supply.

Wildcat purchased the Tabba Tabba project from Global Advanced Metals on 17 May for $7.5 million and a 1.75% gross revenue royalty split between lithium and tantalum products.

With significant capital outlay, the pressure has been on Wildcat to aggressively drill and prove its worth to investors.

Wildcat has done so; with two RC drill rigs and a diamond drilling rig, the company has hit paydirt in its central cluster, Leia.

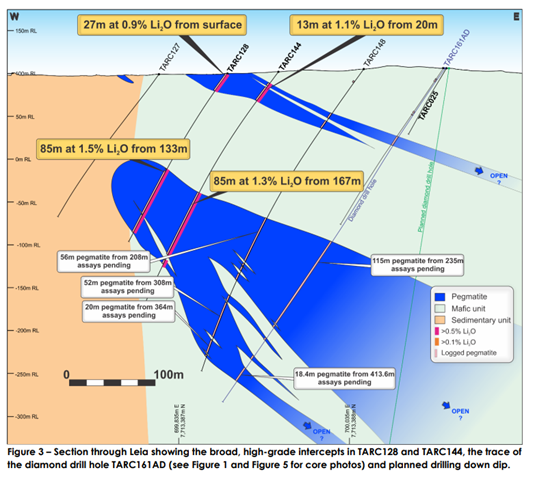

Some of the highlights from the exploration of the Leia site include:

- 85m at 1.5% Li₂O from 133m

- Including 9m at 3.0% Li₂O from 199m

- And 13m at 2.3% Li₂O from 136m

- 38m at 1.1% Li₂O from 132m

- 35m at 1.0% Li₂O from 127m

For a better understanding of the thickness of these intercepts and the pending assays, here are the latest indications from Wildcat.

Souce: Wildcat Resources

As you can see from the above chart, significant assays are still pending from this site to map the potential.

The company has 58 RC hole results pending from its latest round of sampling and has planned further diamond drilling within this cluster.

Wildcat’s Managing Director Samuel Ekins said today:

‘We continue to be encouraged by the Leia Pegmatite’s scale, grade and tabular consistency having still not found the edges of it with drilling. It really feels as though we are in the midst of a Tier 1 lithium discovery at Tabba Tabba‘

Outlook for Wildcat Resources

The market’s response to these results has been overwhelmingly positive, with investors bidding up Wildcat Resources’ share price in anticipation of the project’s full potential.

However, this potential will likely come at the hands of an experienced miner in the region.

Early reporting has indicated that this will likely come from billionaire Chriss Ellison’s Mineral Resources [ASX:MIN], who shares links with the Wildcat Chairman and has shown early interest in the project.

After the failure of the Albemarle deal— thanks to meddling from Australia’s richest person, Gina Rinehart— the potential for further WA mining consolidation is ripe.

MinRes has purchased three other smaller mines in the region with processing infrastructure and is very aware of the potential of this project longer-term.

However, lithium prices may not see their peak again, with Chinese lithium carbonate prices down over 70% from their November 2022 top.

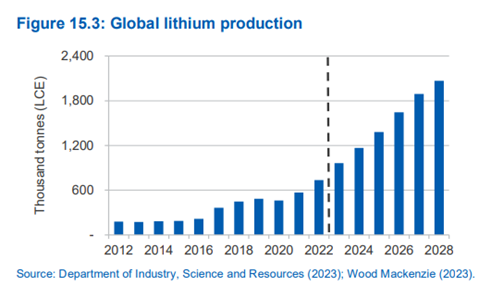

Global lithium demand continues to grow rapidly, driven by a surge in demand for EVs, which account for 80% of it. However, lithium supply is also ramping up quickly.

Demand for EVs has also been spotty this year, with markets like Australia seeing a healthy uptick in electric or hybrid demand while the US has been lagging behind.

The Australian Department of Industry has forecasted prices are likely to moderate slowly through 2028 as more supply comes online.

Source: Department of Industry, Science and Resources

That same report also highlights another significant metal to look out for in the move towards renewable sources… and that’s copper.

According to the October resources report:

‘With significant demand growth expected over the outlook period, and with mined production growth likely to slow, it is projected that a market deficit will emerge.’

Copper shortages could be seen this decade

Stopping climate change will require trillions and a global supply of critical minerals — one special metal from this range is copper.

Copper is required in almost all electrical devices, and each EV requires around 80kg of copper —four times that of a regular combustion vehicle.

As we heard from our latest government forecast, that demand is beginning to outstrip supply.

Our resident resources expert has raised this issue for some time and has mapped out the best move for investors to capitalise on this shortage.

If you subscribe to Fat Tail Commodities, you will have access to resources expert James Cooper’s most recent thoughts on the subject.

James will give you a wealth of investment ideas and veteran insights into the copper industry.

He’ll also explain the copper supply crisis and how you can position yourself to take advantage of incoming changes in the industry.

Find out more about the coming red draught and click here today.

Regards,

Charlie Ormond

For, Fat Tail Commodities

Comments