Dear Reader,

Have you noticed how the mainstream press is trying to turn panic buying into a good thing?

I’ve seen headlines like ‘panic buying drives biggest retail sales…’

…or in today’s paper: ‘Australians were the world’s best panic buyers’.

According to the article, Australia ‘out-shopped’ 54 other countries when it came to panic buying, with research showing that ‘Australian consumers were the quickest in the world to raid supermarket aisles in search of toilet paper and canned soup…’.

No matter how you try to spin it, panic buying is never a good thing…not even if you hold the ‘world’s best’ title or if it helped prop up the economy for a very short period.

Panic buying is a complete loss of confidence.

And, that’s never good because…well, our whole system is based on confidence.

Maintaining confidence is key

Along with containing the health pandemic, maintaining confidence is key.

It’s something the RBA touched on this week’s statement after leaving interest rates at record lows:

‘In the period immediately ahead, much will depend on the confidence that people and businesses have about the health situation and their own finances.

‘The substantial, coordinated and unprecedented easing of fiscal and monetary policy in Australia is helping the economy through this difficult period. It is likely that this fiscal and monetary support will be required for some time.’

Australia came out of the last financial crisis in pretty good shape because of China and the commodities sector. We then got another leg up through the property market, which was aided by high immigration and abetted by low interest rates.

For the time being, immigration is gone. We will have to rely on our local market for the foreseeable future.

And with the virus, every country in the world and all sectors are pretty much exposed. How do you create confidence?

Property is one of our pillars of confidence

For one, construction accounts for about 8% of our GDP production and has around 10% of Australia’s jobs. But those numbers are much higher when you account for all the other industries it influences.

To keep construction going, the government has released some measures this week, in addition to JobKeeper to protect jobs in the sector.

As news.com.au reports, homeowners will get $25,000 to build new homes or renovate as long as they match the grant.

‘Designed to protect tradies’ jobs in the wake of the coronavirus pandemic the final details of the scheme will be announced his week.

[conversion type=”in_post”]

‘But news.com.au has confirmed the requirement that renovators demonstrate substantial spending means smaller, DIY projects will be locked out of the Prime Minister’s renovations bonanza to ensure the money supports tradies’ jobs.

‘Renovators will not just be required to match the cash grants but spend more, ensuring the projects are “substantial”.

‘“We are more interested in the larger projects and new home builds and things like that,” Prime Minister Scott Morrison told 2GB on Monday morning.

‘“We are looking at a bit of drop off in that current home building that’s going on. That’s not good for tradies and not good for jobs.”’

But it’s not only about jobs. We are quite exposed to property because much of our wealth is tied up in property.

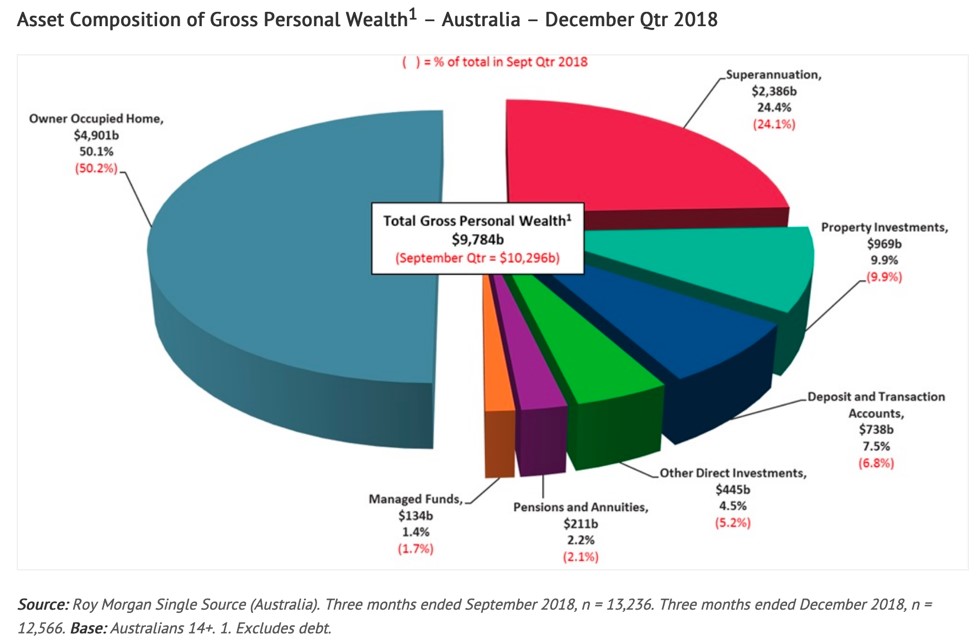

According to data from Roy Morgan, housing and housing investments account for 60% of our personal wealth.

|

|

|

Source: Roy Morgan |

But that percentage is also higher when you consider that it’s likely that other investments like our superannuation are also exposed to property and banks.

Our banks are heavily exposed to property, with their mortgage books amounting to about 80% of our GDP

The last time property prices fell, back in 2018, Australia lost 124,000 millionaires from the Credit Suisse’s global wealth report list, the most from any country in the world. Average wealth fell from US$411,060 to US$386,060 mainly because of falling house prices and a depreciating dollar.

We’ve already seen in 2018 how lower property prices can affect the wealth effect and retail and consumer spending. Consumer spending makes about half of our economy.

Property prices are starting to fall now again, even with all the payment holidays and subsidies. Low immigration and falling rents will also make investing in property less appealing.

The thing with housing is that it is an illiquid asset, it’s not easy to sell if there aren’t buyers, and the values can drop quickly. Of course, much of it will depend on credit flow.

But don’t be surprised to see the government pass on more measures to protect property, to support confidence.

|

Best, |

|

|

Selva Freigedo, |