Updated July 2024

I could never understand the rationale behind gold investors, despite working in the sector as a geologist!

Here was my thinking at the time:

Why would you put your life’s savings into an asset that sits idle in a safe or vault? Rather than collect dividends, interest or rent like most investors, gold investors just end up paying storage fees and insurance!

And Warren Buffett feels the same, famously stating, ‘Gold doesn’t produce anything. It doesn’t innovate, sell products or services, pay dividends, or grow its earnings.’

In fact, gold is his most hated asset.

But with the uncertainty plaguing the world right now, I’ve done a complete 180.

I now firmly believe that gold and ASX gold stocks have their place in your portfolio. I’ll even give you a recommendation later in this article.

Gold is your best ‘contingency plan’

As my colleague and Aussie gold expert Brian Chu wrote in this article, the world is going through a drastic change. He says, ‘Globalism is on the decline. Nationalism is on the rise.’

And with the uncertainty any change brings, it’s critical to be prepared.

I realised this back in 2018, when I was working as a geologist in Sudan.

My wife and I were based in Khartoum, the country’s capital city… A ramshackle of a place situated along the banks of the Nile River.

In many ways, Khartoum was the closest thing you could get to stepping back into a Biblical epoch.

Just a few kilometres beyond the city fringes, you’ll find most people living as they did, centuries ago:

| |

| Source: James Cooper |

Life was good, if basic.

But after 12 months, living conditions in the country started to deteriorate, rapidly.

Sudan’s long-term leader, Omar Hassan Ahmad al-Bashir, a dictator who had ruled the country since 1989, was suddenly overthrown in a military coup.

Sudan was ready to erupt; embassies evacuated staff!

Luckily my wife and I always kept some full-price flights on standby that could get us on a commercial flight if we ever needed to leave in a hurry.

We left everything behind and flew to Cairo, Egypt just in the nick of time.

A mere two days later, the country’s new military regime announced an immediate closure of the country’s only international airport!

I’m no macro or geopolitical expert, but these experiences have shown me that tensions tend to bubble below the surface for months or years, then amplify quickly.

And in today’s increasingly shaky geopolitical environment, who knows where that might lead us in the years ahead?

It has made me realise the importance of having a contingency plan…not just in real life, but with your portfolio as well.

Precious metals like gold are one of the best at this job.

See, economic distress and inflation is bad because it erodes the purchasing power of cash in the bank. But the inverse is true of gold — such uncertainty will actually raise the cost per ounce of gold.

But more than physical gold, gold stocks have their place too.

Because while the former can be used to protect your wealth, the latter can be fantastic at growing it during times of uncertainty.

Perfect timing, too, as gold seems to be in a bull market since the start of 2024 (read more about this here).

And I have the perfect gold stock for the chance to capitalise on this.

Presenting De Grey Mining [ASX:DEG]

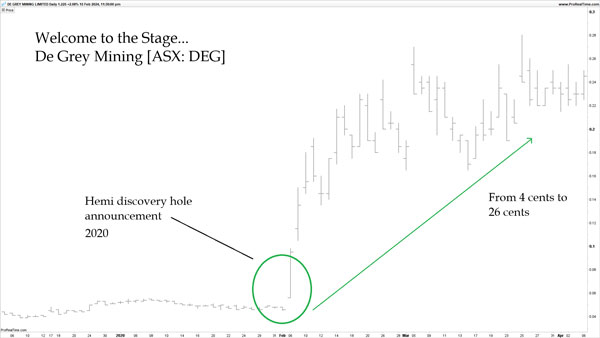

Before 2020, De Grey Mining was a relatively obscure explorer based in Western Australia.

Then, it announced its discovery of the Hemi deposit, widely considered one of the finest geological discoveries in the Pilbara region over the last several years.

The gold stock market thought so, too.

As a result, shares skyrocketed from 4 cents to 26 cents — an unbelievable sixfold gain!

And rather than a brief spike and subsequent crash landing, the share price held and consolidated.

Take a look:

| |

| Source: ProRealTime |

Throughout the years, De Grey’s management has done a good job of identifying new targets and rapidly scaling up Hemi’s resource.

Today, it’s a hefty 10.5 million ounce gold deposit.

With 121 million tonnes grading 1.6 grams of gold per tonne, De Grey has justifiably earned its reputation as one of the most exciting developers on the ASX.

Now, the company is setting its sights on the next step in its development — maiden production.

De Grey’s path towards production

De Grey expects development costs to be around $1.35 billion.

Though to date, the company has only raised $550 million. That leaves a hefty shortfall of approximately $800 million.

We can expect the company to make up the deficit via debt arrangements and capital raises.

The latest share issue was in October 2023, when the company netted around $300 million after issuing approximately 285 million new shares.

Given De Grey has previously set mid-2024 as its target date for finalising project financing, there’s certainly a risk of another capital raise in the near future.

While you could sit on the sidelines with this recommendation, I’m leaning more to the idea that gold could rocket higher on the back of an already strong 2024 so far.

So, when will the company shift into production?

According to De Grey, construction activities were set to begin in the second half of 2024.

This is expected to be finalised two years later, with the first gold pour slated for the second half of 2026.

Once De Grey breaks ground at Hemi, it should handle around 10 million tonnes of gold-containing ore annually.

The company expects peak production of 570,000 ounces in year two.

Based on the company’s Definitive Feasibility Study (DFS), DEG expects a payback period of less than two years, assuming a gold price of $AU2,700 per ounce.

For reference, gold currently trades ABOVE $AU3,500 per ounce, so this period could be potentially shorter if such a price keeps up.

That offers you a glimpse of what the next two years might look like as the company works towards maiden production in 2026.

Of course, this path becomes far easier alongside rising gold prices.

Looking at De Grey’s production costs

Compared to other commodities, gold is a relatively easy metal to process. Once the ore is mined, it’s crushed, treated with chemicals, and sent to the smelter.

The molten gold is then poured into moulds where it cools and hardens. From there the bullion is sent to market where the miners collect their pay cheque.

But the major expense comes from extraction.

You see, extracting gold requires the removal of enormous volumes of rock. For each tonne mined, producers barely recover a single gram of gold!

Extracting and crushing rock is expensive, especially in the hardened silicified rocks typical across Western Australia.

That’s why investors hunt for high-grade deposits… Generally speaking, higher grade equates to lower cost.

But the Hemi deposit is favourable in terms of lower extraction costs. That’s because the ore is closer to the surface and has a geometry that makes extraction easier and cheaper.

Another key metric is the all-in sustaining cost (AISC).

This is crucial as it offers a straightforward glimpse of a mine’s total cost (including operating expenses, taxes and royalties) per ounce of gold sold.

The lower the AISC, the better.

De Grey’s AISC sits around $US850 per ounce — a very enviable cost profile for any gold producer.

To put that in perspective, some of the biggest players in this industry…chiefly, Newmont, Barrick, Northern Star, and Kinross…hold AISCs between $US1,200 and $US1,300.

Obviously, De Grey is exceeding the AISC benchmark here. That places the company in a competitive position even if gold doesn’t spike higher in the years ahead.

But once mining gets underway, the realities of operation and production costs tend to surprise to the downside. In other words, higher than expected costs.

The pitfalls of a deposit truly come to light when a producer starts to break ground at the project.

De Grey will be doing extremely well if it can maintain an AISC below $US1,000 in the years ahead.

De Grey’s risks and opportunities

Gold mining is a tricky business, and there are many other risks and unknown costs to consider.

The biggest threat comes from the geology. Gold deposits are notorious for what’s known as the ‘nuggety effect’.

See, gold rarely disperses evenly. You might have high-grade deposits in one area, but significantly lower volumes just a few metres around it.

These inconsistencies can make forecasts tricky and error-prone.

Geologists often have to settle at a best guess calculation to determine the total size of a resource. This comes from complex modelling and reserve estimates using all the company’s drilling data.

Getting this step wrong can result in higher extraction costs, poor head grade for the mill, less gold, and ultimately less profit.

This is why gold is expensive.

And it’s why investing in gold mining stocks can be tricky. Its high risk investing.

You’ll need to trust the gold companies’ educated guesses to inform your own investing moves. Why am I telling you this?

Because, considering all the unknowns that still exist, De Grey’s team of specialists have arrived at a magic figure of 10.5 million ounces of gold.

Like any developer or producer, time will tell how accurate this is.

Final thoughts

As you can see, investing in a pre-production miner like De Grey offers plenty of risks.

There are simply too many unknowns during this phase. And successfully turning a concept into a full-blown, revenue-producing mine is no small feat.

A lot of things can go wrong along the way.

But, everything considered, De Grey owns a valuable, large-scale, low-cost deposit in an ideal jurisdiction.

This is as close as you can get to ticking all the right boxes for a budding gold producer.

More importantly…

De Grey is set to capitalise at a time when gold prices are continuing to climb higher.

It’s also why I’m eyeing other Australian gold stocks aside from De Grey.

If you’re keen to learn more about them, I invite you to subscribe to my premium advisory, Diggers and Drillers.

Using my decades of experience as an exploration geologist…and my network of mining insiders on the field…I watch the Aussie mining sector daily, trying to spot investment opportunities in gold, silver and other critical metals that most people miss out on.

And I send only the best picks — including buy, sell and hold instructions — to my subscribers.

If you’re serious about investing in the mining sector, this is the way to do it.

Learn more about Diggers and Drillers here.

Regards,

|

James Cooper,

Editor, Diggers and Drillers

Comments