Everyone knows the FAANG (or FAMGA) club is doing extremely well during this mess.

And although it’s not officially in the club, Tesla Inc [NASDAQ:TSLA] may be the pick of the bunch.

Increasingly gains on the S&P 500 [SPX] are concentrated in the hands of just a few companies.

There’s a good reason for this — the pandemic is accelerating the push towards technology like never before.

But there are two perspectives out there, which offer very different visions of what the market will do in the coming months.

Bears and value versus big tech bulls — and my view

In the bear corner, you’ve got people who think a double-dip crash is on the way and that we are approaching dotcom-level valuations on big tech.

A follow up to this view would say something like, ‘Big tech is now a defensive play, positions in these stocks allow investors and funds to exit quickly should the market tank.’

Value is the name of the game for these bears.

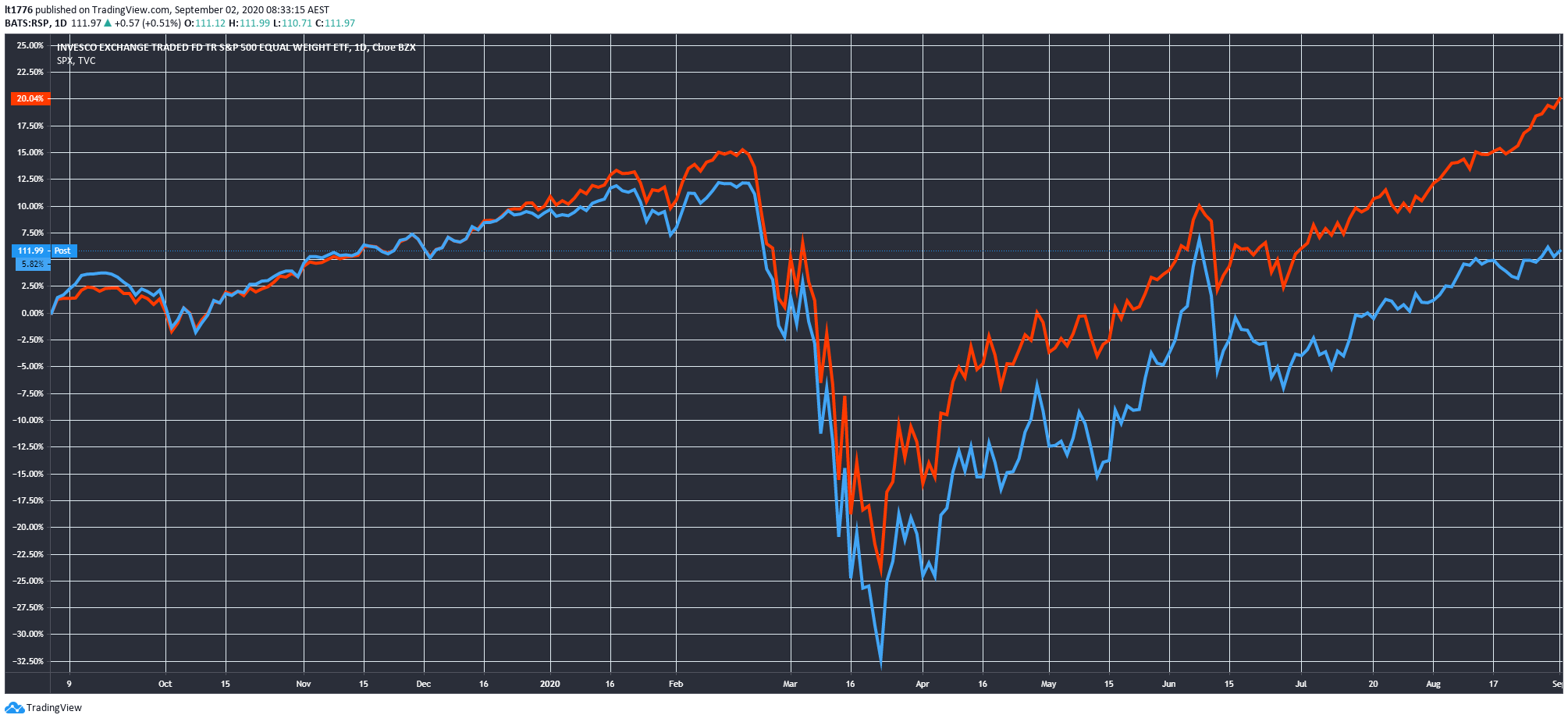

So, let’s take a look at little-known US fund, the Invesco S&P 500® Equal Weight ETF [RSP].

RSP is an equal weight ETF, meaning it is spread across the 500 companies evenly as opposed to being based on market capitalisation.

Size doesn’t matter with this one.

It’s underperforming the S&P 500 significantly, as you would expect given the run tech companies are on (RSP blue line, SPX red line):

|

|

|

Source: tradingview.com |

[conversion type=”in_post”]

To the value hunters and bears this means that tech looks expensive and everything else looks cheap.

There will be a cyclical shift to value, as the economy recovers, and non-tech companies will get their day in the sun once more.

In the bull corner though, are those that think big tech is just getting started and that their dominant position in our lives is never going to change.

My view is a bit more nuanced.

Anyway, here it is:

- Big tech stocks like FAMGA are at the tail end of a ‘mature’ megatrend

- As a result, and given their massive cash reserves, you should be looking for the next megatrend

- The companies that ride the next megatrend could become acquisition targets or go on their own Amazon-like run up the charts

- Consequently, you should be looking at smaller tech companies in certain areas

- Tech stocks are never going away; you just need to be smarter when picking them

Where to look for the next Amazon-like tech stock run

In the immediate future, I’m looking closely at healthcare.

It sounds counter-intuitive, but it’s not.

You may say:

‘Don’t you know there is a pandemic on? Healthcare is getting crushed!’

First of all, that’s simply not the case.

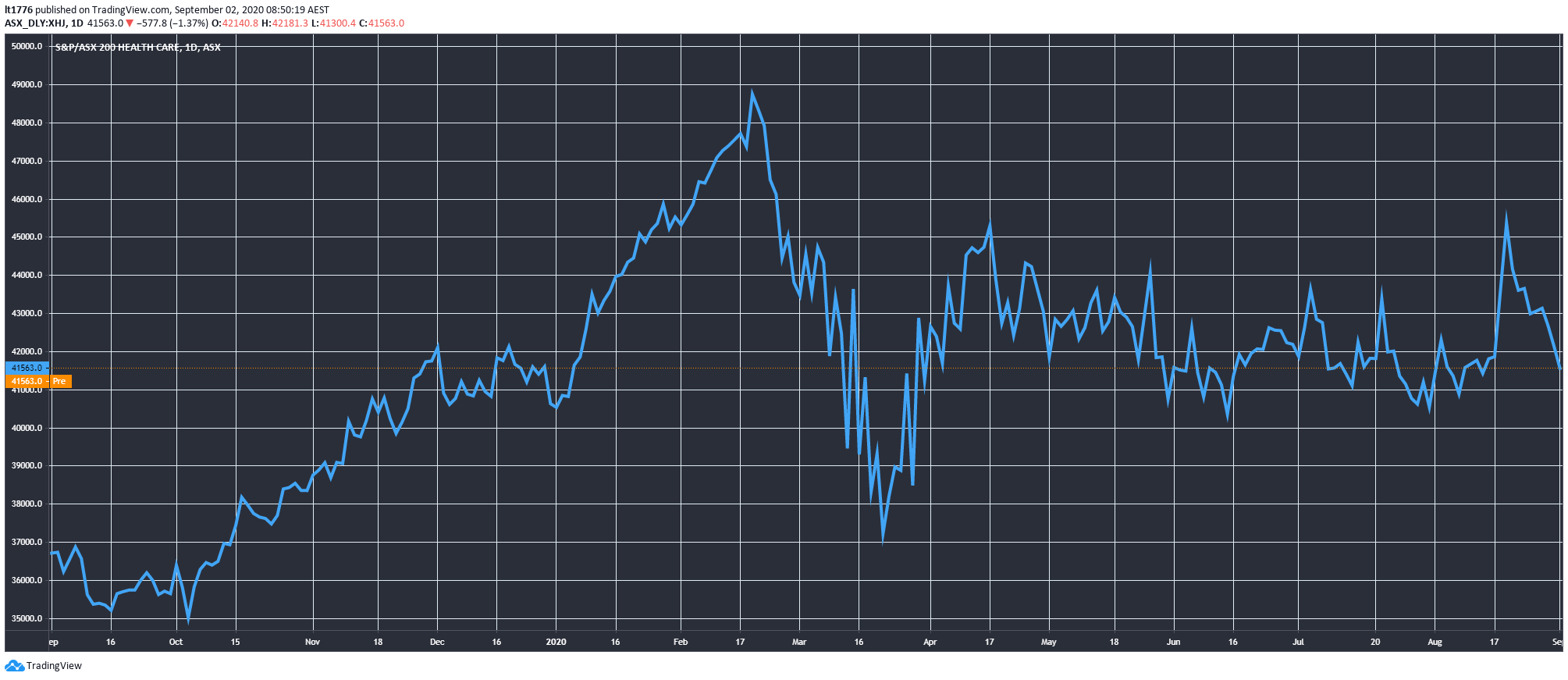

Check out the S&P ASX 200 Healthcare Index [XHJ]:

|

|

|

Source: tradingview.com |

It’s holding up remarkably well from the March market lows.

Secondly, when I say healthcare, I mean medtech (medical technology) more precisely.

Not the big insurance companies or the private hospitals, but the companies bringing efficiency to the sector with new products and services.

I’ve covered the exciting world of medtech stocks before.

But the point remains.

Increasingly, the FAMGA stocks are looking at these types of companies.

FAMGA is at the tail end of the megatrend which was the world going online.

So naturally, they are looking for the next big thing, or else they will become dinosaurs.

This is now Australia’s biggest manufacturing export

I’d also note that Australia is well-placed to lead in the medtech race.

Check this from the Australian Financial Review (emphasis added):

‘It is clear COVID-19 is going to have a profound impact on ambitious state and federal plans to establish Australia as an Asia-Pacific hub for medical technology and pharmaceutical companies.

‘Before COVID-19 arrived, a far-reaching program to develop the MTP sector had centred around a series of growth funds, focussed on pharmaceutical research translation, device development and biotechnology investment.

‘MTP Connect was established in 2015 to drive the program and has overseen more than $100 million invested through the growth funds. The budget for the funds has come from earnings from the nearly $20 billion national medical research fund and was part of a determined push for Australia to leverage its high-class health infrastructure and services.

‘At the same time, state governments have also invested strongly in the sector, with the Victorian government especially focussed on building a large-scale Silicon Valley-like precinct, centred on its world-leading research capability around Melbourne and Monash universities.

‘According to the managing director of Brandon Capital, Dr Chris Nave, the pharmaceutical and medical products market is now Australia’s largest manufacturing export, with an estimated $8.2 billion.’

You read that correctly, pills and medical products are now our biggest manufacturing export.

We can’t make cars, whitegoods, or steel like developing countries can, but we do medtech and pills extraordinarily well.

It’s a combination of a highly educated workforce, top-of-the-line research institutions, and a little help from the taxman.

After we extricate ourselves from this pandemic quagmire, this part of the Australian economy is poised to grow even further.

That’s because the backlog of patients and inefficiencies will need to be addressed somehow.

The imminent ‘Health Revolution’ is a big theme in our Exponential Stock Investor service.

I’d encourage you to learn more about it.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Three Exciting Tech Trends and Three Small-Cap Stocks that could Explode in 2020. Claim Your Free Report.